Calculating Covered Call Trades that are Converted to Collar Trades – December 9, 2024

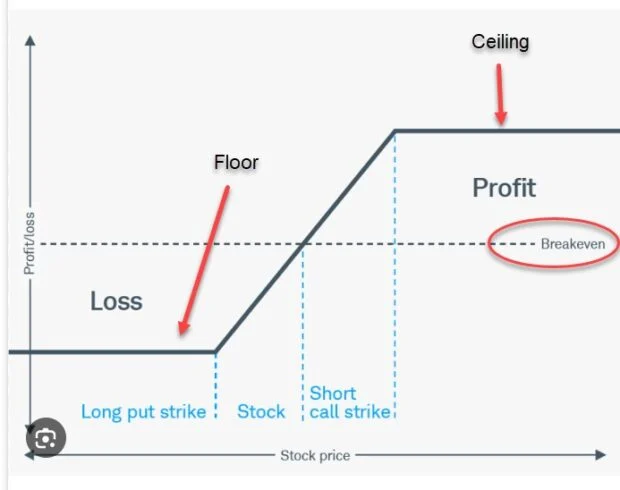

What is a Collar Trade?

The collar strategy consists of 3 legs:

- Buy stock (long position)

- Sell an out-of-the-money (OTM) call option (short call- ceiling)

- Buy an out-of-the-money protective put (long put- floor)

- Since a protective put debit is added to our covered call trades, the initial time-value returns will be lower than traditional covered call writing

- We are purchasing an insurance policy (the protective put) which will protect us from catastrophic share price decline

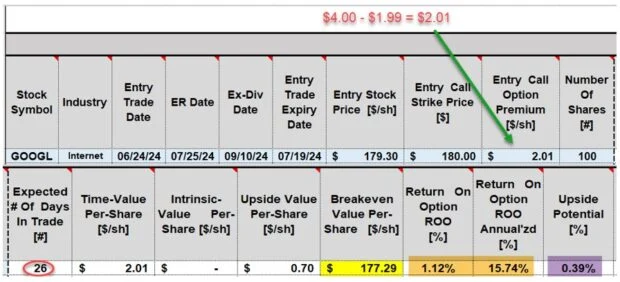

Real-life example with Alphabet, Inc. (Nasdaq: GOOGL): 6/24/2024 – 7/19/2024Buy GOOGL at $179.30

- STO the 7/19/2024 $180.00 OTM call at $4.00 (ceiling)

- BTO the 7/19/2024 $175.00 OTM put at $1.99 (floor)

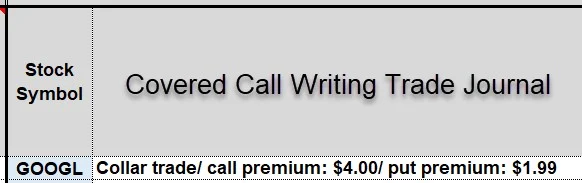

- Net option credit = $2.01

GOOGL call & put option-chain on 6/24/2024

GOOGL collar initial calculations using the BCI Trade Management Calculator (TMC)

- The net option credit is $2.01 per-share (green arrow)

- The breakeven price point is $177.29 (yellow cell)

- The 26-day initial time-value return is 1.12%, 15.74% annualized (brown cells)

- The upside potential is a modest 0.39% (purple cell)

Discussion

The collar strategy is a defensive, conservative approach to covered call writing by adding a protective put. The tradeoff is lower potential returns. We accomplish these calculations by entering a net option credit into the premium column of the Trade Management Calculator (TMC). This software program also allows for an explanatory note in the Covered call Trade Journal, which is an inherent aspect of our TMC spreadsheet.

Author: Alan Ellman