2 Important Dates When Trading Stock Options – January 6, 2025

When we sell covered call or cash-secured put options, there are 2 dates we should factor into our trade decisions. Earnings reports (ER) dates must be considered 100% of the time and ex-dividend dates are important in certain specific scenarios. In this article, a real-life example with PulteGroup, Inc. (NYSE: PHM) will be used to demonstrate how to navigate around these 2 dates.

What are earnings report dates?

These are quarterly filings made by public companies to report their earnings and revenue performance. In the BCI methodology, these should always be avoided, in terms of no option in place, 100% of the time. This is because of the inherent risk from a disappointing ER.

What are ex-dividend dates?

Latest date a shareholder must own a stock to be eligible to receive an upcoming dividend distribution. Ex-dates are the main reason for early exercise. If share retention is an integral part of our trading system, these dates must be avoided when trading options.

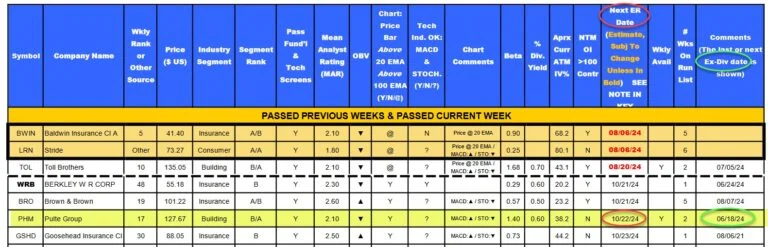

PHM on the 8-2024 Premium Stock Report

Overview & closeup images

- The ER date (red oval) is on 10/22/2024

- The last ex-date was on 6/18/2024 (green oval), so the next is projected to be on 9/18/2024

- Let’s assume we do not want to be subjected to early exercise, we want to avoid both dates

- PHM has weekly options, so we will seek the 9/13/2024 expiration dates which does avoid both

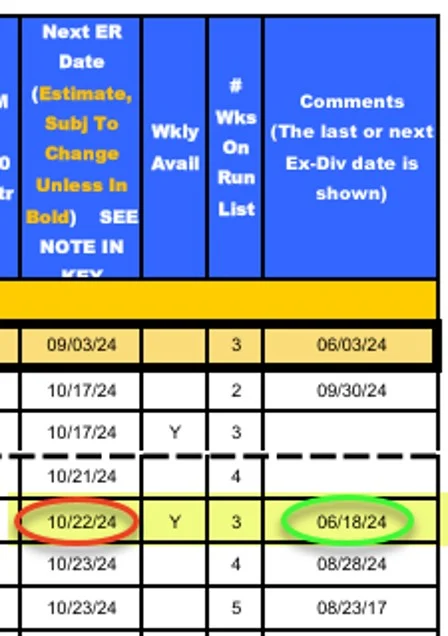

PHM option-chain on 8/12/2024 for ITM and OTM strikes

- The $120.00 ITM strike shows a bid price of $6.00

- The $127.00 OTM strike shows a bid price of $2.50

- Both strikes show a wide bid-ask spread which is negotiable to higher prices, but we will use the worst-case scenarios of these published prices

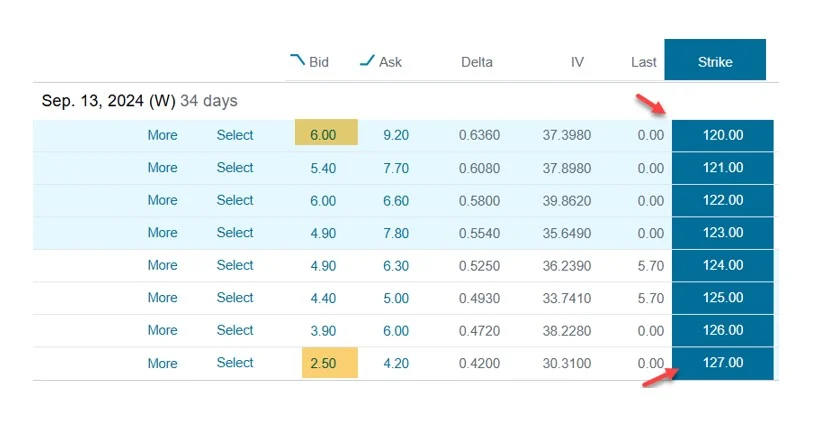

PHM initial ITM and OTM calculations using the BCI Trade Management Calculator (TMC)

- The ITM $120.00 strike shows a time-value return of 2.48%, 27.47% annualized (brown cells) based on a 33-day trade

- The ITM $120.00 strike shows a downside protection (of that time-value profit) of 2.45% (purple cell)

- The OTM $127.00 strike shows a time-value return of 2.03%, 27.47% annualized (green cells) based on a 33-day trade

- The OTM $127.00 strikes shows an additional upside potential of 3.24% (pink cell) if share price moves up to or beyond the OTM strike

- The breakeven price points are shown in the yellow cells

Discussion

The 2 key dates we should be aware of when trading options are the ex-dividend dates and earnings report dates. The former is the main reason for early exercise and the latter represents inherent risk if we are exposed to these reports.

Author: Alan Ellman