Lowering Our Breakeven Price Points After Disappointing Earnings Reports: The BCI Stock Repair Calculator – October 21, 2024

An important BCI rule is never to write a covered call or sell a cash-secured put if there is an upcoming earnings report … too risky if the report disappoints and we don’t want to cap the upside if the report is favorable. There are (rare) scenarios when we hold the stock through the report and then write the call after the report passes. We consider this approach when we have confidence (based on past history) that the report will be a positive one.

This article will address a situation where share price declined dramatically due to an earnings “miss” and how we can lower our breakeven price point without adding additional cash to the trade, using the BCI Stock Repair Calculator.

What is the stock repair strategy?

This is a methodology where we buy 1 at-the-money (ATM) call strike after share price decline and fund it by selling 2 out-of-the-money (OTM) call strikes between current market value and the original purchase price of the shares. This is known as a 1 x 2 ratio call spread.

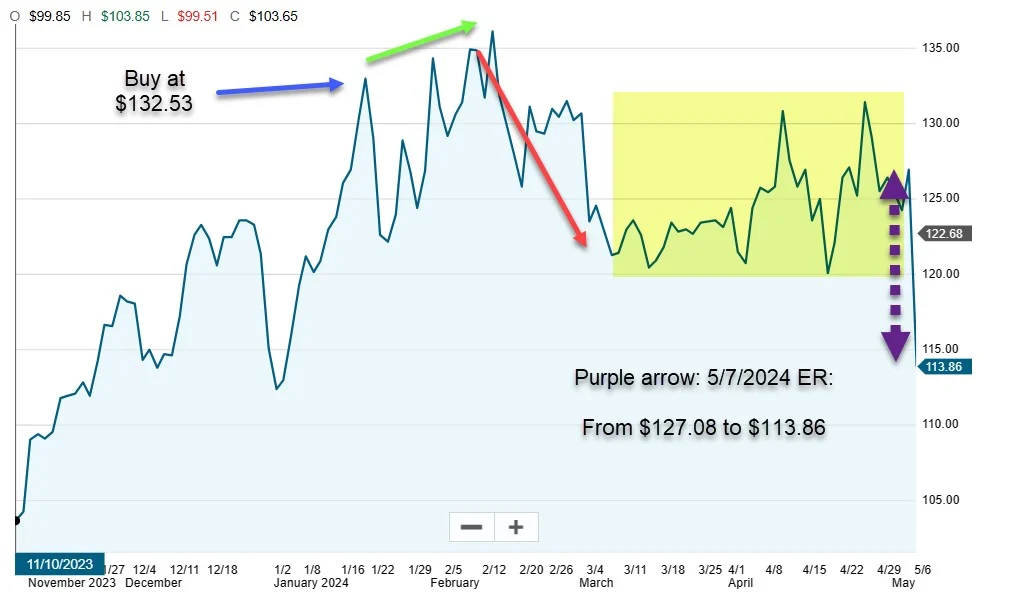

Real-life example with Datalog, Inc. (Nasdaq: DDOG)

- Blue arrow: DDOG purchased on 1/22/2024 at $132.53

- Green arrow: Price acceleration from 1/22/2024 – 2/14/2024

- Red arrow: Price deceleration from 2/14/2024 – 3/5/2024

- Yellow field: Price consolidation from 3/5/2024 – 5/6/2024

- Purple arrow: Price decline from $127.08 to $113.86, after a disappointing ER

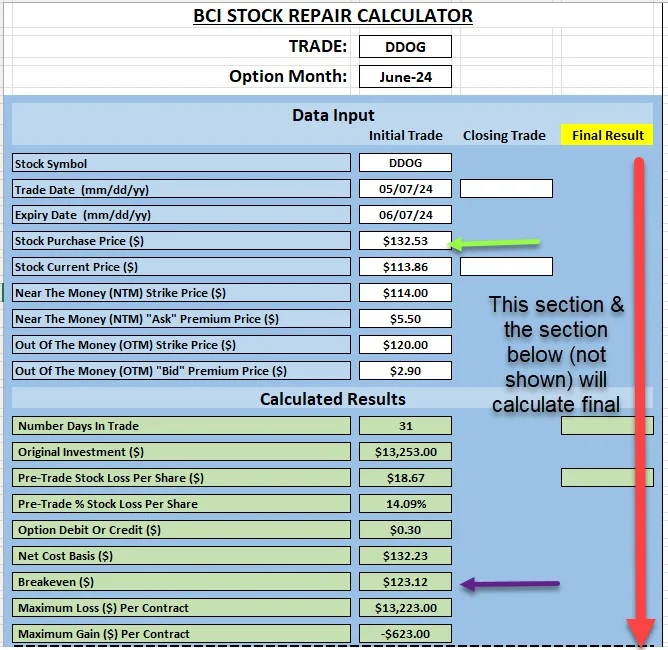

DDOG: Stock Repair Calculator entries & calculations

- 1 x ATM $114.00 call is purchased at $5.50

- 2 x OTM $120.00 calls are sold at $2.90 to fund the long call

- Green arrow: Breakeven price point ($132.53) based on initial share purchase price

- Purple arrow: Breakeven price point ($123.12) after executing the stock repair strategy

- Averaging-down would have resulted in adding significant cash to this losing trade

- In this case, the stock repair strategy resulted in lowering the BE price point by $9.41 per-share, with an additional $0-.30 per-share net option credit

Discussion

The stock repair strategy will allow us to lower our breakeven price points without adding significant cash to the trades and perhaps even generating an option credit. As with all strategies, there are pros & cons that must be mastered before implementing this exit strategy.

Author: Alan Ellman