Rolling-Up Covered Call Trades in the Same Contract Cycle – May 28, 2024

We enter a covered call writing trade, and share price accelerates exponentially. What exit strategy opportunities are available, if any? This article will discuss the mid-contract unwind (MCU) and rolling-up exit strategies, with an emphasis on the latter. A real-life example with Citigroup Inc. (NYSE: C) will be analyzed.

What is the mid-contract unwind (MCU) exit strategy?

This is where we close both legs of the covered call trade (buy back the option and sell the shares). We then use the cash generated from the sale of the shares to enter a new covered call trade with a different underlying security. This protects us against profit-taking when there is a substantial price acceleration after entering the initial trade. In the BCI methodology, we favor this approach over rolling-up in the same contract cycle.

What is rolling-up?

This is where we buy back the original short call and sell a higher strike call with the same expiration date. This will, typically, result in a net option debit with an unrealized share appreciation. We would use this exit strategy when we feel that, despite the recent surge in share price, we are relatively confident that share escalation can continue.

Real-life example shared by premium member, Kalyan, using Citigroup Inc.

- 12/5/2023: Buy 100 x C at $44.69

- 12/5/2023: STO 1 x 1/19/2024 $47.00 call at $1.19

- 12/18/2023: BTC the $47.00 call at $3.15

- 12/18/2023: STO 1 x 1/19/2024 $50.00 call at $1.58 (roll-up #1)

- 1/5/2024: BTC 1 x 1/19/2024 $50.00 call at $4.85

- 1/5/2024: STO 1 x 1/19/2024 $55.00 call at $1.20 (roll-up #2)

- 1/11/2024: BTC 1 x 1/19/2024 $55.00 call at $0.29

- 1/11/2024: Retain shares with current market value of $51.32

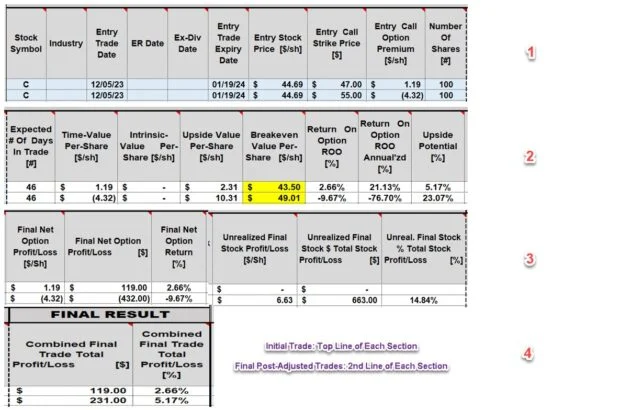

The BCI Trade Management Calculator (TMC): Initial & Final Entries & Calculations

- The top row in each section (1 -4) represents the initial trade

- The 2nd row in each section represents the final trade entries and results

- In section 1, -$4.32 represents the net option debit after executing all trades

- In section 2, we see a maximum potential 46-day return of 7.83% (5.17% + 2.66%)- top row

- In section 2, we see an option debit of -9.67%, with huge upside potential (to the $55.00 strike of 23.07%

- In section 3, the TMC calculates an unrealized share gain of 14.84%

- In section 4, the final (unrealized) result is 5.17%, which was less than the original maximum return of 7.83% ($47.00 strike)

Trade Journal entries in the TMC

Discussion

By rolling-up 2 times, the final (unrealized) result was lower than the initial maximum return which would have been realized without exit strategy intervention. The reason has to do with the time-value spent in closing the 2 rolling trades and buying back the last short call.

A better approach would have been to consider the MCU strategy or take no action at all, depending on the calculations. If our intention is to keep the shares moving forward, rolling-out or out-and-up considerations would come into play.

Author: Alan Ellman