Setting Up a Covered Call Trade: Step-by-Step Process + New Trade Video – February 17, 2025

Establishing our covered call trades require a sequential process including stock selection, option selection and position management. This article will analyze the procedures using a real-life example with Tenet Healthcare Corp. (NYSE: THC).

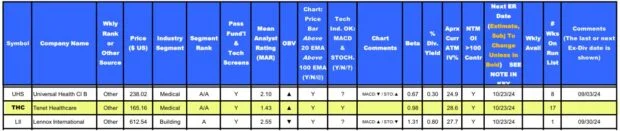

Stock selection using our BCI Premium Stock Report as the resource on 9/20/2024

- Passed BCI’s rigorous fundamental, technical and common-sense screens

- In medical industry segment ranked “A”

- Excellent mean analyst rating of 1.43

- On balance volume bullish

- On our stock list for 16 weeks

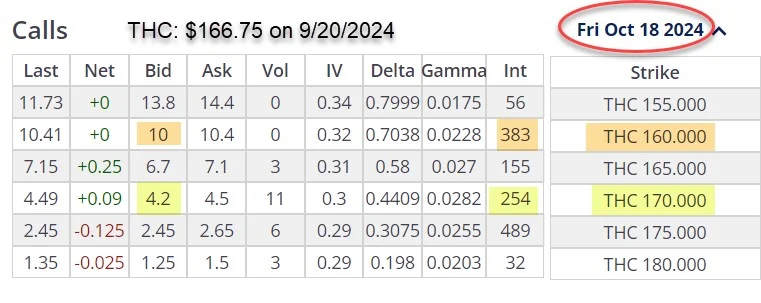

Option-chain on 9/20/2024 (preliminary view, will change when ready to trade)

- Consider the OTM $170.00 call strike in normal to bull market conditions

- Consider the ITM $160.00 call strike in volatile and bear market conditions

- The $170.00 strike will be used in this article

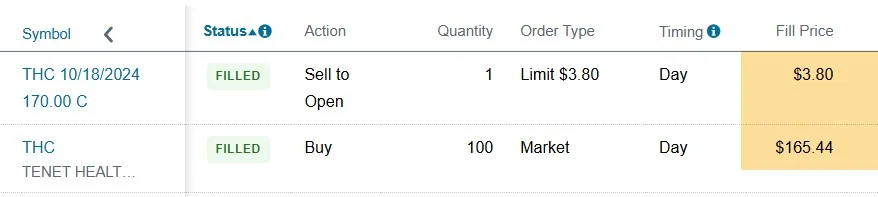

Broker screenshot of share purchase and option sale

- 100 x THC purchased at $165.44

- Sell-to-open 1 x 10/18/2024 $170.00 call at $380.00/contract

- Notice the slight changes from the pre-trade option-chain

- Not shown is the 20% BTC/GTC limit order of $0.76, which is 20% of $3.80 and protects against share price decline

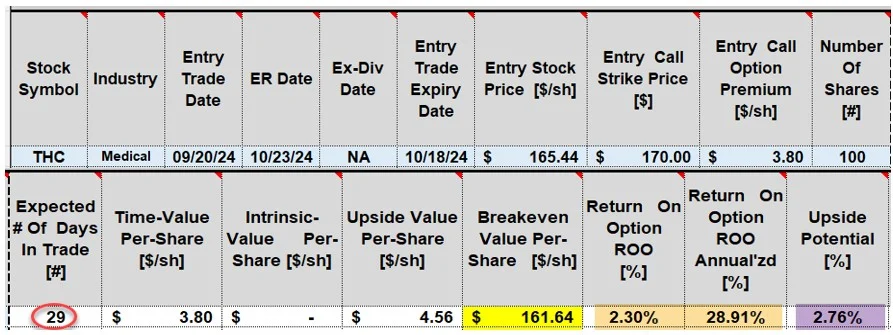

Initial trade calculations with the BCI Trade Management Calculator

- 29-day trade if taken through contract expiration (red circle)

- 2.30% initial time-value return, 28.91% annualized (brown cells)

- Upside potential of 2.76%, if THC moves up to, or beyond the $170.00 strike at expiration (purple cell)

- Possibility of a 5.06%, 29-day return

Discussion

The crafting of our covered call trades incorporates stock selection, option selection and position management. Successful execution of these trades is facilitated by following a blueprint like the one analyzed in this publication.

Author: Alan Ellman