Executing Your First Covered Call Trade – August 19, 2024

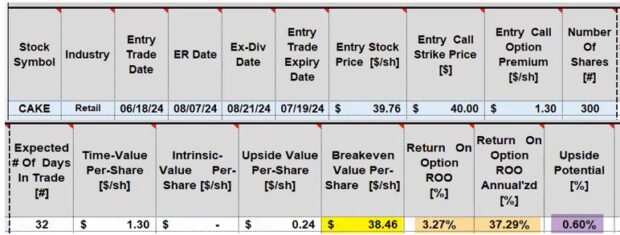

Option trading and covered call writing, in particular, have become increasingly popular over the past several years. As our membership has been growing more than ever, we have a large number of Blue Collar Investors who are relatively new to the process. This article will analyze a real-life covered call trade example with The Cheesecake Factory (Nasdaq: CAKE), taken from one of my portfolios

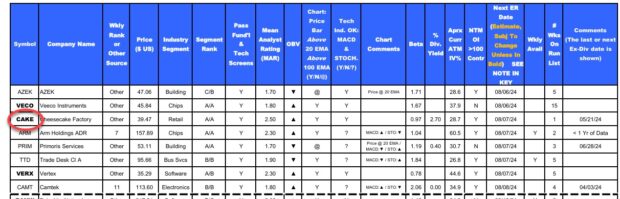

Select a stock or ETF from our watch list

- On 6/18/2024, CAKE was an eligible security on our premium Weekly Stock Screen and Watch List

- Based on the current price-per-share, I will purchase 300 shares and sell 3 covered call contracts

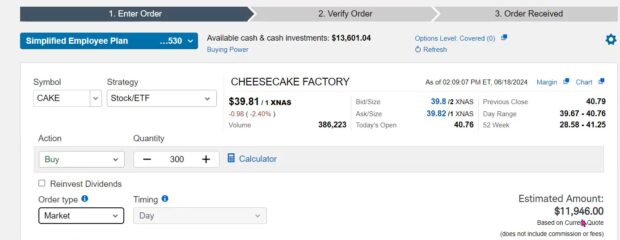

Go to broker platform to purchase the shares

- Ticker symbol (CAKE) is entered

- Enter buy 300 shares

- Market order, day only

- Check estimated amount to make sure there is adequate cash available (red arrow)

- If all looks good, place order (not shown here)

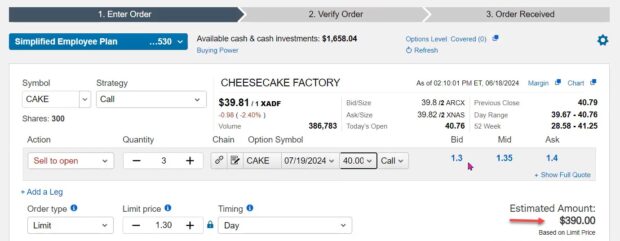

Go to the options link of the broker platform to sell the (3) options

- The strategy is “call”, and we want to Sell to Open”

- 3 contracts

- $40.00 strike

- 7/19/2024 expiration

- The “bid” price is $1.30 (small red arrow)

- Make sure this return aligns with our pre-stated initial time-value return goal range

- Enter limit order at $1.30 (could be up to $1.35- below the midpoint)

- Day order

- For the 3 contracts, $390.00 (minus small commissions) will be sent to our cash account, once executed (seconds)

- After reviewing the order, it is placed, and we check to make sure that the trade has been executed. This takes seconds

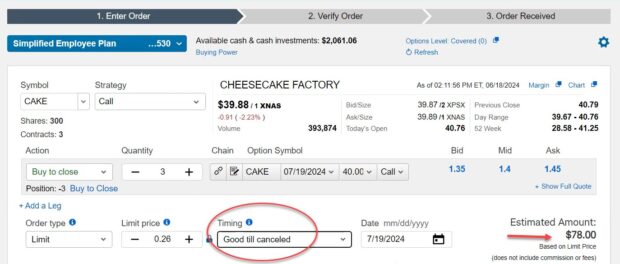

Set up our 20%/10% buy-to-close, good-until-cancelled limit order to protect against share price decline

- Buy-to-close option limit order is set for 3 contracts at $0.26 (20% of $1.30)

- If the $0.26 threshold is reached, it will cost $78.00 to close the 3 contracts, minus tiny trade commission

- This will be changed to $0.13 (10% of $1.30) with 2 weeks remaining on the monthly contract

Calculating our initial returns

- Our Trade Management Calculator (TMC) shows a 32-day return of 3.27%, 37.29% annualized (brown cells)

- There is an additional potential of 0.60%, if share price rises to or beyond the $40.00 strike price (purple cell)

- The breakeven price point is $38.46 (yellow cell)

Author: Alan Ellman