Why Wasn’t My Deep In-The-Money Covered Call Exercised? – August 5, 2024

When we write covered calls, our expectation is that if the strike expires in-the-money (ITM), even by $0.01, our shares will be sold at the strike price as a result of option exercise. We check our brokerage accounts the Saturday after expiration Friday and our shares are gone and our cash accounts have grown. This is the case nearly all the time, but there are some unusual circumstances when exercise of ITM strikes will not take place. Thanks to Brian K. for sharing his trade with KKR & Co Inc. (NYSE: KKR) which exemplifies such an aberration.

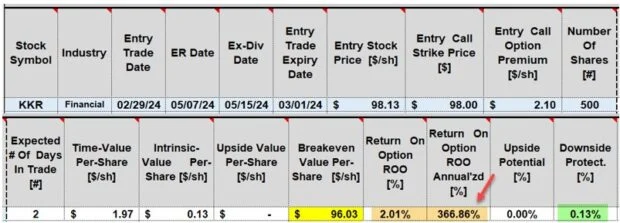

Brian’s KKR trade

- 2/29/2024: Buy 500 x KKR at $98.13

- 2/29/2024: STO 5 x 3/1/2024 $98.00 calls at $2.10

- 3/1/2024 (next day, expiration Friday): KKR trading at $98.83 at 4 PM ET, assignment expected

- 3/1/2024: Between 4 PM ET and 4:25 PM ET, KKR traded (on light volume) between $99.00 – $101.00

- 3/1/2024: Between 5:26 PM ET and 5:30 PM ET, KKR dropped to $95.50 – $96.00

- 3/2/2024: Checked brokerage account and shares not sold, option expired without exercise

- 3/3/2024: KKR opens at $96.50 and closed at $98.80

Analysis goals for this article

- Identify any red flags for trade entry

- Propose a possible explanation why exercise did not occur

Price chart red flag

- #1: Exponential moving averages are bullish (a big positive)

- #2: The MACD histogram tuned negative, a bearish signal

- #3: The stochastic oscillator dropped below the 80% and is descending, a bearish signal

- #4: Volume is robust, giving credence to the technical indicators

Calculation red flag

- Brown cells: This trade represents a 2-day return of 2.01%, 366.86% annualized

- Yellow cell: Breakeven price point at $96.03

- Green cell: Minimal downside protection (of the time-value profit) of 0.13%

An annualized option return of 366.86% tells us that there is extremely high implied volatility in KKR at the time of the trade, with market expectation of potential extreme price movement, either up or down, by contract expiration. Are we willing to incur this risk? For some of us, yes; for most of us, no. There is no right or wrong here, but we must identify the risk inherent in our trades before making final decisions on where we will place our hard-earned money.

Why was there no exercise?

At 4 PM ET on expiration Friday, we can no longer manage our trades. If a strike is expiring ITM, we can (almost) always expect exercise and assignment of our shares, even if the strike is ITM by only $0.01. In Brian’s trade, KKR was expiring $0.83 ITM at 4 PM ET, but no exercise. This is because market-makers have an additional (approximately) 90 minutes to notify the Options Clearing Corporation (OCC) if they want to pursue exercise. If there is expectation of negative news coming out after hours, causing share price decline by Monday morning’s market open, these ITM calls may not be exercised.

I researched KKR news at the time of the trade and found several articles regarding insider trading as potential explanations for the high implied volatility of KKR:

Discussion and lessons learned

- If we enter trades with huge annualized premium returns, the underlying securities have extremely high implied volatility and, therefore, high risk

- When covered call strikes expire ITM, even by $0.01, exercise will, typically occur

- In rare cases, ITM strikes will not be exercised, usually due to negative news or the expectation of negative news coming out after hours

- Market-makers (not us) have an additional (approximately) 90 minutes after-hours, to decide on exercise

Author: Alan Ellman