Rolling-Out Our Covered Call Trades After Rolling-Down – January 27, 2025

Market volatility can cause our covered call trades to whipsaw up and down, much like a roller-coaster. In this article, a real-life trade with The Industrial Select Sector SPDR Fund (NYSE: XLI) will be analyzed. In this series of trades, shared with me by premium member, Charlie, share price declined triggering a roll-down exit strategy and then recovered, leaving the rolled-down strike in-the-money (ITM). Charlie turned to the What Now worksheet tab of our Trade Management Calculator (TMC) to evaluate rolling-out and rolling-out-and-up opportunities.

XLI trades from 7/26/2-24 – 8/16/2024

- 7/26/2024: Buy 200 x XLI at $126.76

- 7/26/2024: STO 2 x 8/16/2024 $127.00 calls at $1.97

- 8/5/2024: BTC 2 x 8/16/2024 $127.00 calls at $0.19 (1o% guideline)

- 8/5/2024: STO 2 x 8/16/2024 $123.50 calls at $1.82 (roll-down)

- 8/16/2024: XLI trading at 126.96, leaving the rolled-down $123.50 strike ITM

- 8/16/2024: To BTC the 8/16/2024 $123.50 strike, the ask price is $3.60

- 8/16/2024: The bid price to roll-out to the $124.00 (close to $123.50) strike is $4.45

- 8/16/2024: The bid price to roll-out–and-up to the $127.00 strike is $2.42

What price do we enter for the stock when evaluating rolling opportunities after rolling-down?

Charlie rolled-down from the $127.00 strike to the $123.50 strike, which is now ITM since share price as expiration approached was 126.96. The correct entry into the Unwind Now worksheet tab of the Trade Management Calculator (TMC) is $123.50, because that is what the shares were worth at the time of the rolling considerations.

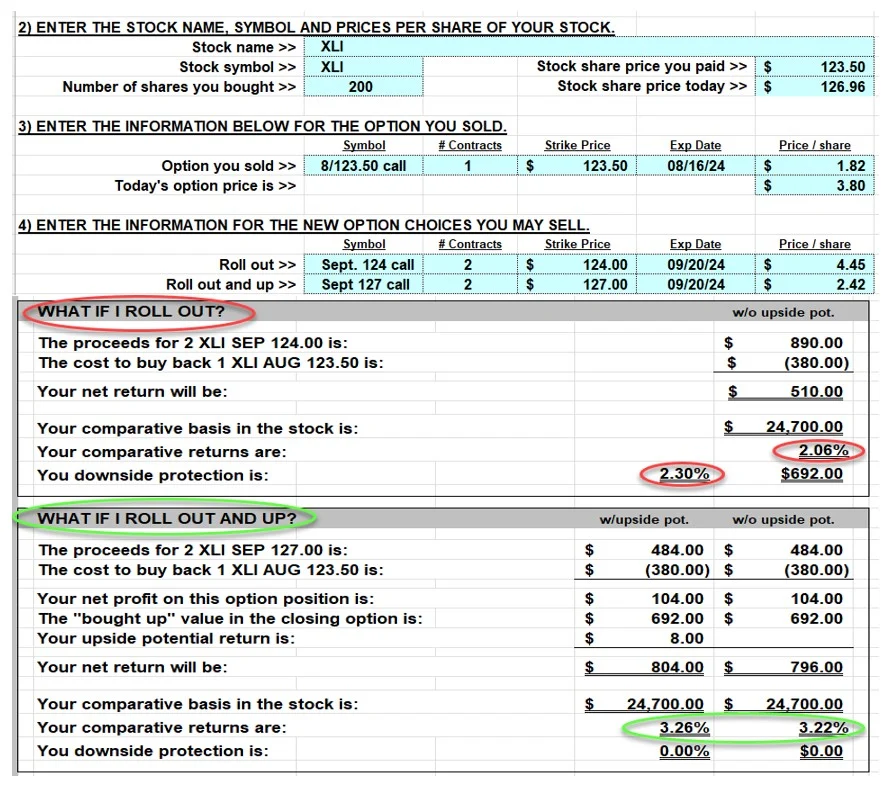

Unwind Now worksheet tab calculations for XLI trades (Note: # contracts in the screenshot should read “2”)

- Rolling-out to the $124.00 strike results in a 2.06% 1-month return with 2.30% downside protection of that time-value profit. This would be an appropriate choice for a defensive position that yields significant returns

- Rolling-out-and-up to the $127.00 strike results in a 3.26% initial time-value + unrealized share appreciation return with an additional 3.22% upside potential should share price accelerate to the $127.00 strike or higher. This path should be considered when bullish on the market and the stock

- Since 200 shares were purchased, 1 contract of each strike can also be sold

Discussion

After rolling-down a strike that is expiring ITM as expiration approaches, we use the rolled-down strike price to enter into the Unwind Now worksheet tab of the TMC. The spreadsheet will calculate initial and unrealized returns to asst us in these exit strategy decisions.

Author: Alan Ellman