Hitting a Double and Selling the Stock Using the Trade Management Calculator – October 28, 2024

Hitting a Double is a covered call writing exit strategy where the short call is bought back after share price declines and resold when share price recovers. At expiration, we may decide to buy back the 2nd short call and sell the shares. This article will analyze such a series of trades, shared by a BCI member, using the BCI Trade Management Calculator (TMC) and an exchange-traded fund (XLE).

Real-life example with Energy Select Sector SPDR Fund (NYSE: XLE)

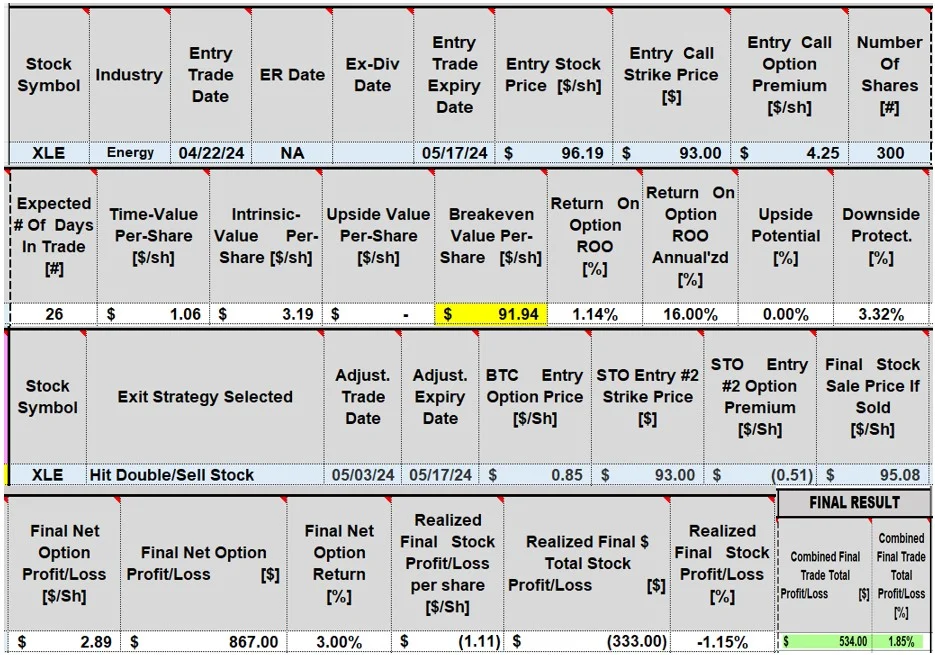

- 4/22/2024: Buy 300 x XLE at $96.19

- 4/22/2024: STO 3 x 5/17/2024 $93.00 calls at $4.25

- 5/1/2024: BTC 3 x 5/17/2024 $93.00 calls at $0.85 (share price decline)

- 5/3/2024: STO 3 x 5/17/2024 $93.00 calls at $1.58 (Hitting a double)

- 5/17/2024: BTC 3 x 5/17/2024 $93.00 calls at $2.09

- 5/17/2024: Sell 300 x XLE at $95.08

Trade entries & calculations in the TMC

- The initial trade resulted in an initial time-value return of 1.14%, 16.00% annualized

- The BTC entry of $0.85 is entered using the exit strategy Hitting Double/Sell Stock

- The STO of the 2nd option is combined with the cost-to-close at expiration (+ $1.58/-$2.09- highlighted in brown cells above)

- The final net option return for the 26-day trade is 3.00%

- The final realized share loss is 1.15%

- The final realized net cash return is $534.00

- This translates to a 1.85%, 26-day return (25.97% annualized)

Discussion

When using the hitting a double exit strategy and then deciding to buy back in-the-money strikes prior to expiration to sell the shares, we can incorporate the cost-to-close with the 2nd option premium sale and this approach will result in accurate calculations. The BCI Trade Management Calculator (TMC) will facilitate all these transactions.

Author: Alan Ellman