Using Delta to Determine an Ultra-Defensive In-The-Money Covered Call Strike – November 18, 2024

When writing covered calls in bear and volatile markets, we may choose to take a defensive posture and use in-the-money call strikes which offer additional downside protection in the form of intrinsic value. We can take this approach to an even higher level of protection by quantifying our risk and establishing a high probability of successful trades. In this article, a real-life example with NVDIA Corp. (Nasdaq: NVDA) will be used to analyze these scenarios.

What is Delta?

There are 3 definitions of Delta. The one that applies to this article is: The approximate probability of a strike expiring in-the-money (ITM) or with intrinsic value. In previous articles and webinars, I have discussed using implied volatility (IV) to establish trading ranges with approximate 84% probability of successful trades. We have also previously described using Deltas of 16 to avoid exercise of out-of-the-money call strikes (also approximately 84% of the time) This would be particularly useful when using the portfolio overwriting strategy.

How to use Delta for ITM strikes to create 84% probability of successful trades

Our goal, in these situations, is to prevent our shares from moving below the deep ITM call strike. Our defined goal is to create an 84% probability of successful trade that will still yield significant returns, while also having meaningful downside protection of the time value return. A reasonable expectation, using this strategy approach, is an initial time-value annualized return goal range between 10% and 20%. Therefore, the Delta of choice is 84. This will simulate the low end of the trading range calculated using IV.

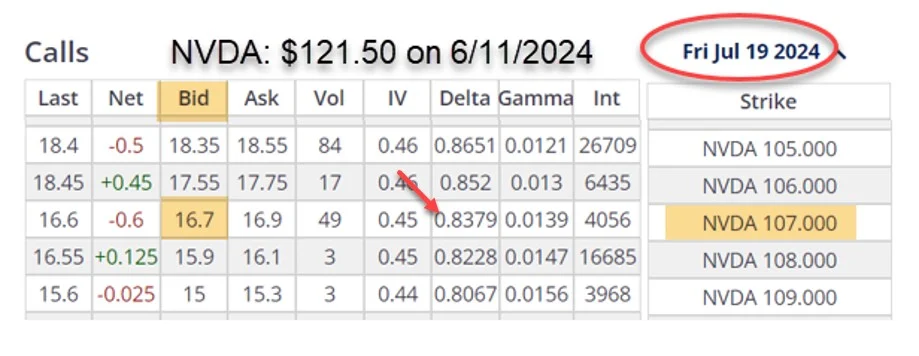

NVDA ITM option chain on 6-11-2024

- A Delta of 84 (0.8379- red arrow) is associated with the $107.00 deep ITM strike

- The option chain shows a bid price of $16.70

- Let’s place this data in our Trade Management Calculator (TMC)

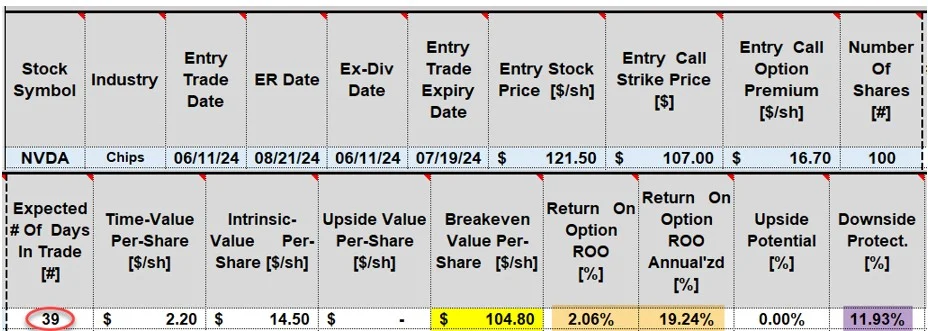

NVDA ITM calculations on 6-11-2024

- If taken through expiration, this is a 39-day trade (red oval)

- The breakeven (BE) price is $104.80 (yellow cell)

- The initial time-value return is 2.06%, 19.24% annualized, falling in the high end of our expected range (brown cells)

- The downside protection of the time-value return is 11.93% (purple cell). This is the amount the stock price can decline while still realizing the 2.06% return. It is different from breakeven

Discussion

When seeking ITM covered call strikes with approximately an 84% probability of success (not falling below the ITM strike), using Deltas of 84 is a reasonable approach which will also allow for significant time-value returns.

Author: Alan Ellman