Calculating Our Rolling-Out Trades: 2 Approaches Using the BCI Trade Management Calculator (TMC) – June 3, 2024

When we roll-out our covered call writing trades, the initial strike is in-the-money (ITM) as expiration is approaching and we made a decision to retain the underlying security for the next contract cycle. We have maximized our initial contract return and are initiating a new trade with a later-dated expiration. This article will analyze 2 methods of entering these trades into our TMC.

Hypothetical rolling-out-and-up trade

- 10/23/2023: Buy 100 x BCI at $24.00

- 10/23/2023: Sell-to-open (STO) 1 x 11/17/2023 $25.00 call at $1.00

- 11/17/2023: BCI trading at $30.80 on expiration Friday

- 11/17/2023: Buy-to-close (BTC) the 11/17/2023 $25.00 call at $5.83

- 11/17/2023: STO 1 x 12/15/2023 $30.00 call at $2.00 (rolling-out-and-up to an ITM strike)

2 approaches to archiving and calculating these rolling-out-and-up trades

- We can enter the $5.83 BTC debit in the 1st or 2nd contract cycle

- If we enter the debit in the 2nd cycle (12/15/2023 expiration), we will get an accurate maximum return result for the original (11/17/2023 expiration) contract but skewed exit strategy stats in the next cycle that will require manual adjustments. In this scenario, we enter the premium as a net debit of $3.83 ($5.83 – $2.00) in the latter dated expiration (12/15/2023)

- If we enter the $5.83 debit in the 1st cycle (11/17/2023 expiration), the results will not reflect a maximum return in the initial trade, but will give accurate data and exit strategy statistics in the next contract cycle (12/15/2023 expiration)

- Both approaches will result in an accurate 2-contract combined total result. It’s simply a matter of trader preference

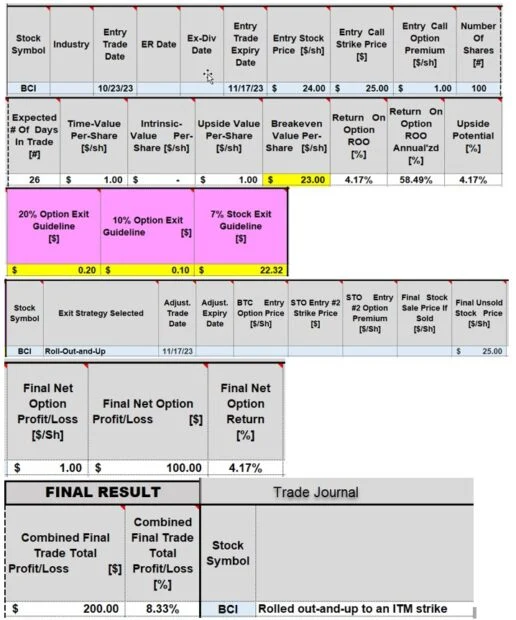

Approach # 1: BTC debit entered into 2nd contract cycle (12/15/2023 expiration)

- A maximum 1st contract cycle return of 8.33% is unrealized at that point in time (shares not yet sold)

- A note is made in the trade journal, indicating a rolling-out-and-up to an ITM strike trade

- The BCI Trade Management Calculator (TMC) is used for these computations

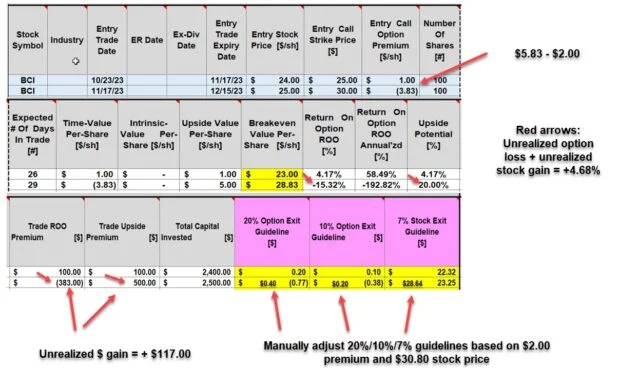

Entries into the next contract cycle

- In the 12/15/2023 cycle, a net option debit of $3.83 is entered

- This results in a total option debit of -15.32% and an unrealized share gain of $5.00 ($500.00 per-contract)

- This results in a net credit of $117.00 per-contract

- Since a negative option premium is entered, exit strategy buyback price points will need to be manually adjusted, based on the $2.00, 2nd contract premium (red arrows on bottom)

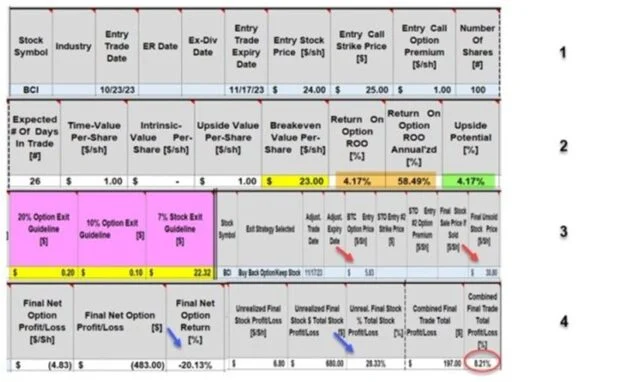

Approach # 2: BTC debit entered into 1st contract cycle (11/17/2023 expiration)

- #1: Initial trade entries

- #2: Initial trade returns with upside potential

- #3: BTC debit entered with current market value noted

- #4: Final 1st contract results reflect a negative option return and an unrealized share gain, netting a total unrealized return of 8.21%

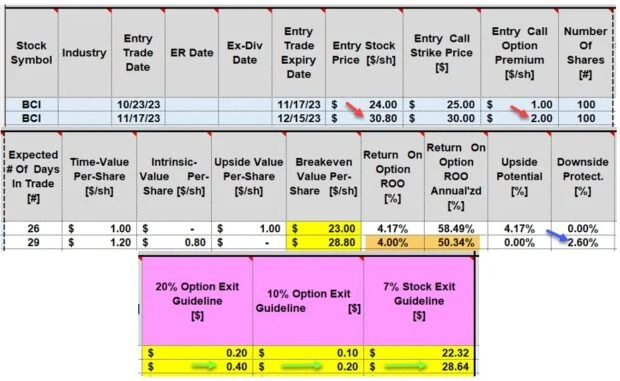

Calculations in the next contract cycle

- Current share price (at the time of the roll) and 2nd contract premium ($2.00) are entered

- Calculations proceed normally, reflecting an initial time-value return of 4.00% with downside protection of 2.60%, since an ITM strike is used

- The exit strategy buyback price points (green arrows) are accurate and do not need manual adjusting

Discussion

There are 2 methodologies for archiving and entering our covered call writing rolling-out trades. The first involves entering our BTC option debit in the latter contract cycle. This will result in an accurate reflection of a maximum return in the first contract but will require adjustments of exit strategy price points in the 2nd contract cycle.

In the 2nd approach, we enter the BTC debit in the 1st contract cycle, which will result in an option reduction and an unrealized share appreciation. There will be no need to adjust exit strategy buyback price points in the next contract cycle.

Both methods work and both will produce an accurate representation of the total 2-contract results. It’s simply a matter of investor preference.

Author: Alan Ellman