Portfolio Overwriting NVDA Using Implied Volatility – December 16, 2024

When NVIDIA Corp. (Nasdaq: NVDA) split 10-for-1 in June 2024, more retail investors had the opportunity to leverage this stock to sell options. Many already owned NVDA, but now owned 10x the number of shares at 1/10 the price. Writing covered calls against this security created an opportunity for a cash flow on a superior-performing stock (at that point in time). This article will analyze one way to write covered calls using NVDA and implied volatility to both generate income and create a high probability of avoiding exercise of the options and subsequent sale of the shares. This approach to covered call writing is known as portfolio overwriting.

What is portfolio overwriting?

This is a covered call writing-like strategy where deep out-of-the-money (OTM) calls are written to both generate cash-flow and create a low probability of exercise.

What is implied volatility (IV)?

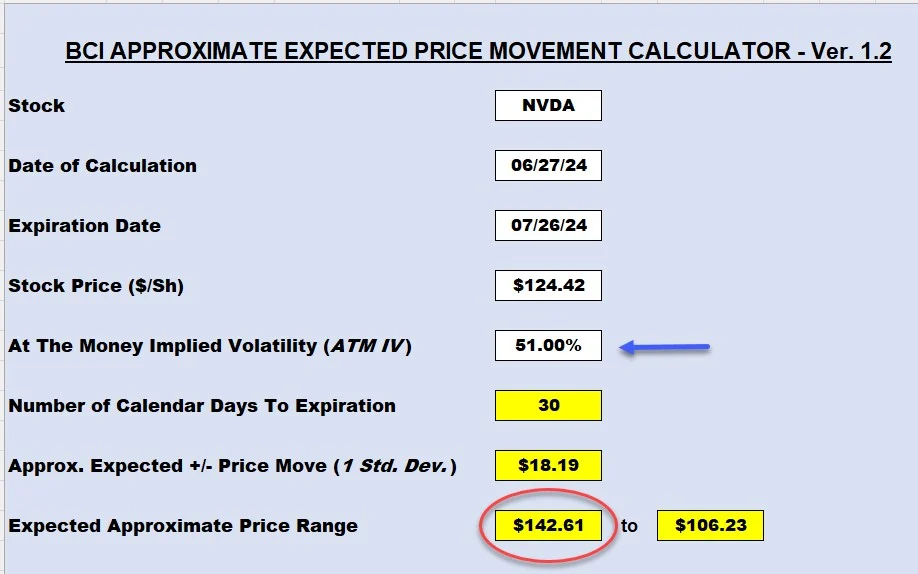

IV is a forecast of the underlying stock’s volatility as implied by the option’s price in the marketplace. Implied volatility stats are based on annualized price movement and 1 standard deviation (expected to fall into the price movement range approximately 68% of the time). To make IV specific to the contract we are considering, we must use a conversion formula to calculate the expected trading range. The BCI Expected Price Movement Calculator will accomplish this for us, using an at-the-money (ATM) IV for the contract in consideration. The conversion formula is inherent in the spreadsheet. Of the remaining 32%, 16% is expected to fall under and 16% above the range. Our concern when portfolio overwriting is the high end. If share price moves above the deep OTM call strike, our shares are subject to exercise (sale).

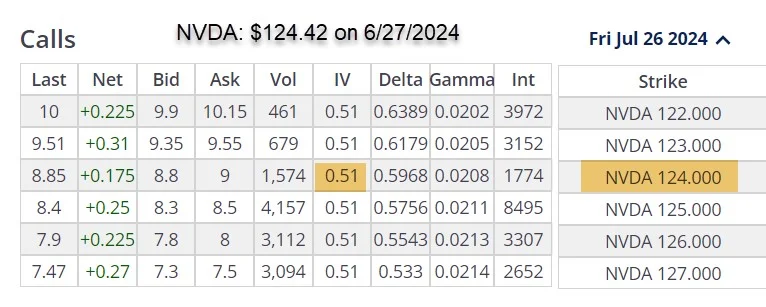

Determining the ATM IV for NVDA ($124.42) for the 7/26/2024 expiration

The near-the-money $124.00 shows an IV of 51%.

Calculating the expected trading range with an emphasis on the high end to avoid exercise

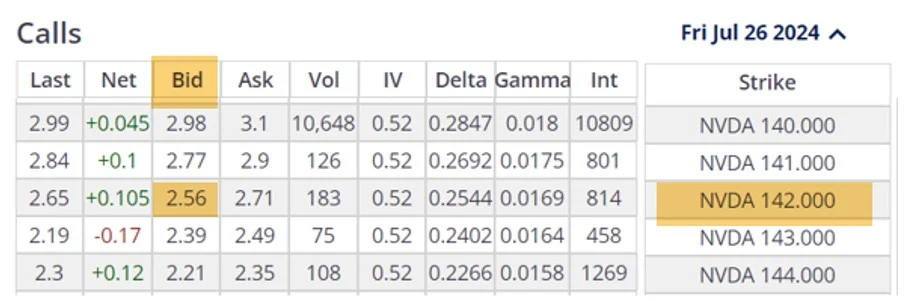

We will check an option-chain for the deep OTM $142.00 strike which will give us an (approximately) 84% probability of not falling outside the projected range.

NVDA deep OTM option-chain

The $142.00 deep OTM strike shows a bid price of $2.56. Let’s calculate using the BCI Trade Management Calculator (TMC).

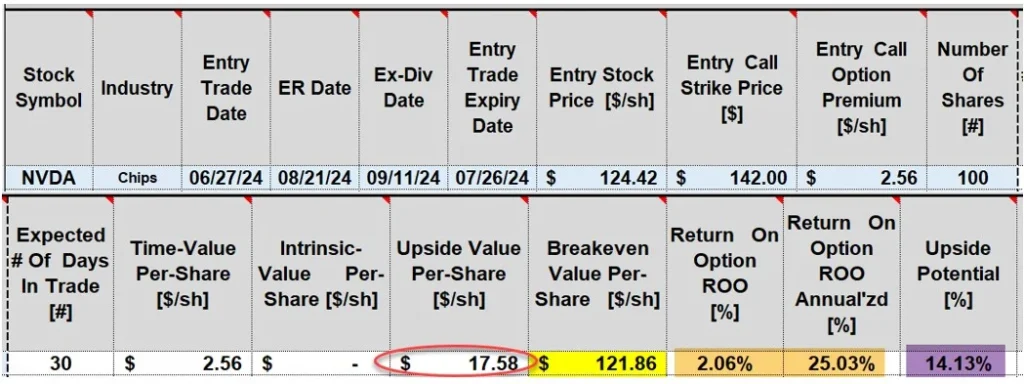

NVDA initial calculations

- Yellow cell: The BE price is $121.86

- Brown cells: The initial 30-day return is 2.06%, 25.03% annualized

- Purple cell: There is an upside potential opportunity of 14.13%

Discussion

When seeking to generate cash-flow while, at the same time, looking to avoid exercise, using IV and the BCI Expected Price Movement Calculator can create 84% probability-of -success trades. Even if share price does move beyond the deep OTM call strike selected, we can always buy back or roll that option prior to expiration.

Author: Alan Ellman