Doubling Our Maximum Covered Call Returns Using the Mid-Contract Unwind (MCU) Exit Strategy – December 2, 2024

Our covered call writing trades offer 2 income streams when using out-of-the-money (OTM) call strikes. (Make that 3, if we incorporate dividends into the strategy). These consist of option premium + share appreciation from current market value up to, or beyond the call strike. These combined income streams are considered by many to be our maximum return for the cash investment inherent in the trade. This article will analyze a series of trades with Invesco Nasdaq 100 ETF (Nasdaq: QQQM), an exchange-traded fund, and The Cheesecake Factory Inc. (Nasdaq: CAKE) where the maximum return was more than doubled, using the mid-contract unwind (MCU) exit strategy.

What is the Mid-Contract Unwind (MCU) exit strategy?

This is a covered call writing exit strategy employed when share price rises substantially after the trade is initiated. Additional profit cannot be realized as the trade stands. Both legs of the trade are closed, and the cash generated from the security sale is used to enter a new covered call trade, in the same contract cycle, with a new stock or ETF.

What is the rationale behind MCU?

As share price moves up, the time-value component of the premium will approach (but never reach) $0.00. Yes, intrinsic value will increase, but this is negated by the increase in share value when the option ceiling is eliminated.

Real-Life Trades with Invesco Nasdaq 100 ETF (Nasdaq: QQQM) &

The Cheesecake Factory, Inc. (Nasdaq: CAKE)

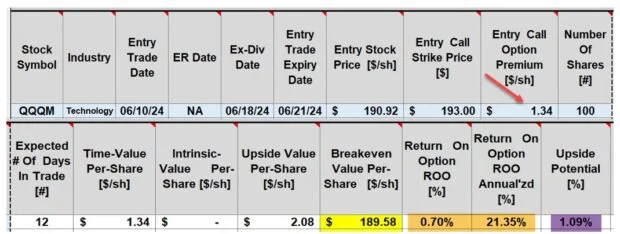

- 6/10/2024: Buy 100 x QQQM at $190.92

- 6/10/2024: STO 1 x 6/21/2024 $193.00 call at $1.34

- 6/10/2024: Set a BTC GTC limit order at $0.13 (10% guideline to protect against share price decline)

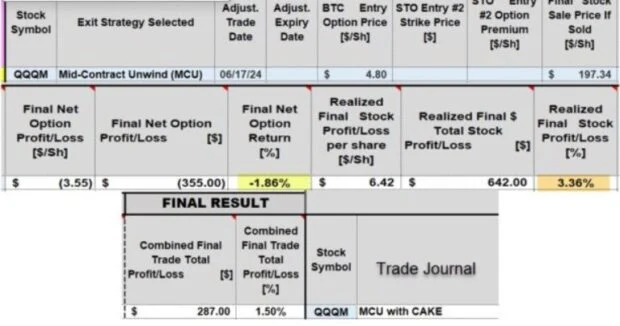

- 6/17/2024: BTC the 6/21/2024 $193.00 call at $4.80 (ignore the 10% guideline as share price accelerated to $197.34)

- Of that $4.80, only $0.44 is time-value

- 6/17/2024: Sell 100 x QQQM at $197.34

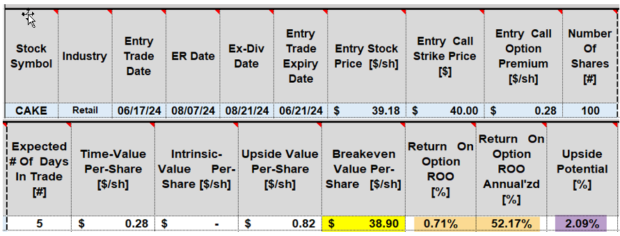

- 6/17/2024: Buy 100 x CAKE at 39.18

- Remaining cash from the sale of QQQM went into other trades to diversify

- 6/17/2024: STO 1 x 6/21/2024 $40.00 call at $0.28

- 6/17/2024: Set a BTC GTC limit order at $0.03

Initial QQQM calculations on 6/10/2024

The Trade Management Calculator (TMC) shows a maximum return of 1.79% (0.70% + 1.09%).

Executing the MCU exit strategy: Final realized QQQM returns

The final, realized return is 1.50%, a loss of 0.29% from the original maximum return.

The CAKE trade initial return

The TMC shows a maximum return of 2.80% (0.71% + 2.09%).

What happened with the CAKE trade at expiration?

CAKE closed at $40.01 at expiration, $0.01 higher than the strike and shares were sold at $40.00, realizing the maximum profit for this 2nd trade in the same contract cycle.

Review of % Initial Versus Final Post-Adjusted Returns

- QQQM: Initial max return = 0.70% + 1.09% = 1.79%

- QQQM: Final return after MCU = 1.50% (-0.29% cost-to-close)

- CAKE: Final realized return: 2.80% (0.71% + 2.09%)

- QQQM/CAKE: Combined 12-day return: 4.30% (1.50% + 2.80%)

- MCU increased trade results by *140%

- *The % return is very slightly lower because additional cash was added to the trades when closing the QQQM short call

- The remaining cash from the sale of QQQM also resulted in additional cash profits

Discussion

Our option trades can be enhanced using exit strategy implementation, when those opportunities arise. MCU can benefit us when share price rises significantly after trade entry. We must be prepared to act and take advantage of these scenarios.

Author: Alan Ellman