Shorter Dated Options Deliver Higher Annualized Returns: The Square Root Rule – December 23, 2024

When selling covered calls or cash-secured puts, using contract expirations several months out (or longer) have the appeal of large option premiums. However, when we annualize these returns, they pale in comparison to the returns generated by shorter-dated expirations. Another concern related to longer-dated expirations is the potential exposure to risky earnings report events.

What is the Square Root Rule?

This rule applies to at-the-money (ATM) strikes. Simply stated, it takes approximately 4 x the time to double an option price when using longer-dated ATM options. If a 1-month option return is $1.00 per share, to double that to $2.00, we would have to go out 4 months. The square root of 4 = 2. Let’s add more color with a real-life example using Apple Inc. (Nasdaq: AAPL).

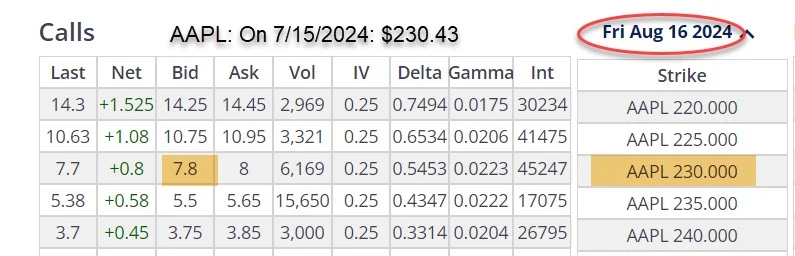

AAPL 8/16/2024 expiration option-chain on 7/15/2024

With AAPL trading at $230.43 on 7/15/2024, the $230.00 ATM strike shows a bid price of $7.80. Now, if we go 4 months out, will we receive 4 times that amount, $31.20? The square root rule states that we will receive only double that amount, the square root of 4 = 2. Let’s see.

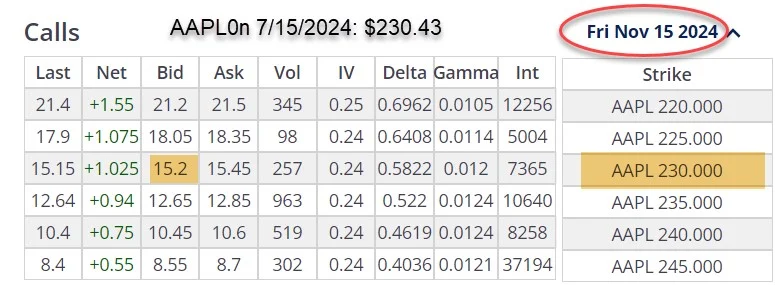

AAPL 11/15/2024 expiration option-chain on 7/15/2024

With AAPL trading at $230.43 on 7/15/2024, the $230.00 ATM strike shows a bid price of $15.20. This is approximately double the 1-month $7.80 return, not even close to quadrupling that initial return.

Discussion

Using shorter-dated options will result is greater annualized returns. It will also assist in avoiding earnings report events and, in some cases, ex-dividend dates. Let’s not be enticed by large initial premiums until we put those cash returns into proper perspective and evaluate the pros & cons of using these options.

Author: Alan Ellman