How to use the CEO Strategy with Inverse ETFs in Extreme Bear Markets – September 3, 2024

The CEO Strategy is a covered call writing-like strategy, a streamlined approach to covered call writing. It is an acronym for Combining ETFs with Stock Options. It involves using only the 11 Select Sector SPDRs as underlying considerations and reduces the number of covered call writing exit strategies from 14 to 4. This article features detailed information as how to utilize this user-friendly and time-efficient approach to covered call writing in extreme bear market conditions like we experienced in 2008, 2017 and 2022. For this approach, we turn to inverse ETFs.

What are inverse ETFs?

These are exchange traded funds that use derivatives to profit when market indexes decline. When a market benchmark declines in value, these securities appreciate.

4 Inverse ETFs appropriate for the CEO Strategy

- ProShares Short Dow 30 (Nasdaq DOW)

- ProShares Short QQQ (Nasdaq: PSQ)

- ProShares Short Russell 2000 (Nasdaq: RWM)

- ProShares Short S&P 500 (Nasdaq: SH)

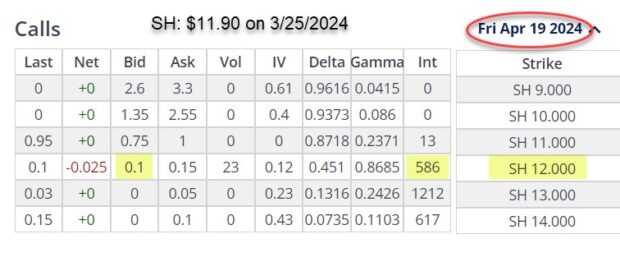

Option-chain for SH on 3/25/2024

With SH trading at $11.90. the $12.00 out-of-the-money (OTM) 4/19/2024 strike generated $0.10 per-share. Open interest was strong at 586 contracts.

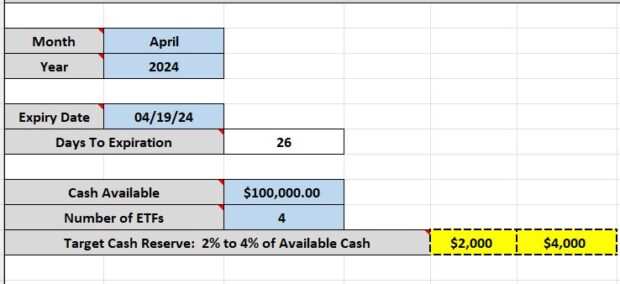

Portfolio set-up input information for a $100k portfolio with 4 securities: The BCI Portfolio Setup Spreadsheet

The spreadsheet guideline for exit strategy cash reserve range is $2,000.00 – $4,000.00 (yellow cells).

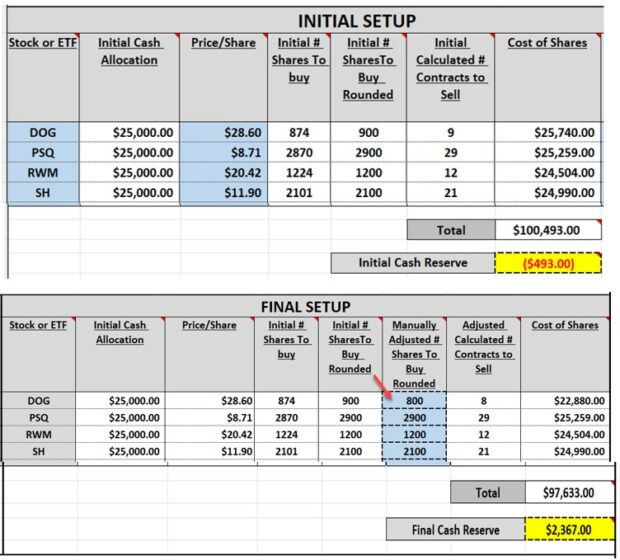

Initial and final portfolio setups

- The spreadsheet (top half) shows a shortfall of $493.00 with no cash reserve for exit strategies (red numbers)

- We will reduce DOG from 900 to 800 shares (red arrow)

- The revised spreadsheet now has a cash reserve of $2,367.00 (bottom right)

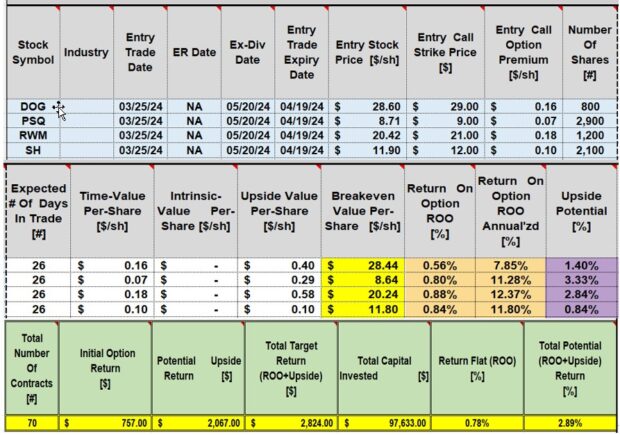

Initial calculations using the inverse ETF CEO strategy using the BCI Trade Management Calculator (TMC)

- Initial trade data is entered from the option-chains into the blue cells (top section)

- Yellow cells: Breakeven price points

- Brown cells: Initial and annualized returns based on 26-day trades

- Purple cells: Additional upside potential cash % returns if share value appreciates from current market value up to, or beyond the OTM strikes

- Bottom section shows total portfolio initial returns of 0.78% ($757.00) with a possibility of $2,824.00 (2.89%), if all shares move up to the 4 OTM call strikes

- These are 26-day trades

Discussion

In extreme bear markets, the CEO Strategy can be implemented with Inverse ETFs. The BCI principles of diversification, cash allocation, trade execution and management still apply.

Author: Alan Ellman