Circumventing Earnings Reports with Weekly Options – October 14, 2024

Always avoid earnings reports when selling covered call or cash-secured put options. This is a BCI rule to protect against serious share price decline after a disappointing earnings release. This article will analyze a real-life example with Datadog, Inc. (Nasdaq: DDOG), which demonstrates how to incorporate weekly options during a month when an earnings release is due out.

On 4/29/2024, DDOG was an eligible stock on our premium member stock report, but its earnings report was due out on 5/7/2024. If we are abiding by the BCI earnings report rule, we cannot use the monthly 5/17/2024 contract expirations. However, DDOG does have weekly options and the 5/3/2024 expiration is not in conflict with the 5/7/2024 date. Let’s examine this potential trade.

DDOG data on 4/29/2024

- DDOG: $130.99

- On our premium stock list for 4 weeks

- High implied volatility (IV): 63.30%

- Industry segment rank: B

- $133.00 weekly call strike has a bid price of $2.49 (can be negotiated higher)

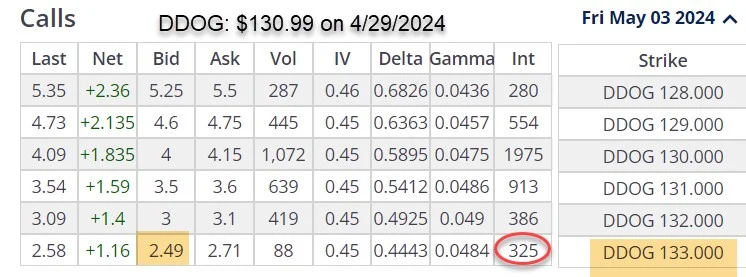

DDOG option-chain on 4/29/2024

With DDOG trading at $130.99, the $133.00 OTM strike shows a published bid price of $2.49, with adequate option liquidity (325 contracts of open interest).

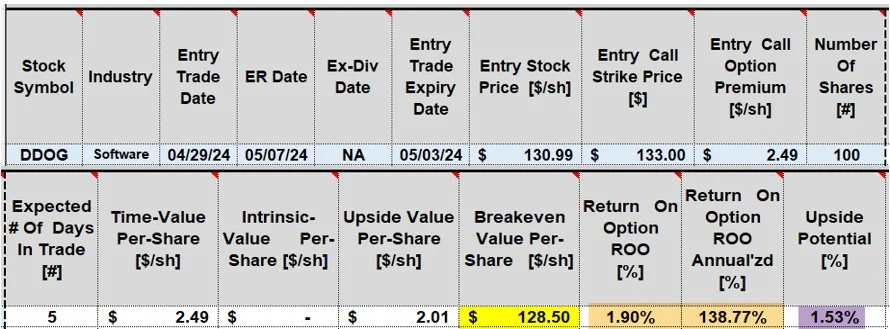

DDOG initial 5-day calculations using this high implied volatility (IV) security

- Brown cells: The trade offers an initial 5-day return of 1.90%, 138.77% annualized (result of the high IV)

- Yellow cell: The breakeven price point is $128.50

- Purple cell: Upside potential (if the share price moves up to, or beyond the OTM $133.00 strike) is an additional 1.53%, for the 5-day trade

- The maximum 5-day return (with upside potential) is 3.43%, 178.36%, based on 52, 5-day trades

Discussion

In the BCI methodology, we avoid earnings report due to the risk incurred from a potentially disappointing earnings release. Stocks & ETFs that have associated weekly options, offer a technique to use these securities by sidestepping the week of the release.

Author: Alan Ellman