Rolling a Successful Weekly Covered Call Trade – November 4, 2024

When our covered call trades are expiring in-the-money (ITM), we have an unrealized (shares are not yet sold) maximum return. This consists of option premium + any unrealized share appreciation from purchase price to the strike, if an out-of-the-money (OTM) strike was utilized.

In this article, a real-life example with Crocs, Inc. (Nasdaq: CROX) will be analyzed as how to roll-out such a successful trade using the BCI Trade Management Calculator. This will represent a 4-day, holiday-shortened weekly trade.

CROX data from our BCI Premium Member Stock Report on 5/28/2024

- CROX: $153.33(Apparel industry)

- Industry

- Segment rank “A”

- Implied volatility (IV): 30.5%%

- Weekly options are available

- Next ER: 8/6/2024

- No dividend

- $155.00 weekly (4-day) call strike has a bid price of $0.90

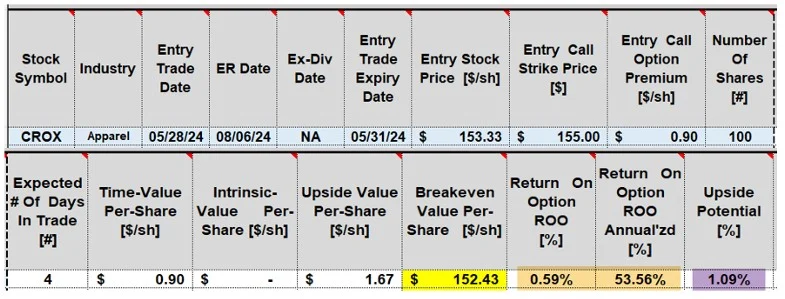

Initial trade calculations using the BCI Trade Management Calculator (TMC)

- 5/28/2024: CROX purchased at $153.33

- 5/28/2024: The 5/31/2024 $155.00 call is sold at $0.90

- The breakeven (BE) price point is $152,43 (yellow cell)

- The initial 4-day return is 0.59%, 53.56% annualized (brown cells)

- Upside potential is 1.09% (purple cell)

- 5/31/2024: On expiration Friday, CROX was trading at $155.64, leaving the $155.00 strike ITM (not shown in image)

- 5/31/2024: The cost-to-close the $155.00 strike was $0.70 ($064 of intrinsic-value + $0.06 of time-value)

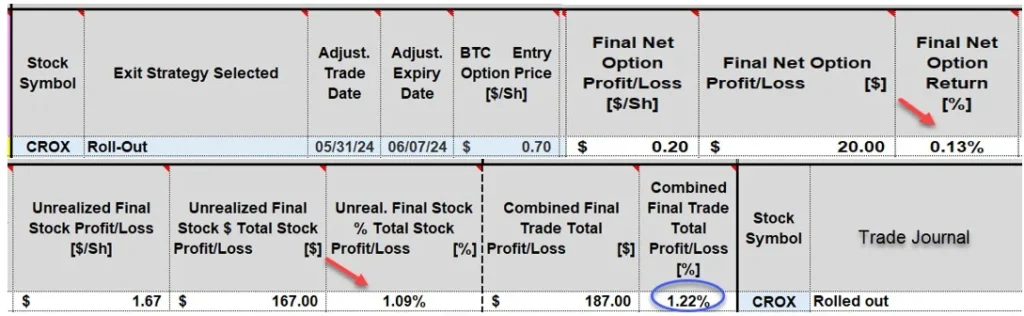

Final initial contract results, incorporating the $0.70 BTC

- The final 4-day option return is 0.13% (top red arrow)

- The unrealized stock return is 1.09% (bottom red arrow)

- The total 4-day unrealized (shares not sold) is 1.22% (blue oval)

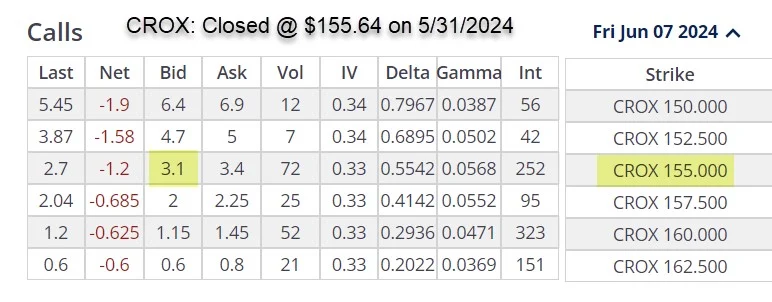

CROX option-chain on 5/31/2024 for the 6/7/2024 weekly expirations- for rolling-out considerations

- The rolling-out $155.00 strike offers a bid price of $3.10 per share (yellow cells)

- The share value at the time of the roll is $155.00, not $155.64, due to our initial contractual obligation to sell at $155.00

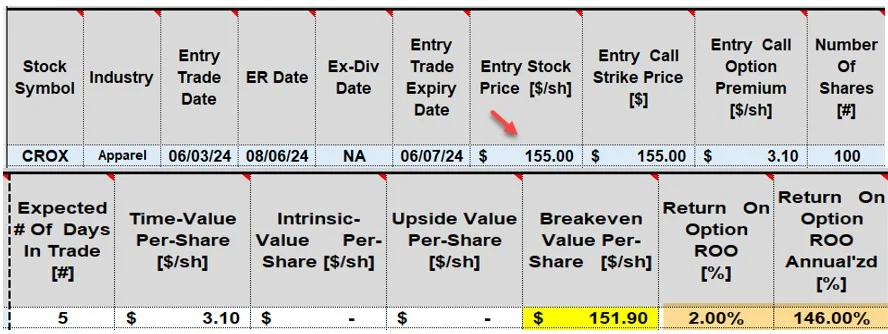

Initial calculations for the 6/7/2024 contract

- Stock price of $155.00 is entered (red arrow)

- The BE price point is $151.90 (yellow cell)

- The initial 5-day return is 2.00%, 146.00% annualized (brown cells)

- There is no upside potential because the $155.00 strike is ITM at the time of the roll

Discussion

A top-performing stock can generate significant annualized returns and upside potential using weekly call (and put) options, even in a holiday-shortened week. When the strike is expiring ITM and we decide to use the same security in the next option cycle, we can roll the option, assuming the initial calculations meet our pre-stated initial time-value return goal range.

Author: Alan Ellman