How Our Option Prices are Determined

When we sell covered calls or cash-secured puts, we access option-chains to determine the value of the premiums we are selling. This article will highlight the factors that determine these prices and compare them to the prices generated by option pricing models like the Black-Scholes Pricing Model.

Factors that determine option pricing

- Consensus of all market participants (retail investors & professionals)

- Supply & demand (most important factor)

- Real value determined by what traders are willing to pay

- NBBO: National Best Bid and Offer: Regulation by the SEC that requires brokers to execute trades at the lowest “ask” price when buying securities and the highest “bid” price when selling securities

Option Pricing Models (Black-Scholes, binomial option pricing, and Monte-Carlo simulation etc.)

- Calculate theoretical option value

- Account for variables such as current market price, strike price, volatility, interest rate, and time to expiration

- The primary goal of option pricing theory is to calculate the probability that an option will be exercised or be in-the-money (ITM), at expiration

- Options pricing theory also derives various risk factors or sensitivities based on those inputs, which are known as the option’s Greeks

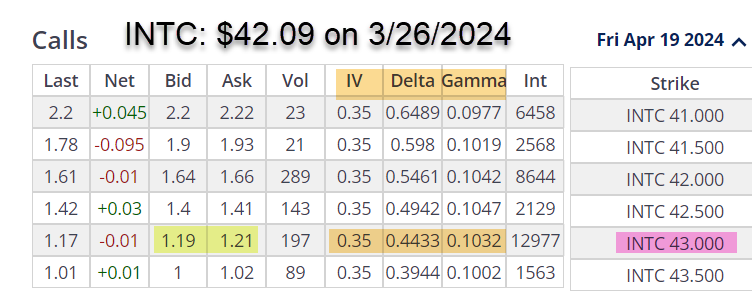

Real-life example with Intel Corp. (Nasdaq: INTC): Option-chain on 3/26/2024

- 3/26/2024: INTC trading at $42.09

- 3/26/2024: The 4/19/2024 OTM $43.00 call (pink cell) shows a bid-ask spread of $1.19 – $1.21 (yellow cells)

- Implied volatility is 35%, Delta is 0.4433 and Gamma is 0.1032 (brown cells)

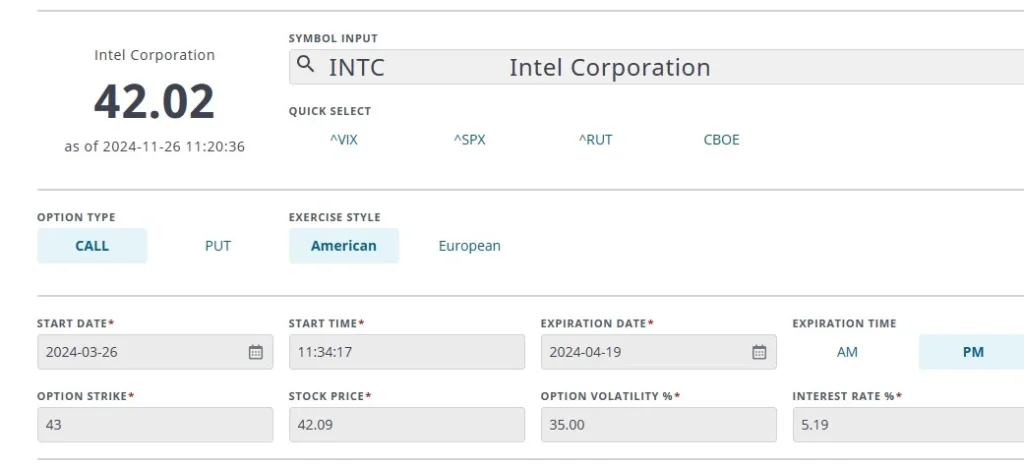

- These stats are placed into an Option Calculator like the one provided by the Options Industry Council (OIC)

Options calculator entries (from option-chain)

Option Calculator results

- Delta and Gamma stats are similar to those on the option-chain

- The theoretical value of the option is $1.176, less than the $1.19 – $1.21bid-ask spread

- Based on this data, it can be said that the current value of the 4/19/2024 $43.00 call option is overpriced

- It’s all about supply & demand

Discussion

Theoretical option values can be calculated using option pricing models. These are only guidelines. Real option value is determined by what traders are willing to pay for the option, and that is based on supply and demand. Market-makers will publish the NBBO, and these are the prices we pay or receive from our option trades.

Author: Alan Ellman