Analyzing and Learning from A Weekly Cash-Secured Put Trade – April 21, 2025

Prior to executing our cash-secured put trades, we must establish our initial time-value return goal range. This will lead us to the most appropriate strike. This article will focus on a real-life trade with Marvel Technology, Inc. (Nasdaq: MRVL), shared with me by David, a BCI premium member. He was concerned because he was having difficulty achieving his pre-stated weekly initial time-value return goal range of 0.5% – 1% or 26% – 48% annualized. He was also seeking trades that offered low risk of exercise. The specific trade David inquired about (see below) represented a terrific learning experience and that’s why I decided to use it in this publication.

Is it reasonable to expect a 26% – 48% annualized initial return while retaining low risk of exercise?

No. To achieve traditional put-selling returns, we must use relatively near-the-money strikes which have Deltas in the 30% – 40% range (guidelines), and therefore subject to exercise (without exit strategies) approximately 30% – 40% of the time. The strikes will be slightly out-of-the-money.

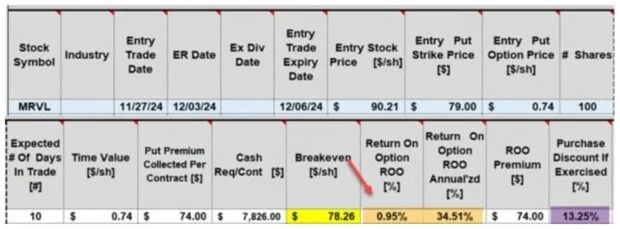

David’s real-life 10-day trade with MRVL

- 11/27/2024: MRVL trading at $90.21

- 11/27/2024: STO 1 x 12/6/2024 $79.00 put at $0.74

- 11/27/2024: The $79.00 put shows a Delta of 13%, meaning approximately a 13% of being subject to exercise

- 11/27/2024: The implied volatility of the ATM $90.00 strike is a whopping 84%

MRVL calculations using the BCI Trade Management Calculator (TMC)

- The initial 10-day time-value return is 0.95%, 34.51% annualized (brown cells)

- The breakeven price is $78.26 (yellow cell)

- If exercised, MRVL will be purchased at a 13.25% discount from share price at trade entry (purple cell)

- This trade seems to meet both goals, so what’s the catch?

How is it possible to generate a 34% annualized return with a strike that has a Delta of 13% and an ATM implied volatility of 84%?

I’ll bet most of you already have this one figured out.

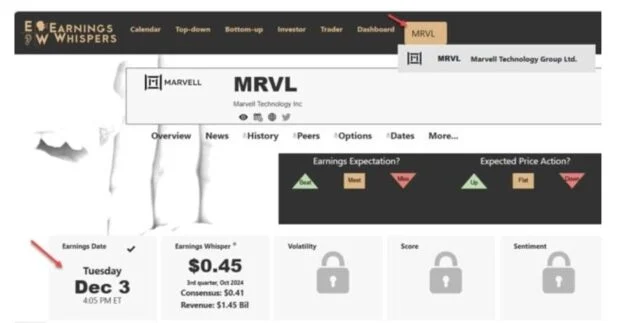

That’s right. There is an earnings report (ER) due prior to the 12/6/2024 contract expiration. This trade should be avoided due to the risk of a disappointing ER.

Discussion

Weekly (10-day, in this case) cash-secured put initial time-value returns of 0.5% – 1% is achievable, but not without moderate risk of being subjected to exercise at expiration. To create low risk of exercise trades, we need to use strikes deeper out-of-the-money which will generate lower weekly/annualized returns. In this article, exercise risk was replaced by earnings report risk. Not worth it, in my humble opinion.

Author: Alan Ellman