Using Implied Volatility & Delta When Selecting Ultra-Low Risk Cash-Secured Put Strikes – July 29, 2024

When we sell cash-secured puts with the goals of generating cash-flow while simultaneously crafting trades with low probability of exercise, strike selection becomes critical. To accomplish these objectives, we can turn to implied volatility (IV) and Delta to assist in our trade decisions. We will utilize deep out-of-the-money (OTM) put strikes, with low probability of being subjected to exercise, and, in return, accept lower annualized premium returns.

What is implied volatility?

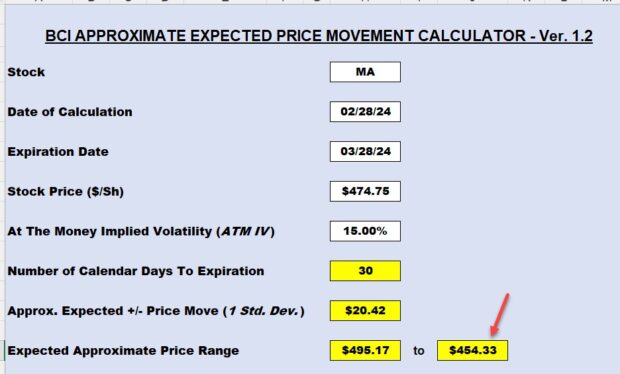

This is a forecast of the underlying security’s volatility as implied by the option price in the marketplace. BCI’s Expected Price Movement Calculator will facilitate computing upper and lower price ranges with an approximate 84% accuracy.

What is Delta?

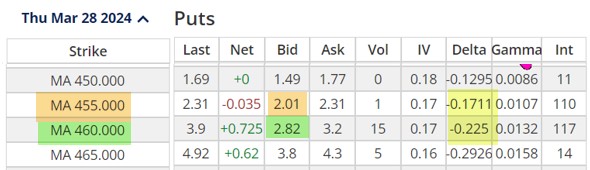

The approximate probability of an option expiring in-the-money (ITM). If we want craft trade low probability exercise, we focus on low Delta put strikes. If our intention is to set up put trades with a 90% probability of avoiding exercise, we look for put strikes with deltas of -10 or less (put strikes have deltas showing a (-) sign, since put value is inversely related to share price movement.

Real-life trade with Mastercard Inc. (NYSE: MA)

- 2/28/2024: MA trading at $474.75

- 2/28/2024: The IV of the $475.00 put strike for the (1-month) 3/28/2024 expiration is 15%

- Goal is to construct a trade with a 25% or better probability of success (option expiring OTM)

- We will use IV to establish an approximate 84% probability of success trade

- We will use a Delta < 25% to initiate a trade with < 25% risk of exercise

Using implied volatility and the BCI Expected Price Movement Calculator to create an 84% probability of success trade ($455.00 OTM put strike)

Using Delta (-0.225) to create a 77.50% probability of success trade (MA option-chain on 2/28/2024)

- Using IV and the BCI Expected Price Movement calculator, leads us to the $455.00 put strike and an 84% probability of success trade

- Using a -22.5% Delta points us to the $460.00 put strike and a 77.50% probability of success trade

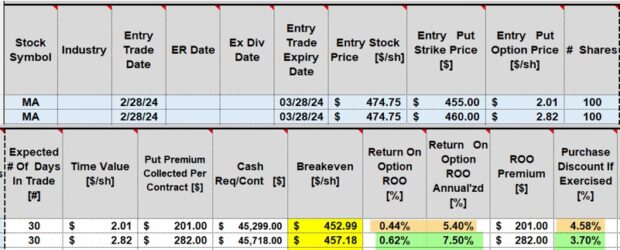

MA calculations using the BCI Trade Management Calculator (TMC)

- The $455.00 strike (84% probability of success) has an initial annualized return of 5.40%

- The $460.00 strike (77.50% probability of success) has an initial annualized return of 7.50%

Discussion

Delta and implied volatility can be utilized to create high probability of success trades when seeking to generate cash-flow, while simultaneously avoiding option exercise and having shares put to us. The tradeoff is lower premium returns than traditional selling of cash-secured puts. These stats and calculations are not 100% precise but are statistically meaningful and will provide framework guidelines as how to craft our trades, factoring in our goals and personal risk-tolerance.

Author: Alan Ellman