What is Covered Call Writing Time-Value Cost-To-Close? – April 14, 2025

The success of our covered call writing trades is, to a great extent, dependent on our position management skill set. One of the strategies in our exit strategy arsenal is the mid-contract unwind exit strategy (MCU). WE may close both legs of the trade if share price declines precipitously, but let’s focus on situations when share price accelerates exponentially. When should we close our trades that are in an unrealized maximum gain position?

Relevant factors impacting our option premiums when share price soars after trade entry

When the share price rises substantially, the intrinsic-value component (amount share price is above the call strike) of the premium rises dollar-for-dollar with share increase. However, the time-value component of the premium decreases and heads to, but rarely reaches, $0.00 as the strike moves deeper and deeper in-the-money.

This means that the total cost-to-close the short call goes up, but most of that is in the form of intrinsic-value. This “loss” of intrinsic-value is negated by the unrealized rise in share value when the call strike is no longer creating a maximum gain ceiling on share value. Therefore, the actual debit caused by closing both legs of the trade is the time-value component of the premium only. This is known as the time-value cost-to-close.

Real-life example with Vertiv Holdings Co. (NYSE: VRT)

- These trades were shared with me by a BCI member

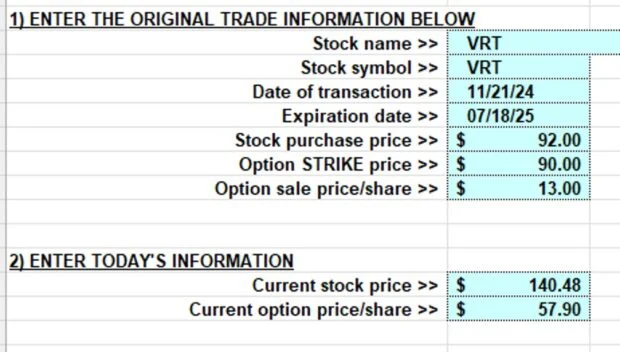

- 3/14/2024: Buy 100 x VRT at $92.00

- 3/14/2024: STO 1 x 7/18/2025 $90.00 call at $13.00

- 11/21/2024: VRT trading at $140.48

- 11/21/2024: The cost-to-close the 7/18/2025 $90.00 call is $57.90 (intrinsic-value + time-value)

- Should the mid-contract unwind exit strategy be initiated?

Mid-contract unwind exit strategy implementation guideline

If we can generate at least 1% more than the time-value cost-to-close (CTC) by contract expiration, the MCU exit strategy should be given serious consideration. We will use the “Unwind Now” worksheet tab of the BCI Trade Management Calculator to calculate a % time-value CTC. This tab is located at the bottom of the TMC spreadsheet.

VRT “Unwind Now” worksheet entries

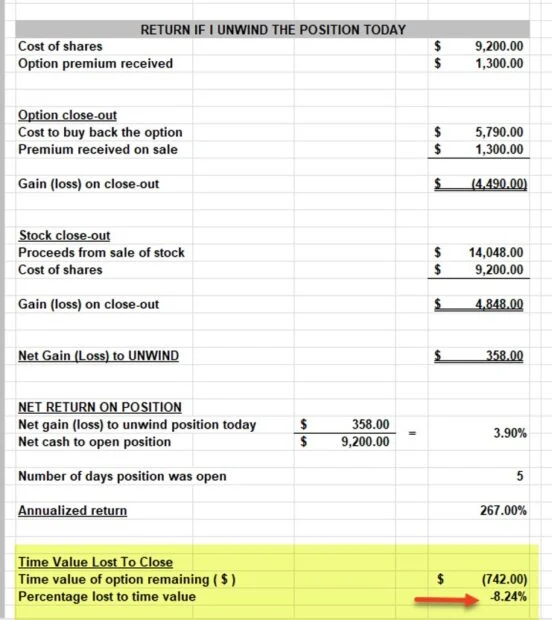

VRT “Unwind Now” worksheet final calculations

The spreadsheet shows a loss of 8.24% in time-value if both legs of the trade are closed today. Can we generate > 9.24% over the next 8 months by initiating the MCU exit strategy? Probably, yes.

Discussion

These trades represent wonderful educational opportunities:

- When share price accelerates exponentially, leaving the call strike deep, deep in-the-money, the MCU exit strategy should be evaluated, utilizing the “Unwind Now” worksheet tab of the TMC

- It is not the entire premium we should evaluate, but rather the time-value component only

- This started as a 16-month trade, taking the shareholder through multiple earnings reports … way too risky

- Longer-dated options generate lower annualized returns. Consider weekly and monthly options as our go-to expirations

Author: Alan Ellman