Anatomy of a Successful Weekly Cash-Secured Put Trade with PINS – November 11, 2024

Selling cash-secured puts (CSP) has a goal of generating weekly or monthly cash flow with or without taking possession of the underlying security. This article will analyze a real-life weekly (6/3/2024 – 6/7/2024) trade with Pinterest, Inc. (NYSE: PINS) where the goal was cash flow only.

Data accessed from the BCI Weekly Stock Screen & Watch List on 6/3/2024)

- PINS: $41.27

- On our stock list for 3weeks

- #6 on IBD Big Cap 20

- Modest implied volatility (IV): 25.2%

- Industry segment rank: B (Internet)

- Next ER: 7/30/2024

- $40.50 weekly put strike has a bid price of $0.22

- To avoid exercise, PINS must be above the $40.50 strike at expiration or exit strategy intervention would be necessary

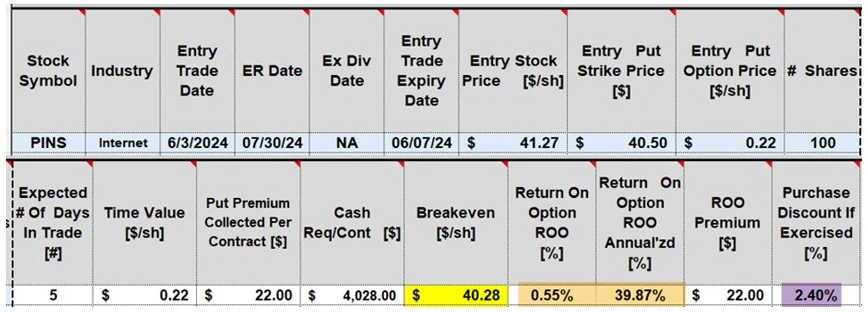

PINS initial trade calculations

- Calculations are made using our BCI Trade Management Calculator (TMC)

- With PINS trading at $41.27, the breakeven (BE) price point is $40.28 (yellow cell)

- The 5-day initial return is 0.55%, 39.87% annualized) brown cells)

- If PINS is purchased at the BE price point, it will represent a 2.40% discount from the price when the trade was initiated (purple cell)

- At expiration, PINS was trading at $44.11, well above the $40.50m strike. No position management was required

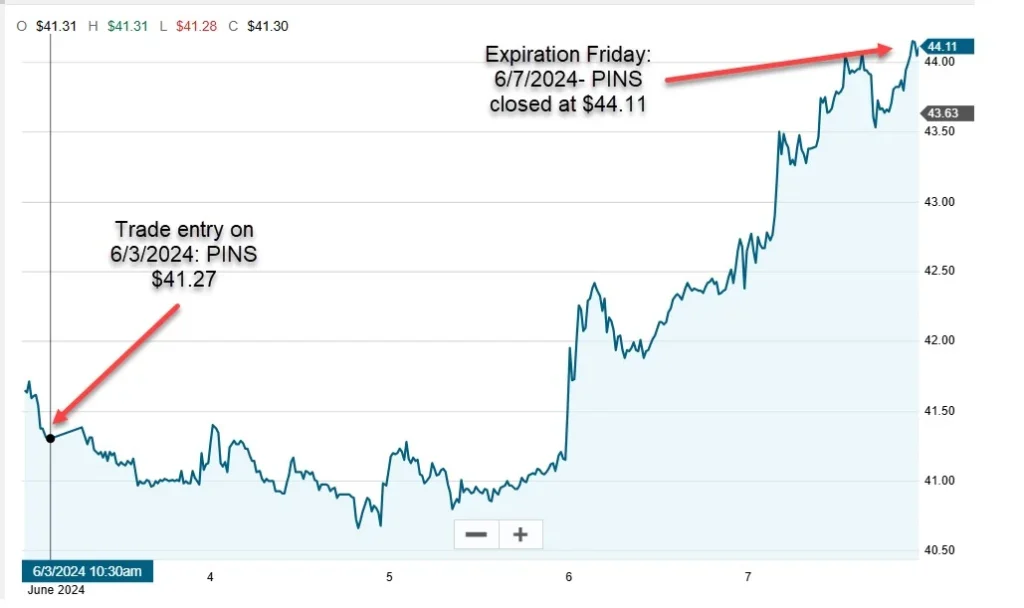

Graphic representation of this 5-day trade

- When seeking to generate cash flow from option premium while, at the same time, avoiding exercise, our hope and expectation is that share price will main above the out-of-the-money (OTM) put strike

- If share price declines only slightly (stays above $40.50), stays the same or moves higher, we win

- In this case, PINS closed the week at $44.11, a big win for the good guys (us)

Discussion

Not all trades will be winning ones. Our reasonable goal is to have many more winners than losers. The odds are dramatically in our favor when we screen for stocks that are fundamentally and technically sound and meet our common-sense requirements (minimum trading volume, as 1 example).

In this case with PINS, no exit strategy intervention was needed, and our maximum return was realized.

Author: Alan Ellman