Can We Make Money Selling Options in a Confirmed Bear Market? / New Video – September 16, 2024

Covered call writers and put sellers frequently inquire about generating positive cash flow when the market crashes or in confirmed bear markets as we had in 2008 (real estate crash) and in 2022 (COVID-related crash). Over the years, I have written about and produced videos detailing protective approaches we can execute in short-term bear markets. These have included using ITM call strikes, deep OTM put strikes, the PCP strategy, ultra-low risk Delta and (IV implied volatility) strategies among many others. In this article (does not apply to current market conditions), we will analyze one approach to making money in confirmed long-term bear markets using inverse ETFs.

What are Inverse exchange-traded funds (ETFs)?

These are securities that are constructed by using derivatives for the purpose of benefitting from the decline in the underlying benchmark. When the market goes down, these securities accelerate.

Inverse ETFs to consider

- PSQ: Short QQQ (Nasdaq-100)– Recently executed a 1-for-5 reverse stock split

- DOG: Short Dow 30 (DJIA)

- SH: Short S&P 500 (S&P 500)

- RWM: Short Russell 2000 (Russell 2000)

Inverse ETF Portfolio Setup

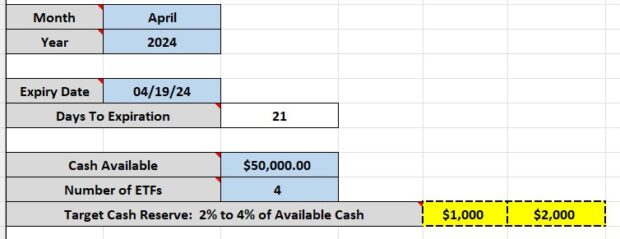

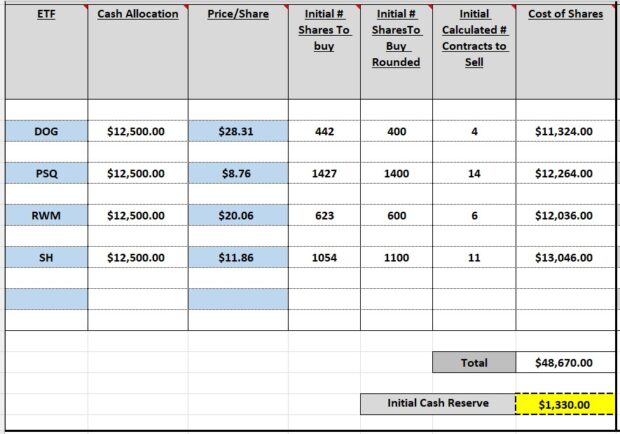

- Using a portfolio with $50k available and 4 ETFs

- 21-days to expiration

- Cash reserve guideline is $1k – $2k

- $48,670.00 will be spent to purchase the shares calculated

- A cash reserve of $1330.00 is available for potential exit strategy executions

Option-chain for PSQ on 4/1/2024

With PSQ trading at $8.76, the $9.00 OTM call strike generated a bid price of $0.05. Option-chains for DOG, RWM and SH were also researched.

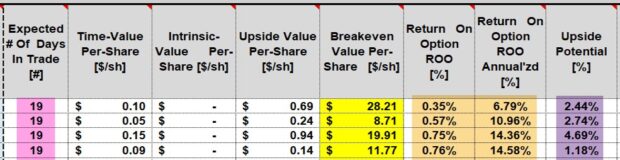

Inverse ETFs: Initial Trade Calculations Using the BCI Trade Management Calculator (TMC)

- Pink cells: 19-days to contract expiration

- Yellow cells: Breakeven price points

- Brown cells: 19-day and annualized initial option returns

- Purple cells: Additional % upside potential returns

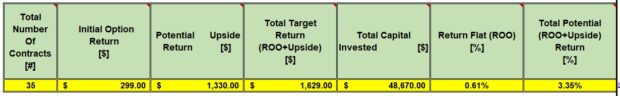

Inverse ETFs: Initial Portfolio Calculations Using the BCI Trade Management Calculator (TMC)

- 35 contracts sold

- $299.00 in option premium generated

- Additional $1330.00 in upside potential (share appreciation up to the OTM call strike)

- $48,670.00 invested in share purchases

- Flat 19-day return (no upside) of 0.61%, 11.72% annualized

- Total 19-day return with maximum upside is 3.35%, 64.36% annualized

Discussion

In confirmed long-term bear markets, we can turn to inverse ETFs to generate positive cash flow. Once these trades are entered, we immediately go into “position management mode” as we do when structuring our trades more conventionally.

Author: Alan Ellman