Portfolio Overwriting Weekly Covered Calls with Chipotle Mexican Grill – July 22, 2024

Portfolio overwriting is a covered call writing-like strategy seeking to both generate cash flow and retain the underlying shares. Share retention may be motivated by our bullish long-term assessment of the security and/or concern for negative capital gain tax consequences, if exercised and shares are sold.

Strategy implementation

- Sell weekly (other expirations can be used) deep out-of-the-money (OTM) call options with a goal of initial annualized returns between 10% and 20%

- Since deep OTM call strikes are used, there will be significant upside potential to our trades

- Select the strike based on implied volatility, resulting in an approximate 84% probability of the strike not expiring in-the-money (ITM), or with intrinsic-value and subject to exercise

- After entering the trade, set 10% buy-to-close, good until cancelled (BTC/GTC) limit orders for rolling-down or “hitting a double” opportunities

Real-life example with Chipotle Mexican Grill, Inc. (NYSE: CMG)– Post 50-for-1 stock split

- 7/8/2024: CMG trading at $62.77: 500 shares owned

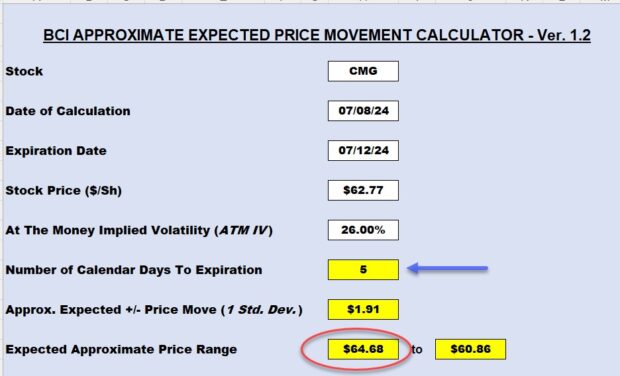

- 7/8/2024: Turn to the BCI Expected Price Movement Calculator to determine the upper end of the 5-day trading range, with an approximate 84% probability of accuracy

- 7/8/2024: Sell-to-open 5 covered calls at the bid or negotiated price

- 7/8/2024: Set 10% BTC/GTC limit orders on the 5 contracts

- The at-the-money (ATM) implied volatility is 26%

BCI Expected Price Movement Calculator

Based on the spreadsheet calculations, an OTM strike of $65.00 is selected for this 5-day trade.

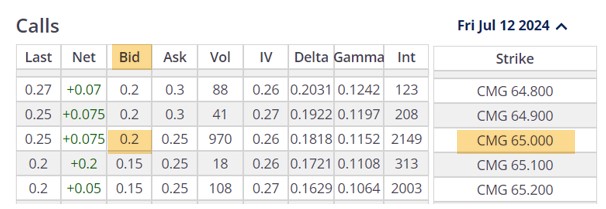

CMG option-chain on 7/8/2024

The $65.00 OTM weekly strike shows a bid price of $0.20. Let’s use the BCI Trade Management Calculator (TMC) to generate our initial weekly returns.

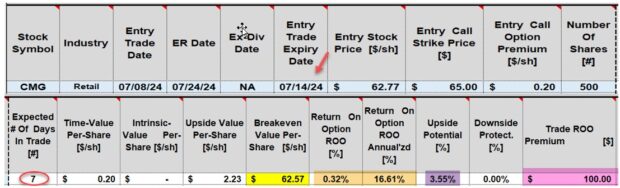

CMG: Initial trade calculations with the TMC

- Note that I used an expiration date of 7/14/2024 (red arrow), not the actual 7/12/2024. I did this because, with weekly options, we do not trade on weekends and making it a 7-day trade, rather than a 5-day trade, will more accurately generate our annualized returns

- The 7-day initial time-value return is 0.32%, 16.61% annualized (brown cells), aligning with our goal of 10% – 20% annualized

- There is an additional 3.55% of upside potential (purple cell), if share price accelerates from current market value up to or beyond the OTM $65.00 strike

- For the 5 contracts, $100.00 cash is generated into our broker account (pink cell). This translates to > $5,000.00 per year

- After the trade is executed, a BTC/GTC limit order is placed at $0.02 (10% of $0.20)

Discussion

Portfolio overwriting securities we want to retain for the long-term can be accomplished by utilizing implied volatility and the BCI Expected Price Movement Calculator. This will result in an approximate 84% probability that the strike will not expire ITM. If it does, we can always roll the option to a later date.

Author: Alan Ellman