How to Enter and Archive Cash-Secured Put Trades Around an Earnings Report – February 13, 2023

In last week’s segment, I posted a series of cash-secured put trades with Etsy, Inc. (Nasdaq: ETSY). Some trades were executed before an earnings report and a few post-earnings. This article will detail how to accurately enter and archive all trades using the BCI Trade Management Calculator.

Stage 1:

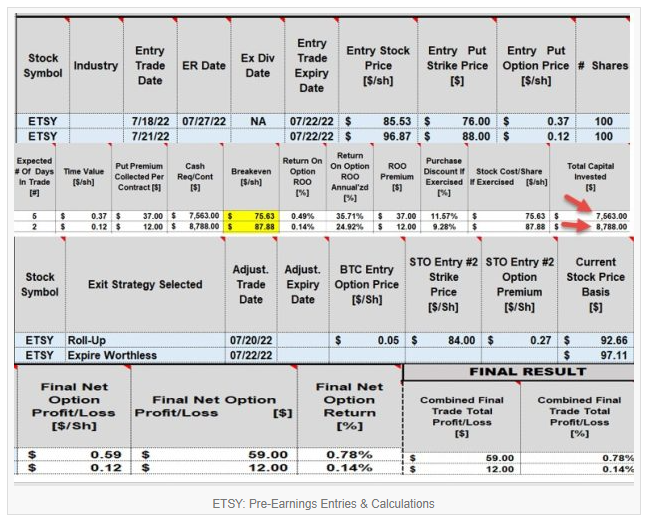

Pre-earnings report (ER) trades

- 7/18/22: ETSY trading at $85.53 with ER due out 7/27/22. Will write a weekly put option and skip the following week of the ER

- 7/18/22: The 10-Delta, deep OTM 7/22/22 put shows a strike of $76.00 (approximate 90% probability of no exercise based on Delta)

- 7/18/22: STO 1 x 7/22/22 $76.00 put at $0.37

- 7/20/22: ETSY trading at $92.66

- 7/20/22: BTC 1 x 7/22/22 $76.00 put at $0.05

- 7/20/22: STO 1 x 7/22/22 $84.00 put at $0.27 (roll-up #1)

- 7/21/22: ETSY trading at $96.87

- 7/21/22: BTC 1 x 7/22/22 $84.00 put at $0.03

- 7/21/22: STO 1 7/22/22 $88.00 put at $0.15 (roll-up #2)

- 7/22/22: The $88.00 put expires out-of-the-money and worthless

- 7/27/22: ETSY closes at $95.50 and reports earnings after closing

Pre-earnings trade entries & calculations

The final results after 2 roll-ups included returns of 0.78% + 0.14%. The spreadsheet shows 2 capital investments (red arrows) when there should be only 1 as the first is incorporated into the 2nd. We will account for this below in the capital adjustment section.

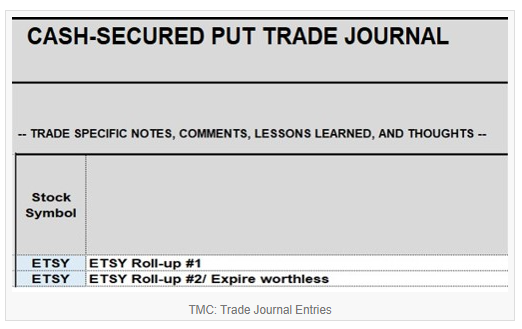

Pre-earnings rolling-up trade notes

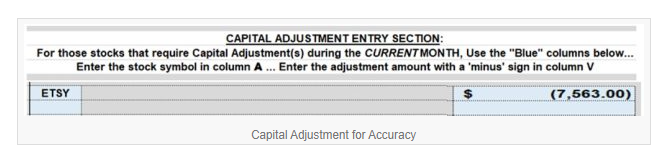

Capital Adjustment Entry Section

With this adjustment % returns will be accurate and reflect profit/losses based on actual cash invested.

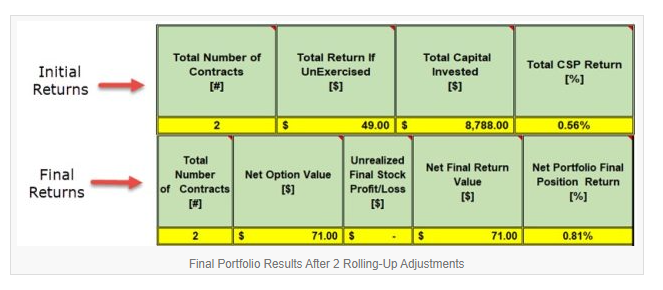

Initial and final portfolio results after 2 rolling trades (5-day returns)

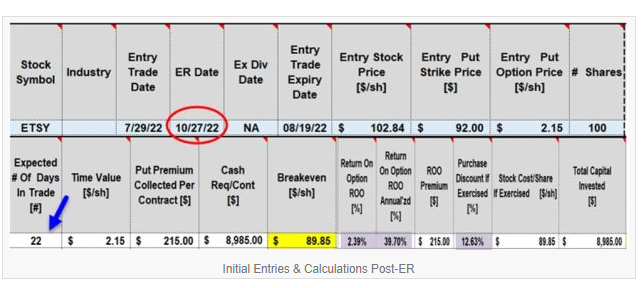

Post-ER initial trade entries and initial calculations

The spreadsheet reflects an initial time-value return of 2.39%, 39.70% annualized based on a 22-day trade.

Discussion

The Trade Management Calculator (TMC) allows for pre-and post-earnings report trade entries and calculations. Using the Trade Journal and capital adjustment sections will also be useful in archiving and ensuring the accuracy of our trade calculations.

Author: Alan Ellman