The Mystery of Our Brokerage Accounts: Where Did My Option Premium Money Go? – December 30, 2024

We sell a covered call or cash-secured put and the cash is immediately placed into our broker cash account. Next, we check our account value, and it did not go up! In some cases, it went down! Where did the option premium money go? This article will explain the broker accounting process and rationale as they relate to selling options.

What is unearned income or revenue?

This is income received with an attached liability. Before we get into options, here’s an example we have all experienced: We purchase an airline ticket for a flight scheduled a month from the sale date. From the airline’s perspective, revenue is generated, but there is the attached liability to provide the flight. Until that service is provided, the income is considered unearned.

Let’s now move to our world of option-selling. We sell the option (airline ticket), but now have an attached obligation, our contractual commitment to buy (puts) or sell (calls) the underlying shares. The contract agreement ceases in one of three ways:

- Short call or put is bought back (closed)

- Short option is exercised

- Option expires worthless

Once our contract obligation ends, the option income is now realized and will be reflected in our broker statements. Until then, the statement will reflect the liability attachment.

Broker accounting process for our contractual obligations

The cash generated from our option sales is, in fact, in our cash accounts. However, when tabulating our total account value, the debit to buy back the option(s), is also reflected in that total. If we sold the option for $2.00 (bid price), the cost to buy it back (at the time of the sale) may be $2.10 (ask price). In this hypothetical, our account value will fall by $10.00 per contract. These liability connotations in our broker statement can be bracketed in red or with minus signs, as shown in the screenshot below.

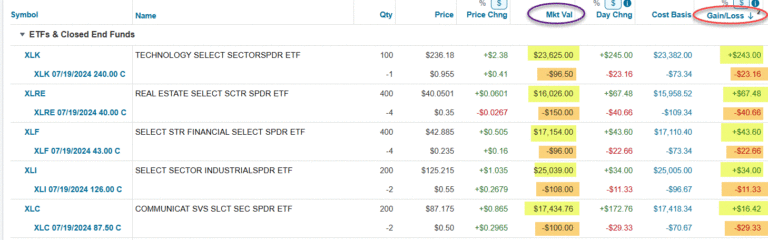

Real-life examples from one of Alan’s accounts

- Stock (ETF) positions are highlighted in yellow

- Short calls are highlighted in brown

- Market value (purple oval) shows positive value for the securities and negative value for the short options

- Gain/loss (red oval) shows that if shares are sold today, all positions would result in a profit (yellow cells); if option positions were closed, all would result in a net debit (brown cells)

Discussion

When we sell our options, the premium cash is in our accounts and available for our use. Our broker’s statement will reflect the liabilities associated with these sales in the form of the cost-to-close (CTC) our short positions, until our commitments no longer exist. It should be noted that the CTC values will change according to the market value of these premiums.

Author: Alan Ellman