Rolling-Up Twice and Closing a Mixed Cash-Secured Put Trade – January 13, 2025

Exit strategies for covered call writing and selling cash-secured puts are critical in achieving the highest level of our trading returns. In this article, a real-life example with SPDR S&P Homebuilders ETF (NYSE: XHB) will analyze a cash-secured put trade with 3 exit strategy implementations. Watch how the trade starts out with significant initial returns, then gets even better and finally turns dramatically against us. Exit strategies save the day!

Real-life example with XHB

- 7/11/2024: XHB trading at $105.89

- 7/11/2024: STO the 8/16/2024 $103.00 OTM put at $2.00

- 7/22/2024: XHB price accelerates to $118.66

- 7/22/2024: BTC the 8/16/2024 $103.00 put at $0.56

- 7/22/2024: STO the 8/16/2024 $110.00 put at $1.82 (roll-up #1)

- 7/31/2024: XHB trading at $118.75

- 7/31/2024: BTC the 8/16/2024 $110.00 put at $0.62

- 7/31/2024: STO the 8/16/2024 $115.00 put at $1.72 (roll-up #2)

- 8/2/2024: XHB price decline to $111.50

- 8/2/2024: BTC the 8/16/2024 $115.00 put at $1.45 (3% guideline)

Graphic representation of the XHB cash-secured put trade with exit strategies

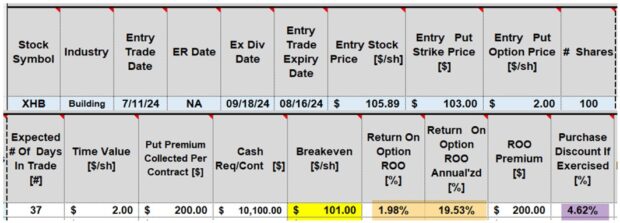

XHB put trade: Initial calculations using the BCI Trade Management Calculator (TMC)

- Brown cells: 37-day return of 1.98%, 19.53% annualized

- Purple cell: If exercised, shares are purchased at the breakeven price point of $101.00 (yellow cell), a 4.62% discount

Exit strategies executed in this series of put trades

Rolling-up: Buying back a put option and selling a new option at a higher strike with the same expiration date. This takes advantage of share price acceleration

3% guideline: Closing a cash-secured put trade when share price declines 3% or more from the strike price sold (3% from $115.00 = $111.55). Thís protects us from substantial share price decline

Option credits & debits

- Credits: $2.00 + $1.82 + $1.72 = $5.54

- Debits: $0.56 + $0.62 + $1.45 = $2.63

- Net credit: $2.91 per share, $291.00 per contract

- Cash required to secure the $115.00 put = $113.28 per share

- Final realized return = $2.91/ $113.28 = 2.57%

Discussion

Exit strategy implementation for this cash-secured put trade turned a 37-day 1.98% initial return into a 21-day 2.57% final realized return. The cash freed up from closing the trade can be used to initiate a new cash-secured put trade with a different underlying security and generate another income stream, still in the same contract cycle.

Author: Alan Ellman