Should I Close My ATM Covered Call with 2 1/2 Months Until Contract Expiration? – July 8, 2024

When our covered call writing trades move deep in-the-money (ITM), the time-value cost-to-close approaches (but does not reach) $0.00. In these scenarios, it may make sense to close both legs of the trade (mid-contract unwind or MCU exit strategy). In this article, a real-life trade with Schwab U.S. Large-Cap Growth ETF (NYSE: SCHG) will be analyzed, where the strike is at-the-money (ATM) and there is still 2 1/2 months remaining until contract expiration.

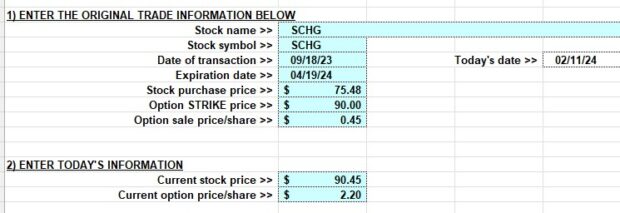

SCHG covered call writing trade

- 9/18/2023: Buy 100 x SCHG at 75.48

- 9/18/2023: STO 1 x 4/19/2024 $90.00 call at $0.45 (215-day trade)

- 2/11/2024: SCHG trading at $90.45

- 2/11/2024: The cost-to-close (“ask” price) the $90.00 call is $2.20

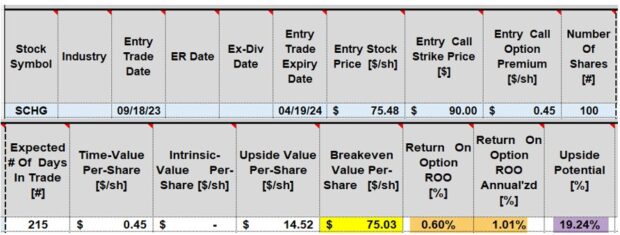

SCHG: Initial trade calculations using the BCI Trade Management Calculator (TMC)

- The initial trade as structured, resulted in a 215-day initial time-value return of 0.60%, 1.01% annualized (brown cells)

- This return will not meet the goals of most covered call writers, even the most conservative investors

- There is substantial upside potential of 19.24% (purple cell)

- The stock leg of the trade is doing quite well, slightly above the $90.00 strike which was initially deep OTM, now near-the-money

- Writing shorter-dated options will result in greater annualized returns

Should we initiate the MCU exit strategy? The “Unwind Now” worksheet tab of the TMC: Entries

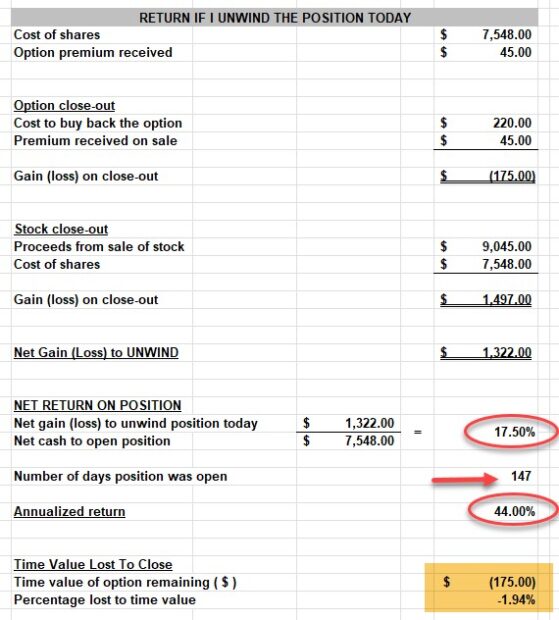

Should we initiate the MCU exit strategy? The “Unwind Now” worksheet tab of the TMC: Calculations

- If the trade is closed on 2/11/2024, it will cost (in time-value), $175.00 per contract, or 1.94%

- If closed on 2/11/2024, the final result would be a realized profit of $1322.00 per contract (almost all share appreciation)

- This is a 147-day return of 17.50%, 44.00% annualized. Not bad

- We ask ourselves if we can generate at least 1% more than 1.94%, with the cash from closing both legs of the trade, by 4/19/2024? Probably, yes

Discussion

Closing both legs of a covered call writing trade is contingent on the time-value cost-to-close. We evaluate if we can generate at least 1% more than this debit by contract expiration to move forward with this exit strategy. The “Unwind Now” worksheet tab of the TMC will provide these calculations.

Author: Alan Ellman