The 5 Most Common Mistakes Made by Covered Call Writers – February 10, 2025

Selling options (covered calls or cash-secured puts) is as much an art as it is a science. There are several principles that must be adhered to in order to achieve the highest levels of returns. In this article, the 5 most common mistakes made by covered call writers will be analyzed.

1. Starting without adequate education

There are 3 required skillsets we need to master in order to achieve the highest levels of returns. It will take most beginners 3 – 4 months to get there:

- Stock selection

- Option selection

- Position management (exit strategies)

Take the time to master all 3 … 1 or 2 is not good enough.

2. Selecting high implied volatility stocks

Extremely volatile stocks will return enticing option premiums. We must understand that high implied volatility (IV) stocks also come with greater risk. We must locate securities that align with our personal risk-tolerance and initial time-value return goal range (2% – 4% per-month, for me).

3. Not considering earnings reports (ERs)

Covered call writing is a conservative, low-risk approach to trading options. Earnings reports can impact share price in a major way, both good and bad. Why take the risk? We know the date of the ER, so let us take this risky event off the table. Always avoid earnings reports.

4. Not factoring in diversification

If we are top-heavy in one industry, let’s say computer hardware, and that industry takes a dive, our entire portfolio is impacted. If we are properly diversified, we will have the opportunity for the other industries to counteract the loss.

5. Not factoring in cash allocation

In addition to being well diversified, we should also allocate similar amounts of cash to each position. It will never be exact but will offer a significant amount of protection should 1 position under-perform.

Diversification & Cash Allocation Spreadsheet

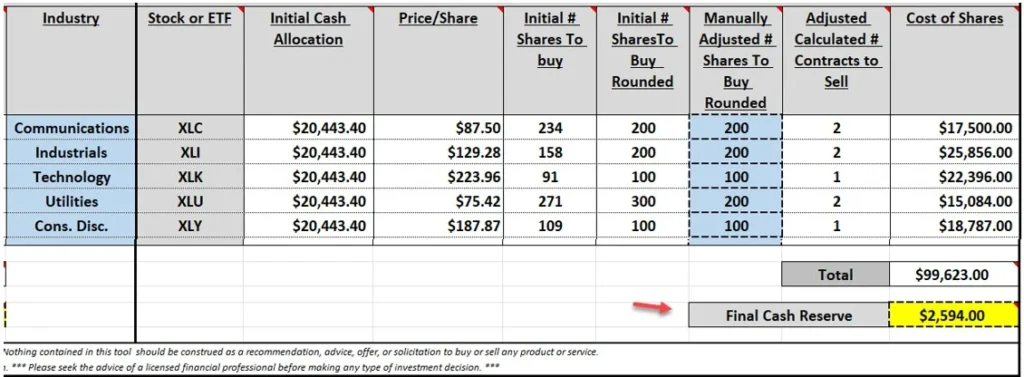

The BCI Portfolio Setup and Results Spreadsheets will assist us in achieving appropriate diversification and cash allocation:

- With $102,217.00 cash available, the spreadsheet allocates $20,443.00 per position

- The final spreadsheet calculations show the # of shares to be purchased, and contracts sold

- It reflects a final cost of $99,623.00

- There is a cash reserve of $2,594.00 (red arrow) for potential exit strategy opportunities

- The blue column to the left shows appropriate industry diversification

Discussion

Avoiding any 1 of these pitfalls will enhance our portfolio results. Avoiding all of them will have a huge positive impact on our financial fortunes.

Author: Alan Ellman