Can We Use Delta to Establish a Low End of a Trading Range for ITM Covered Calls? – February 3, 2025

Implied volatility (IV) can be used to establish approximate upper and lower ends of trading ranges for our covered call and put-selling trades. The BCI Expected Price Movement Calculator was designed for purpose. Delta can also be used to establish an approximate upper end of the trading range with a risk factor approximately equal to the Delta itself. For example, if we are portfolio overwriting and don’t want our shares sold, we would select strikes with low Deltas which reflect the risk of share price moving above the deep out-of-the-money (OTM) call strike. If we own a stock at $48.00 and the $55.00 call strike shows a Delta of 16, there is about a 16% chance of share price moving above the strike and making the trade susceptible to exercise.

Since our risk factor is low, our expectation is that option returns will be lower than that of traditional covered call writing.

This article will analyze how to use Delta to establish an approximate low end of a trading range when we sell a deep in-the-money (ITM) call strike, and we don’t want share price to decline below that strike.

Goal when selling deep OTM call strikes

If we are portfolio overwriting, we don’t want our shares sold. We select strikes with low Deltas, meaning a low percentage probability of the strike expiring ITM or with intrinsic value.

Goal when selling deep ITM call strikes

In this scenario, our initial time-value return will be realized as long as share value remains above that deep ITM call strike. In other words, we want the strike to expire ITM. We select strikes with high Deltas, meaning a high probability of expiring with intrinsic value. If we select a strike with a Delta of 84, our risk factor is 16%., because there is about an 84% probability of expiring ITM.

Real-life ITM call example with Cirrus Logic, Inc. (Nasdaq: CRUS)

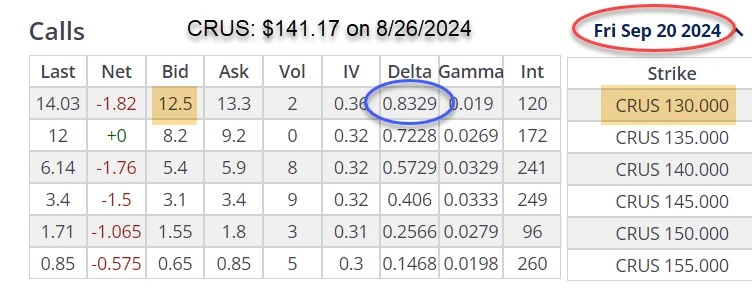

- 8/26/2024: CRUS trading at $141.17

- 8/26/2024: The $130.00 deep ITM call strike shows a Delta of 0.8329 and a bid price of $12.50

- By definition, this represents an approximate 16% risk factor of the strike expiring OTM

CRUS call option-chain on 8/26/2024

- Blue oval: The $130.00 strike shows an approximate 83% of remaining ITM

- Red oval: Expiration date is 9/20/2024, a 26-day trade

- Brown cells: The $130.00 strike shows a bid price of $12.50

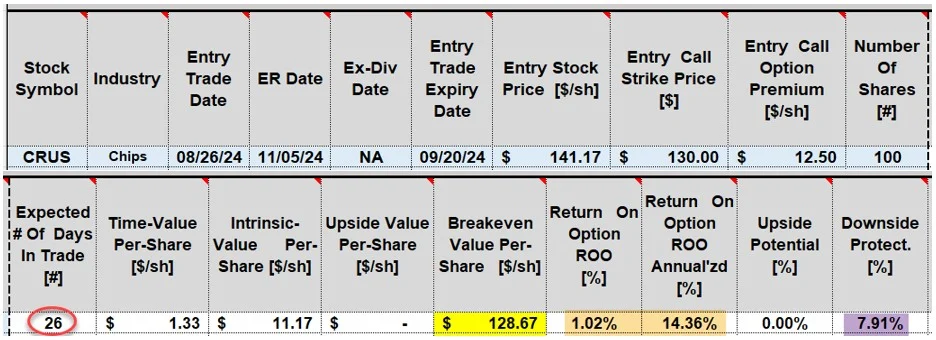

CRUS calculations on/26/2024

- Red circle: The BCI Trade Management Calculator (TMC) calculates a 26-day trade if taken through expiration

- Yellow cell: The breakeven price point is $128.67, well below the current market value of $141.17

- Brown cells: The initial 26-day time-value return is 1.02%, 14.36% annualized

- Purple cell: If share price drops below the $130.00 strike and no exit strategy action is executed, shares are purchased at a 7.91% discount from share price when the trade was initially executed

Discussion

When selling deep ITM covered calls, our goal is to avoid share price from dropping below the strike. Delta can be used to establish a reliable, approximate probability of success trade by selecting strikes with high Deltas. A critical component of this strategy is to check the bid price of these strikes to ensure they align with our pre-stated initial time-value return goal range.

Author: Alan Ellman