Bullish & Bearish Covered Call Trade Executions When Selling Multiple Contracts on the Same Stock – August 13, 2024

When selling covered calls or cash-secured puts, we must be appropriately diversified, as well as allocating a similar amount of cash per position. This will protect our portfolios from significant price decline in 1 or 2 of our positions.

When we sell multiple contracts using the same underlying security, we can also diversify strike prices within those trades. If we are selling 5 contracts using the same stock and the same expiration date, there is no reason to feel we have to use the same strike price for all 5 contracts. We can diversify those as well.

This article will highlight real-life trades using Iron Mountain Inc. (NYSE: IRM), a stock on our premium member stock watch list on 3/11/2024. We will sell 5 contracts and establish trades with both moderately bullish and bearish market assumptions.

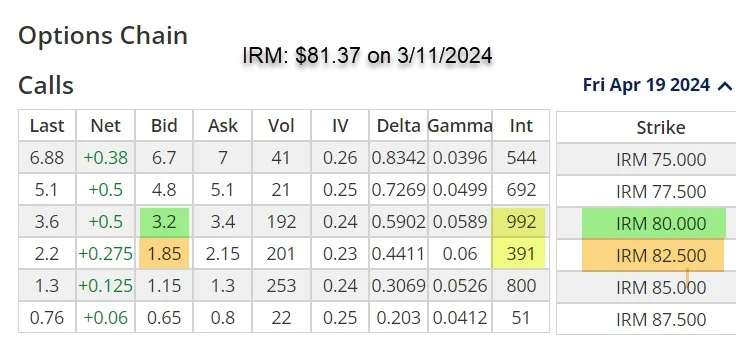

IRM Option-Chain on 3/11/2024 with IRM Trading at $81.37

- The $80.00 in-the-money (ITM) strike (bearish or defensive posture) shows a bid price of $3.20 (green cells)

- The $82.50 out-of-the-money (OTM) strike shows a bid-price of $1.85 (brown cells)

- Both strikes show more than adequate liquidity or open interest of > 100 contracts (992 and 391 – yellow cells)

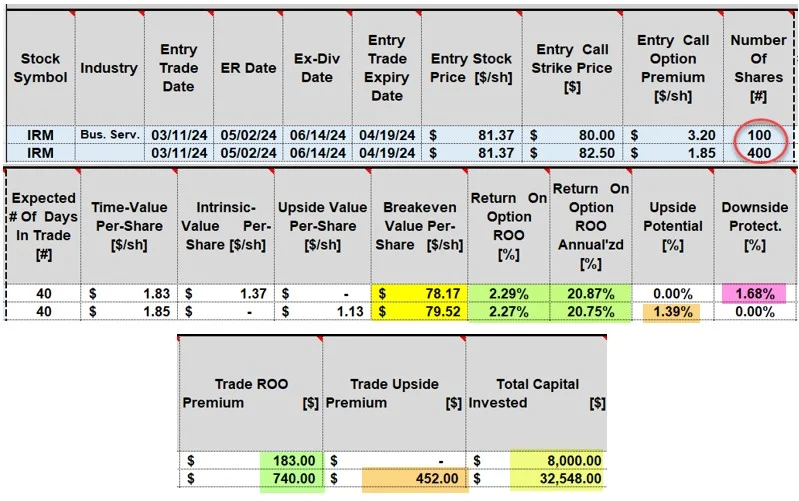

A reasonable bullish market assessment approach (4 x OTM and 1 x ITM)

- Sell 1 x $80.00 call and 4 x $82.50 calls

- The $80.00 has $8000.00 tied up (deducting the intrinsic-value component of the premium)

- The $82.50 call has $32,548.00 tied up (yellow cells on bottom for both)

- Both strikes have annualized returns near 21% (green cells in middle section)

- The ITM $80.00 call has downside protection of the time-value profit of 1.68% (pink cell)

- The OTM $82.50 call has upside potential of 1.39%, resulting in a potential 40-day return of 3.66% (2.27% + 1.39%)

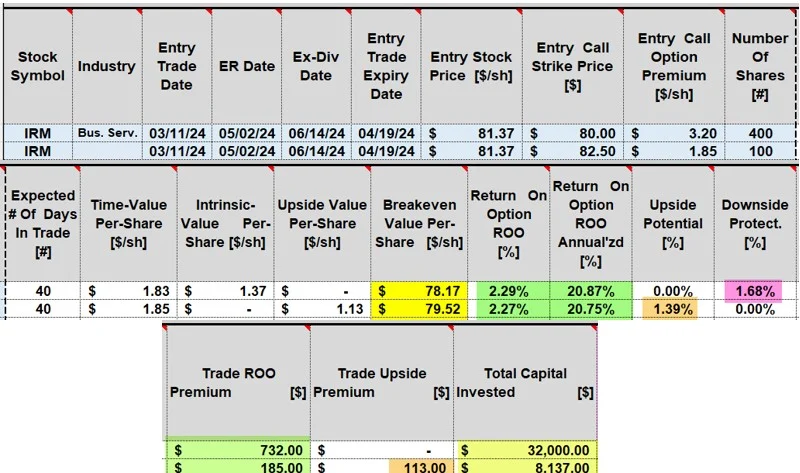

A reasonable bearish market assessment approach (1 x OTM and 4 x ITM)

- Using the BCI Trade Management Calculator (TMC):

- Sell 4 x $80.00 calls and 1 x $82.50 call

- The $80.00 has $32,000.00 tied up (deducting the intrinsic-value component of the premium)

- The $82.50 call has $8,137.00 tied up (yellow cells on bottom for both)

- Both strikes have annualized returns near 21% (green cells in middle section)

- The ITM $80.00 call has downside protection of the time-value profit of 1.68% (pink cell)

- The OTM $82.50 call has upside potential of 1.39%, resulting in a potential 40-day return of 3.66% (2.27% + 1.39%)

Discussion

When selling covered calls or cash-secured puts, diversification and cash allocation are critical to crafting trades that will result in the highest possible returns. In addition to stock (or ETF) diversification and allocating a similar amount of cash per position, we can also diversify strike prices when selling multiple contracts with the same underlying security and the same expiration date.

Author: Alan Ellman