Integrating Cash Allocation into Our Option Portfolios – October 7, 2024

When we construct our covered call writing and cash-secured put portfolios, we must incorporate cash allocation into our investment decisions. In this article, The BCI Portfolio Setup Spreadsheet, the Trade Management Calculator (TMC) and the Premium Stock and ETF reports will be used to analyze the process.

What is cash allocation?

This is our mission to allocate a similar amount of cash for each position in our option portfolio. Since share price varies, based on the amount of cash available, the amount per position will rarely be precisely the same for each position, but we will be “in the ballpark”.

Securities selected from the BCI premium stock & ETF reports on 4/26/2024 for the 5/17/2024 expirations

- Alphabet Inc. (Nasdaq: GOOGL)- stock: $171.30

- Vertiv Holdings Co. (Nasdaq: VRT)- stock: $93.49

- ICICI Bank Limited (NYSE: IBN)- stock: $26.53

- Pure Storage, Inc. (NYSE: PSTG)- stock: $52.95

- Rev Group, Inc. (NYSE: REVG)- stock: $21.24

- Global X Silver Miners ETF (NYSE: SIL)- ETF: $31.95

- Global X Copper Miners ETF (NYSE: COPX)- ETF: $47.52

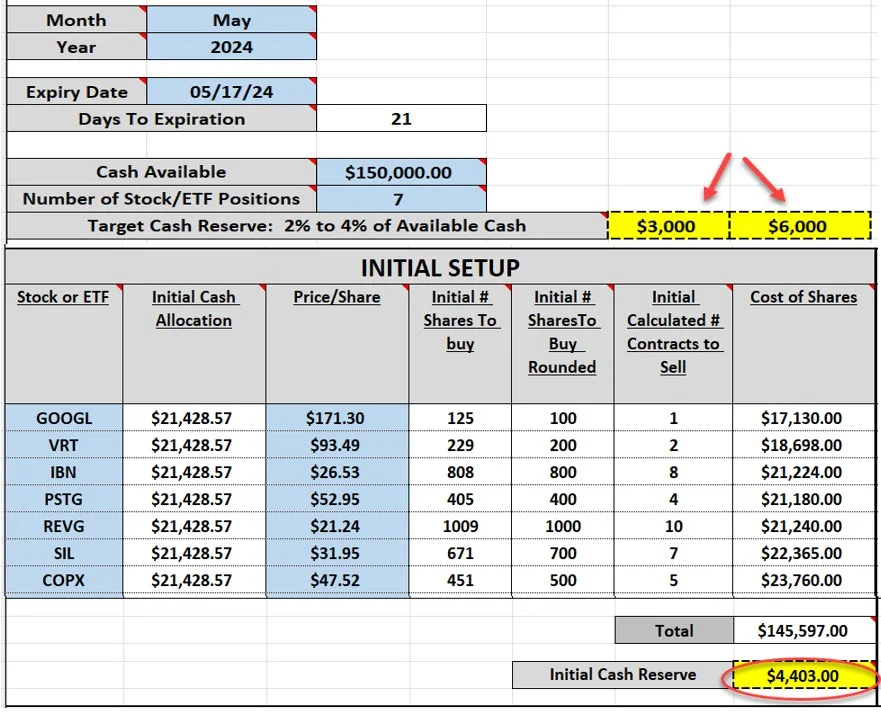

BCI Portfolio Setup Spreadsheet ($150k cash available):

Entries in blue cells and spreadsheet calculations in white cells

- With $150k available, we will allocate approximately $21,428.57 per-position

- There are 21 days to contract expiration

- Using the BCI 2% – 4% guideline for cash reserve needed for potential exit strategy executions, we will need between $3k – $6k (spreadsheet calculations $4,403.00 will be available-yellow cell)

- The spreadsheet clearly guides as to how many shares should be purchased and the number of contracts sold (for cash secured puts, shares are not purchased)

- If the calculations did not work out on this initial attempt, the spreadsheet allows for an adjustment, which was not needed in this scenario

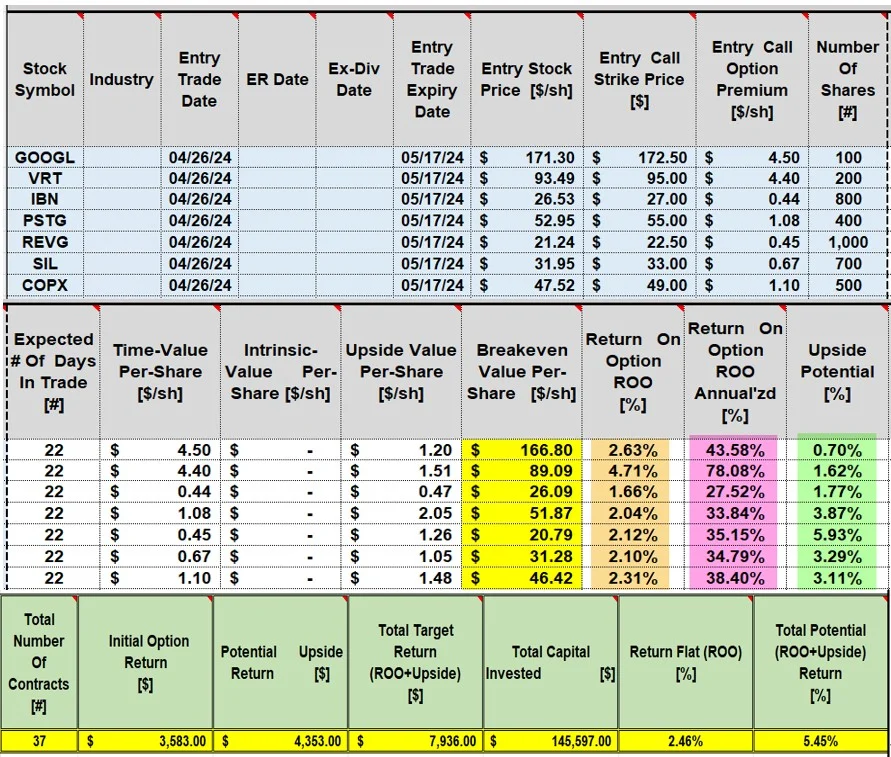

Portfolio initial calculations using the BCI Trade Management Calculator (TMC)

- Yellow cells: Breakeven price points

- Brown cells: Initial 22-day returns

- Pink cells: 22-day returns annualized

- Green cells: Additional potential % returns if share price moves up to or beyond the out-of-the-money call strikes

- Total portfolio initial 22-day return is 2.46% with an additional 5.45% upside potential

- $3583.00 cash was generated selling these 37 contracts

Discussion

Cash allocation is an essential aspect to our option portfolio construction process. In addition to diversifying the securities in our portfolios, we are also dedicating similar amounts of cash per position.

Author: Alan Ellman