Generating Greater Than Maximum Returns Using Exit Strategies – November 25, 2024

Blue Collar Investors know that there are times we shouldn’t “settle” for maximum returns. In this article, a successful covered call trade with QQQM (an exchange-traded fund or ETF) will be analyzed, detailing how a maximum return was enhanced using the mid-contract unwind (MCU) exit strategy. The QQQM trade was converted to a CAKE trade in a 2-week period.

Real-life example with Invesco Nasdaq 100 ETF (Nasdaq: QQQM) and The Cheesecake Factory Inc. (Nasdaq: CAKE)

- 6/10/2024: Buy 100 x QQQM at $190.92

- 6/10/2024: STO 1 x 6/21/2024 $193.00 OTM call at $1.25

- 6/10/2024: Set up a BTC GTC limit order for the $190.00 call at $0.13 (10% guideline)

- 6/17/2024: QQQM trading at $197.34

- 6/17/2024: BTC the 6/21/2024 $190.00 call at $4.80

- 6/17/2024: Sell 100 x QQQM at $197.34

- 6/17/2024: Buy 100 x CAKE at $39.18 (additional cash went into other trades- percentages is what’s important)

- 6/17/2024: STO 1 x 6/21/2024 $40.00 OTM call at $0.28

What is the Mid-Contract Unwind (MCU) exit strategy?

This is a position management technique used when share price accelerates significantly causing the time-value of the premium to approach $0.00. We close both legs of the covered call trade and initiate a new trade with a different underlying security.

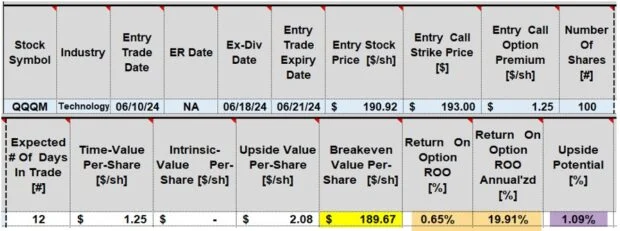

Initial QQQM covered call trade calculations

- Yellow cell: The breakeven price point is $189.67

- Brown cells: The initial 12-day time-value return is 0.65%; 19.91% annualized

- Purple cell: An additional 1.09% of upside potential may be realized

- The maximum return is 1.74% (0.65% + 1.09%)

- Calculations are accomplished using the BCI Trade Management Calculator (TMC)

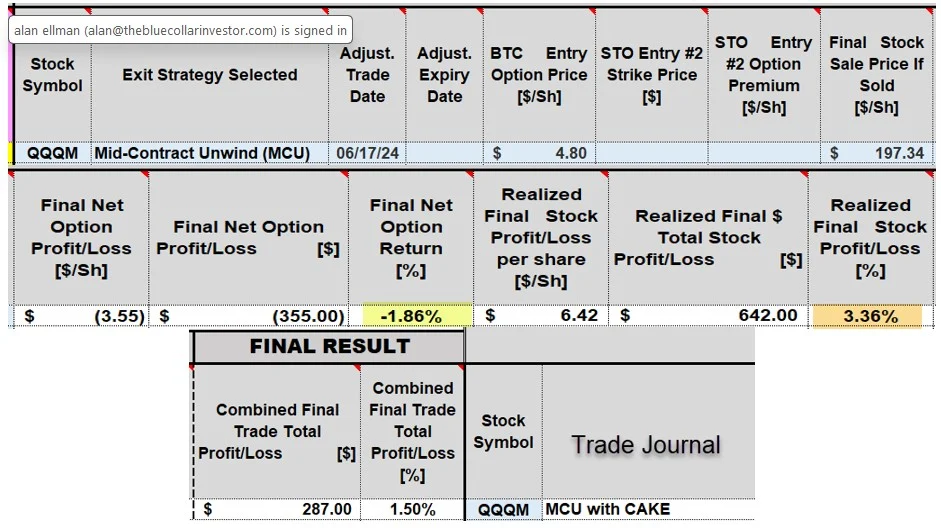

MCU step #1: Closing the QQQM trade

- The final realized return is 1.50%, 0.24% less than the maximum possible return

- There was a realized option loss and a realized stock gain

- Can the CAKE trade compensate for this small loss and more?

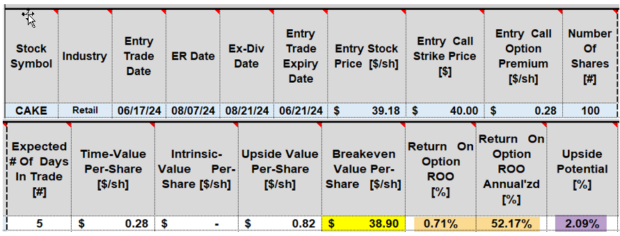

5-day CAKE covered call trade

- Yellow cell: The breakeven price point is $38.90

- Brown cells: The 5-day return is 0.71%; 52.17% annualized

- Purple cell: There is an additional 2.09% of upside potential, should share price rise up to or beyond the OTM strike

- These calculations more than compensate for the 0.24% of lost time-value to close the QQQM trade

Discussion

Many situations will arise where our exit strategy arsenal will allow us to generate greater than maximum returns for our initial investments. The scenarios are not based on luck, but rather on preparation and opportunity.

Author: Alan Ellman