My Covered Call is Expiring In-The-Money and I Want to Keep My Shares – July 15, 2024

Covered call writers will frequently find themselves in a position where the short call is expiring in-the-money (ITM), while still wanting to use the same underlying shares for the next contract cycle. How should this be managed?

3-approaches to be analyzed

- Close both legs of the trade on expiration Friday and open a new one on Monday

- Allow for exercise at the current strike price and open a new trade on Monday

- Roll the option prior to 4 PM ET on expiration Friday (could be earlier)

Pros & Cons of each approach

Closing both legs and re-opening on Monday: This will avoid the weekend risk of shares declining in value and allowing the shares to be purchased at a lower cost basis on Monday. There will be a small time-value cost-to-close (CTC) the original short call. Also, there is the risk that share price may accelerate when trading begins on Monday.

Allowing exercise and re-opening on Monday: This will save us the small time-value CTC and benefit us if share value declines when trading begins on Monday. The risk in this approach is that share value may open higher on Monday.

Rolling the option prior to contract expiration: Prior to 4 PM ET on expiration Friday, we close the current option and open a new, later-dated same or higher strike. This will result in a small option CTC time-value debit but will ensure that our cost basis will not accelerate for a stock that has performed well and we want to retain in our portfolio. This approach is the one I would favor.

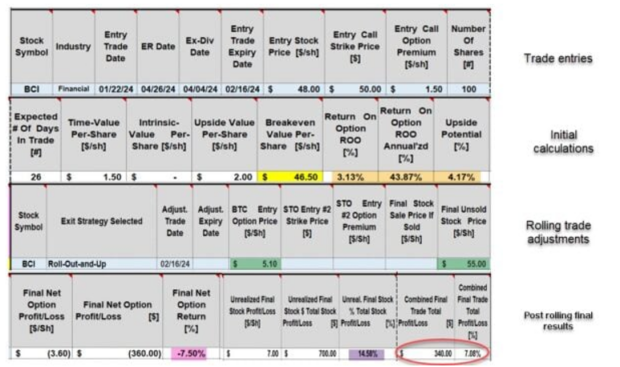

Hypothetical example of rolling a trade out-and-up (BCI example)

- 1/22/2024: Buy 100 x BCI shares trading at $48.00

- 1/22/2024: STO 1 x 2/16/2024 $50.00 call at $1.50

- 2/16/2024: BCI trading at $55.00

- 2/16/2024: BTC the 2/26/2024 $50.00 call at $5.10

- 2/16/2024: STO 1 x 3/15/2024 $55.00 call at $2.00 (roll-out-and-up to an ATM strike))

Initial trade and post-adjusted (rolling-out-and-up) entries and calculations:

The BCI Trade Management Calculator (TMC)

- Initial calculations show a 26-day return of 3.13%, 43.87% annualized (brown cells)

- There is an additional upside potential income stream of 4.17% (also brown cell)

- The 1st aspect of rolling-out-and-up is the $5.10 CTC and is entered into the spreadsheet in the adjustment (exit strategy) section

- At this point, we have a net % option debit of 7.50% (pink cell) and net unrealized stock credit of 14.58% (purple cell), for a final current month return of $340.00 per-contract or 7.08% (circled in red).

- In the screenshot below, the next contract entries and initial calculations will be analyzed

Post-rolling-out-and-up entries and initial calculations

- The $2.00 per-share premium, results in a 29-day initial time-value return of 3.64%, 45.77% annualized (brown cells)

- Since this is an at-the-money (ATM) strike, there is no upside potential or downside protection of the initial time-value profit (green cells)

- There is always a breakeven price point, in this case, it’s $53.00 (yellow cell)

Discussion

When our covered call trades are expiring ITM, we have several choices if we want to use the same underlying’s in the next contract cycle. There are pros & cons to each approach. I strongly favor rolling the options when I am still bullish on the underlying stock or ETF.

Author: Alan Ellman