How to Use the BCI Portfolio Setup Spreadsheet to Craft Our Option-Selling Portfolios – June 10, 2024

When establishing our covered call writing and cash-secured put portfolios, it is critical to factor in stock and industry diversification and cash allocation. Our BCI premium stock & ETF reports along with our Portfolio Setup Spreadsheet will be invaluable assets in achieving these goals.

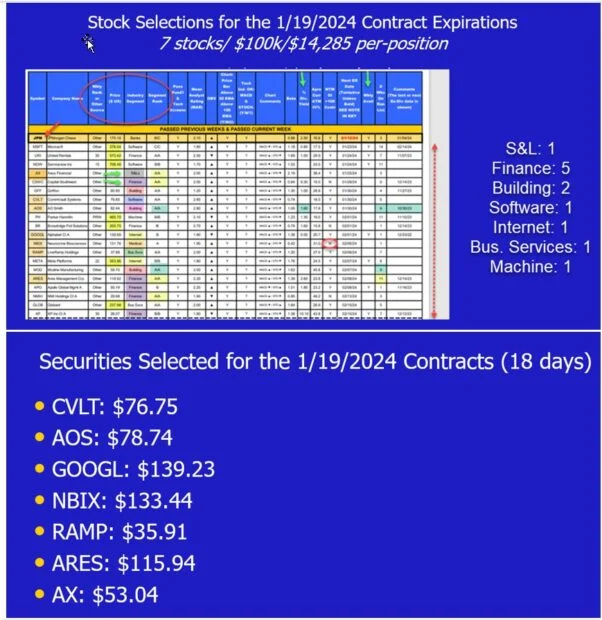

BCI Premium Stock Report example

- The details of this chart are difficult to read in a blog format, so I listed the industry breakdown on the right and the securities selected under the chart.

- Use the BCI screening process to select elite-performing stocks that also factor in stock and industry diversification

- Make sure price-per-share aligns with the cash available

- Click here for a video description of how to use the BCI premium reports

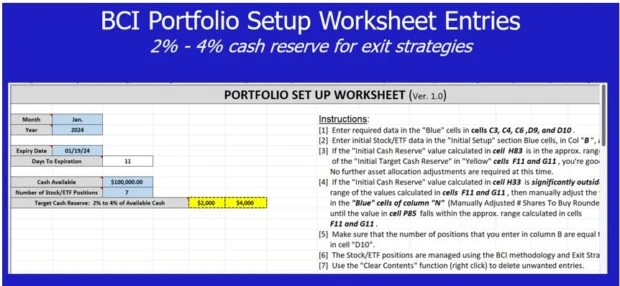

- Enter contract and trade dates into blue cells at top

- Enter cash available and the # of stocks to be used, also into the blue cells

- The spreadsheet will calculate the days to expiration (white cell, 11 in this example)

- The spreadsheet calculates the guideline range for cash reserve need for potential exit strategy executions ($2000.00 – $4,000.000, in this case)

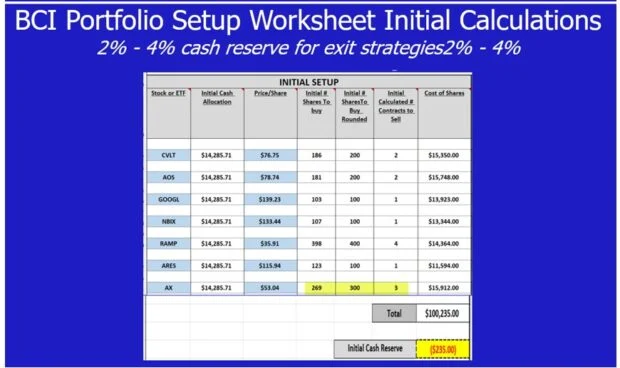

- Enter the stock ticker & price-per-share into the blue cells

- The spreadsheet will calculate the cash allocation ($14,285.71) per-position

- The spreadsheet will calculate the # of shares that can be purchased based on cash allocation and round up or down

- At the bottom of the spreadsheet, the total invested + cash reserve or shortage is computed

- In this case, we are short $235.00 with no cash reserve, so an adjustment is needed

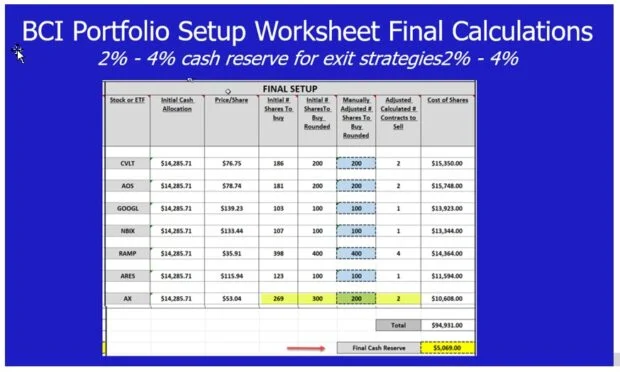

- In the final calculation section, we will adjust AX down from 300 shares to 200 shares

- We now have a reasonable portfolio setup using diversification and cash allocation

- We also have a reasonable cash reserve of $5,069.00 for potential exit strategy opportunities

- Print out this spreadsheet and use when ready to establish new positions for the upcoming contract cycle

Discussion

It is extremely important to incorporate diversification and cash allocation into structuring our option portfolios. Our BCI premium reports and portfolio setup spreadsheets are invaluable tools available for achieving results that will provide maximum opportunities to achieve the highest returns.

Author: Alan Ellman