Option Greeks Defined and Theoretical Calculations + Premium Membership Pricing Information – June 17, 2024

The option Greeks are a series of calculations that measure the factors that impact our option prices and risk. The Black-Scholes Model can be used to determine the theoretical value for a call or put option based on these factors:

- Volatility

- Type of option

- Stock price

- Time to expiration

- Strike price

- Risk-free interest rate

This article will provide brief definitions of the option Greeks and then use Apple Computer, Inc. (Nasdaq: AAPL) to show how the theoretical value of the Greeks is calculated using an option’s calculator.

Option Greeks defined

- Delta: The amount an option value will change for every $1.00 price change in the underlying security. It also measures the approximate probability of the option expiring in-the-money or with intrinsic-value. Deltas for calls run from 0 to 1. Higher Delta options have a greater chance of exercise

- Gamma: The rate of change of Delta, for every $1.00 change in stock price … the “Delta of Deltas”

- Theta: How much the theoretical value of an option price will change with the passage of 1 calendar day. Time-value of our premiums decline for every calendar day we delay selling the option

- Vega: The amount an option price will change for every 1% change in stock implied volatility. High IV options imply greater trade risk, but come with higher associated option premiums

- Rho: Measures the change in an option price due to a change in risk-free interest rates. Not considered a major Greek

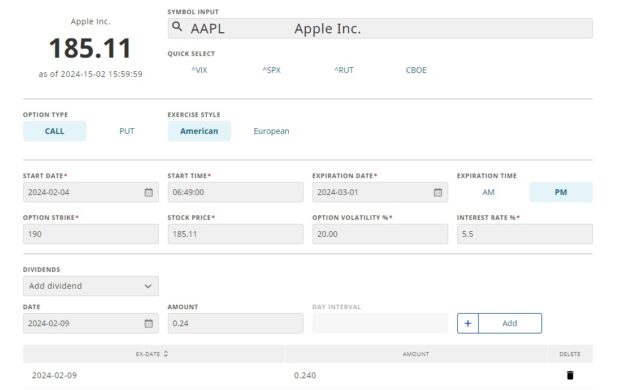

Theoretical Greek & option price calculations for AAPL (2/4/2024 – 3/1/2024): Data entries

The 6 factors mentioned above are entered into the calculator.

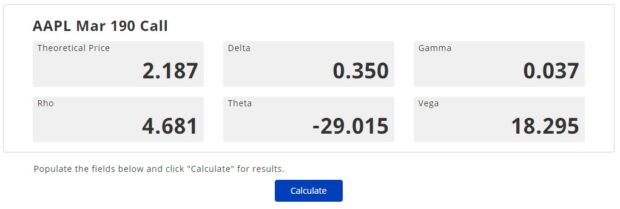

Theoretical calculations after initial entries ($190.00 call valued at $2.187)

In the next screenshot, a real-life option chain on 2/4/2024 will be analyzed to compare theoretical value versus actual values. The focus will be on the top row (theoretical price, Delta & Gamma)

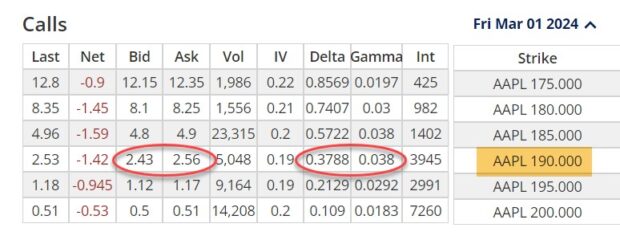

AAPL: Option chain on 2/4/2024

- Investors are willing to pay more for the 3/1/2024 $190.00 call (AAPL trading at $185.11 at the time): $2.43 – $2.56 spread versus the theoretical value of $2.187

- The Delta calculation is similar (0.350 vs. 0.3788)

- The Gamma calculation is even closer (0.038 vs. 0.037)

Discussion

Option prices will frequently vary from the theoretical prices generated by Greek Calculators, as investors may be willing to pay more (or less) than these calculated prices. The Option Greeks must be understood (especially Delta, Vega and Theta), in terms of how they impact our option trades. Their specific numerical stats rarely have to be accessed, except in cases where we are taking ultra-low-risk approaches to option trading.

Author: Alan Ellman