Aggressive and Defensive Covered Call Writing Trades – September 30, 2024

When crafting our covered call writing trades, we can do so aggressively, using out-of-the-money (OTM) call options, or defensively, using in-the-money (ITM) strikes. In this article, a real-life example with GigaCloud Technology Inc. (Nasdaq: GCT), will be used to analyze both approaches.

GCT trade information on 4/22/2024

- GCT trading at $35.63

- The 5/17/2024 $40.00 OTM call had a bid price of $2.25

- The 5/17/2024 $30.00 ITM call had a bid price of $6.90

GCT option-chain on 4/22/2024

- The $30.00 ITM strike, displays a bid price of $6.90 (brown cell)

- The $30.00 strike shows a Delta of 0.7716, approximating a 23% risk of the price dropping below the $30.00 strike. This is our risk factor of losing all or part of our initial time-value premium

- The $40.00 OTM strike shows a bid price of $2.25

- Note the IV (implied volatility) column shows IV > 100%, which explains the substantial premiums and risk associated with this security

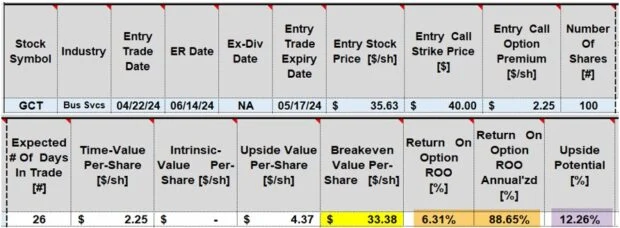

GTC aggressive (OTM) initial calculations using the BCI Trade Management Calculator (TMC)

- The TMC calculates an initial 26-day return of 6.31%, 88.65% annualized (brown cells)

- There is also an opportunity of an additional 12.26% return (purple cell), if share price accelerates to or beyond the $40.00 strike at expiration

- The breakeven price point is $33.38 (yellow cell)

- This trade is most appropriate in normal – to- bull market environments

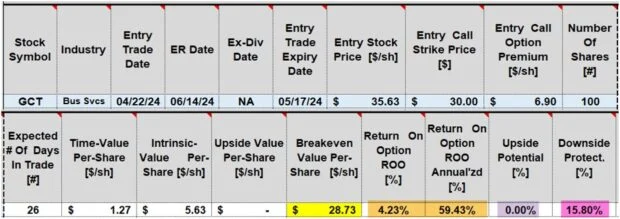

GTC defensive (ITM) initial calculations using the BCI Trade Management Calculator (TMC)

- The TMC calculates an initial 26-day return of 4.23%, 59.43% annualized (brown cells)

- There is no opportunity for additional share appreciation (purple cell), since we are agreeing to sell our shares at a lower price than current market value

- If the option is exercised and shares are put to us at the breakeven price point of $28.73 (yellow cell), we will have received a price discount of 15.80% (pink cell) from when the trade was entered

- This trade is most applicable in bear and volatile market environments or simply to mitigate the significant risk associated with high-IV stocks

Discussion

One of the many significant benefits of the covered call writing strategy is that we can craft our trades to bullish or bearish market environments. This also applies to constructing our trades based on personal risk tolerance. We should take advantage of these strategy opportunities and not use a “one size fits all” approach.

Author: Alan Ellman