I Made a Lot of Money, So Why Am I Crying? – June 24, 2024

Covered call writing trades have 2 components: we are long the stock and short the option. When evaluating the success or lack thereof for our trades, we must factor in both legs of the trade. In this article, we will analyze an example of how we can focus on the negative aspect of a trade but ignore the huge positive status of the trade. A real-life example with an exchange-traded fund (ETF), Vanguard Russell 1000 Growth Index Fund (Nasdaq: VONG) was shared with me by a BCI member and will be analyzed for this article.

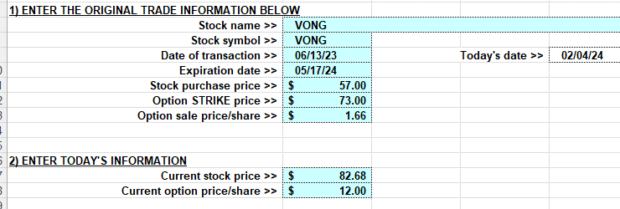

VONG trades overview

- 6/13/2023: Buy 4000 x VONG at $57.00

- 6/13/2023: STO 40 x 10/19/2023 $65.00 calls

- 10/19/2023: Rolled out-and-up as share price accelerates

- 11/17/2023: Rolled out-and-up to the 5/17.2024 $73.00 call as share price continues to accelerate

- The average option credit after the initial sale and 2 rolls is $1.66 per share

- 2/4/2024: VONG trading at $82.68

- 2/4/2024: The cost-to-close the 5/17/2024 $73.00 call is $12.00

What’s the problem here?

Our member is concerned that he is losing $24,000.00 on the options side, if the trade is closed.

Another perspective

If the short call is closed on 2/4/2024 for $12.00 per share, the share value no longer has a ceiling at $73.00, but is actually now worth $82.68 per share. The “Unwind Now” worksheet tab of the BCI Trade Management Calculator (TMC) will provide the calculations that will clarify the overall trade position. Will it be time for Kleenex or champagne?

VONG “Unwind Now” trade entries

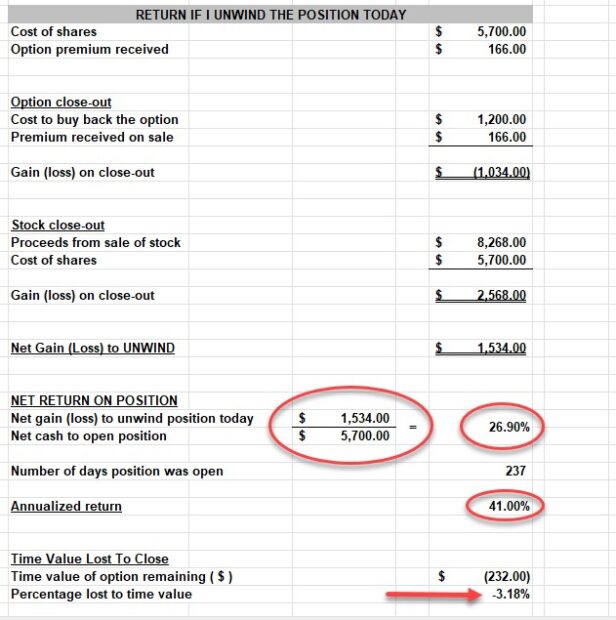

VONG “Unwind Now” trade calculations per-contract

- If the trade was closed (both legs) on 2/4/2024, the net credit would be $1534.00 per contract ($61,360.00 for 40 contracts)

- This represents a return of 26.90%

- Based on the 237 days in the trade (if closed on 2/4/2024), this annualizes to 41.00%

- The actual time-value cost-to-close (eliminating the intrinsic-value captured from share appreciation to current market value), is 3.18%. We ask ourselves, Can we generate > 3.18% in profit between 2/4/2024 and 5/17/2024? I say yes.

- So, champagne or Kleenex?

Discussion and valuable takeaways

- These trades did not lose money, they were incredibly profitable

- If the intention was to keep VONG as a long-term asset, then a different covered call writing approach should be implemented, Portfolio Overwriting. In this strategy, only deep out-of-the-money call strikes are sold

- We must evaluate both legs of our covered call writing trades to properly evaluate trade results

- Unwinding covered call trades (mid-contract unwind exit strategy), includes calculating the time-value cost-to-close

- Despite the huge success of these trades, VONG is not an ideal candidate for option-selling because the open interest is quite low, and the bid-ask spreads are uncomfortably large

Author: Alan Ellman