Converting a High Risk to a Low Risk Covered Call Trade – January 20, 2025

High implied volatility securities can be used in covered call trades in a defensive manner using the appropriate call strikes. In this article, Neurocrine Biosciences, Inc. (Nasdaq: NBIX) will be used to analyze the conversion process.

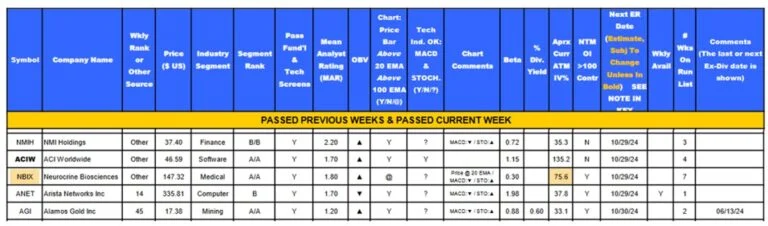

NBIX data on 8/15/2024 from the BCI Premium Stock Report

- Industry rank: A

- Media Analyst Rating (MAR): 1.80

- 7 weeks on BCI “eligible” list

- Initial time-value return goal range for a 1-month expiration is 2% – 4% (as 1 example)

- Implied volatility (IV): 75.6% (extremely high and risky)

The concern is the high IV which represents substantial risk to the downside.

Converting a high-risk to a low-risk trade

By opting for an in-the-money (ITM) strike, the intrinsic-value component of the premium will lower the breakeven (BE) price point substantially.

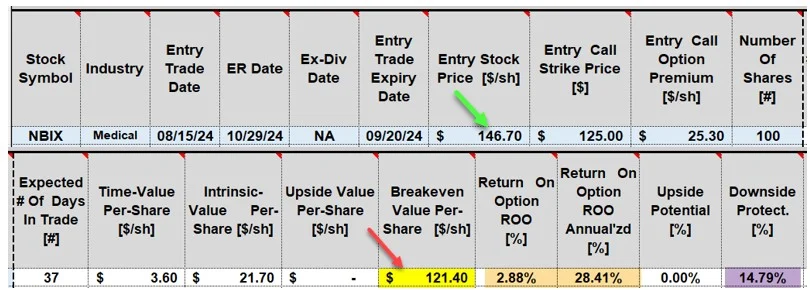

NBIX option-chain data on 8/15/2024 with NBIX trading at $146.70

- $155.00 OTM strike: $11.00 premium (BE -breakeven- at $135.70)

- $125.00 ITM strike: $25.30 premium (BE at $121.40)

- Strikes in the $170.00 – $180.00 range generate 2% – 4%

Pros & cons of the OTM strike

- 2 income streams possible if share price rises

- Higher breakeven price points than ITM strikes

- Significant initial time-value returns

Pros & cons of the ITM strike

- Significant initial time-value return

- No upside potential if share price rises

- Lower BE price points

- Intrinsic-value acts as an insurance policy, paid for by the option buyer

Deep ITM initial calculations resulting in meaningful downside protection

- Yellow cell: BE price point is $121.40, compared to current market value of $146.70 (green arrow)

- 37-day return is 2.88%, 28.41% annualized (brown cells)

- Downside protection of the time-value profit is 14.79%

- Calculations achieved with the BCI Trade Management Calculator (TMC)

Discussion

Using deep ITM call strikes can convert high-IV and high-risk trades into low-risk trades, while still offering significant initial time-value potential returns.

Author: Alan Ellman