-

Setting Up a Weekly CEO Portfolio – March 10, 2025

The CEO Strategy is a streamlined approach to covered call writing. It is an acronym for Combining Exchange-traded funds with stock Options. The methodology uses only the Select Sector SPDRs as underlying securities. These are exchange-traded...

Read More -

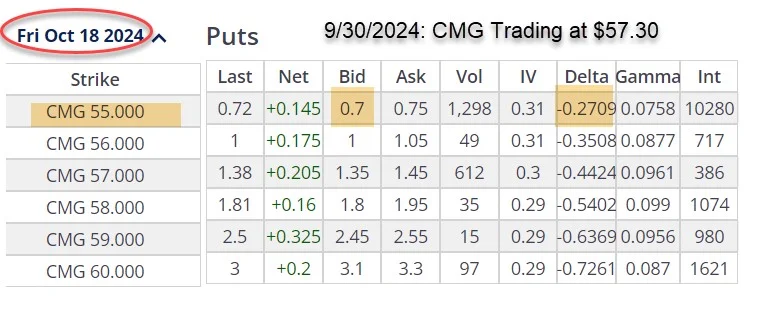

The Inverse Relationship Between Stock Price and Put Premium – March 3, 2025

When selling our cash-secured puts, understanding the correlation between stock price and our put premiums is critical to maximizing the success of our trades. For covered call writing, the relationship...

Read More -

Rolling-Up Twice and Closing a Mixed Cash-Secured Put Trade – January 13, 2025

Exit strategies for covered call writing and selling cash-secured puts are critical in achieving the highest level of our trading returns. In this article, a real-life example with SPDR S&P...

Read More -

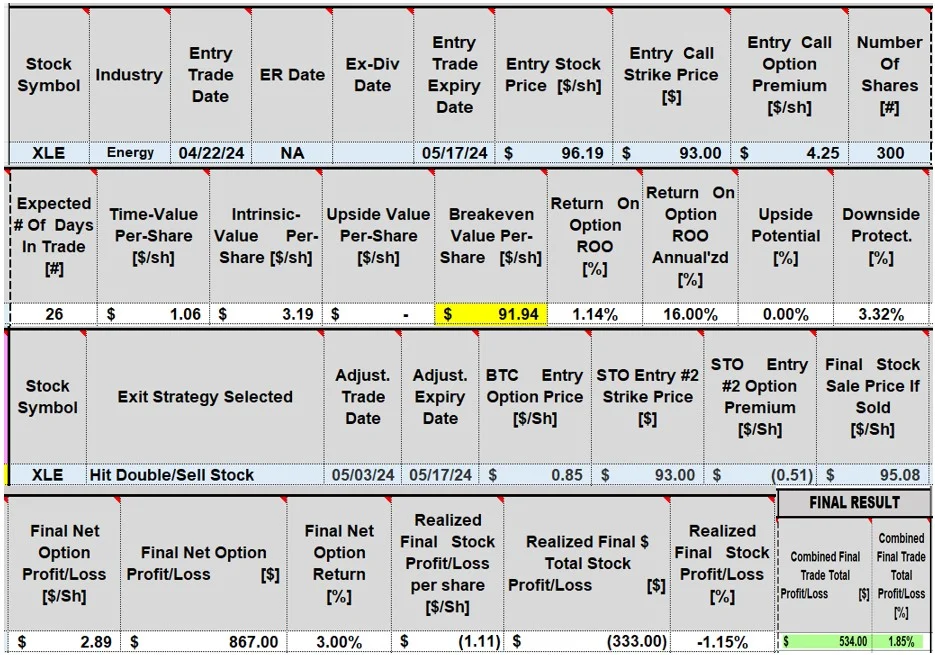

Hitting a Double and Selling the Stock Using the Trade Management Calculator – October 28, 2024

Hitting a Double is a covered call writing exit strategy where the short call is bought back after share price declines and resold when share price recovers. At expiration, we...

Read More -

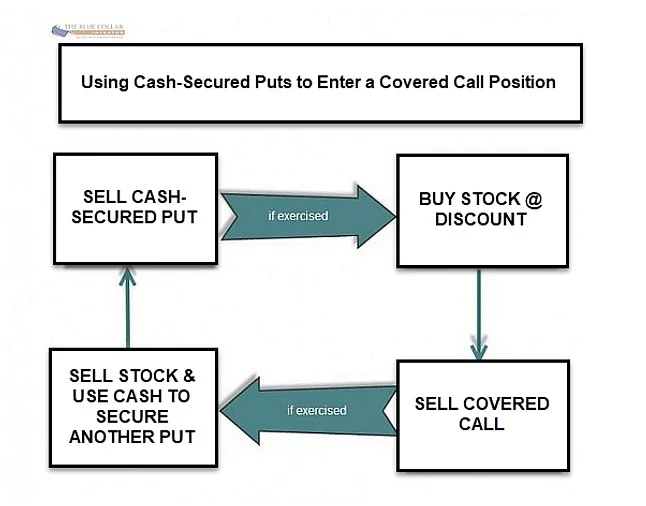

Combining Covered Call Writing and Selling Cash-Secured Puts – January 15, 2024

When we integrate both covered call writing and selling cash-secured puts into one multi-tiered option selling strategy, we have our Put-Call-Put or PCP Strategy. Outside the BCI community, this is...

Read More -

Whisper Numbers: Another Reason to Avoid Earnings Reports – January 02, 2023

BCI Rule: Never write a covered call or sell a cash-secured put if there is an upcoming earnings report prior to contract expiration. All other parameters in our BCI methodology...

Read More -

Selling Cash-Secured Puts: 2 Favorable Outcomes, November 27, 2023

When we sell cash-secured puts (CSPs), we are getting paid to undertake the contractual obligation to buy the holders shares at a price that we (the sellers) determine, called...

Read More