-

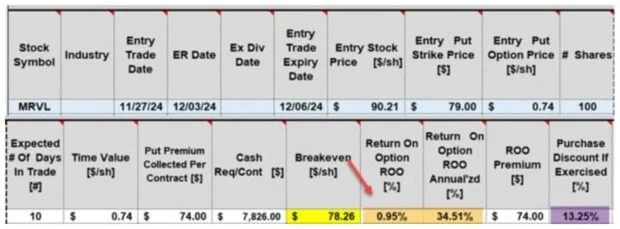

Analyzing and Learning from A Weekly Cash-Secured Put Trade – April 21, 2025

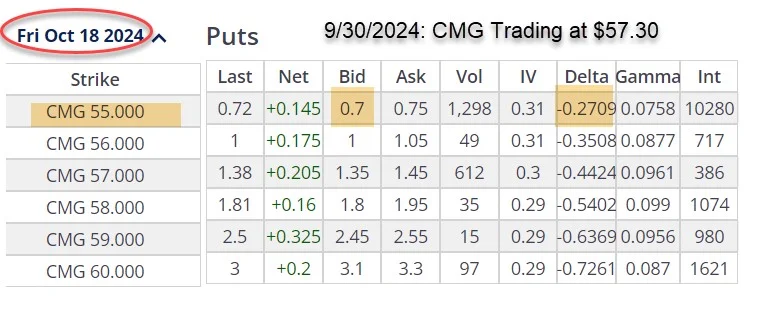

Prior to executing our cash-secured put trades, we must establish our initial time-value return goal range. This will lead us to the most appropriate strike. This article will focus...

Read More -

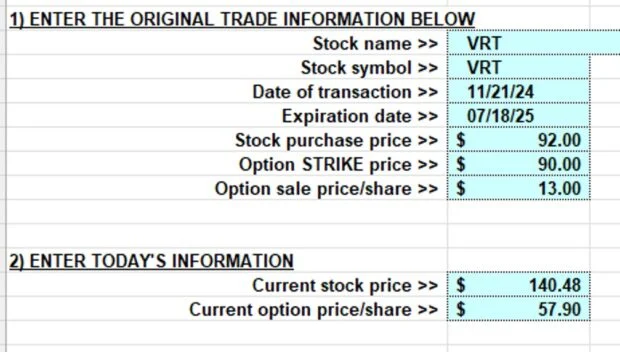

What is Covered Call Writing Time-Value Cost-To-Close? – April 14, 2025

The success of our covered call writing trades is, to a great extent, dependent on our position management skill set. One of the strategies in our exit strategy arsenal is the mid-contract...

Read More -

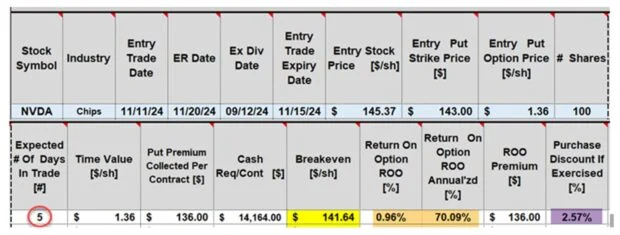

Evaluating a 1-Week Cash-Secured Put Trade with NVDA – April 7, 2025

Cash-secured put and covered call writing trades can be winning or losing trades. When executed and managed properly, we will have many more winners than losers. Some trades will...

Read More -

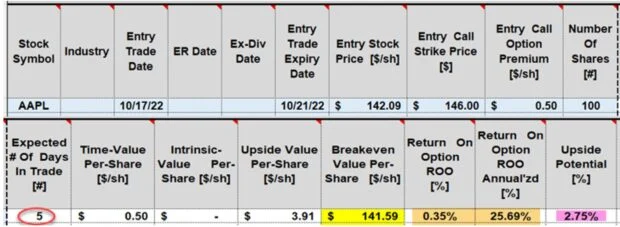

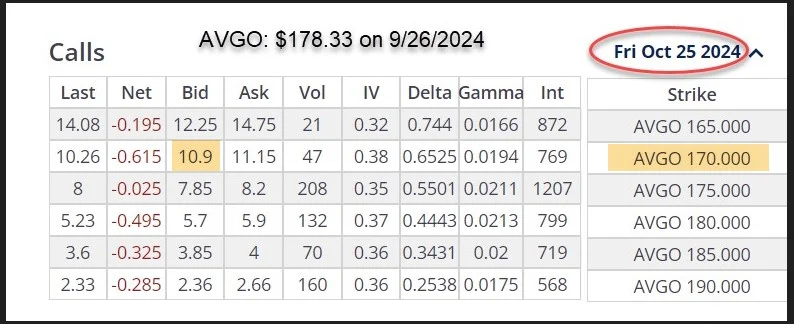

Using Weekly Covered Call Options to Avoid Earnings and Ex-Dividend Dates – March 31, 2025

When entering our covered call trades, we should always avoid the risk of earnings report dates. If we choose to hold the stock through that ER date, that’s okay,...

Read More -

How to Improve Results for a Rolling-Down Covered Call Trade – March 24, 2025

Rolling down is a frequently used covered call writing exit strategy to mitigate when share price declines. The original sold option is closed (bought back), while simultaneously opening another at...

Read More -

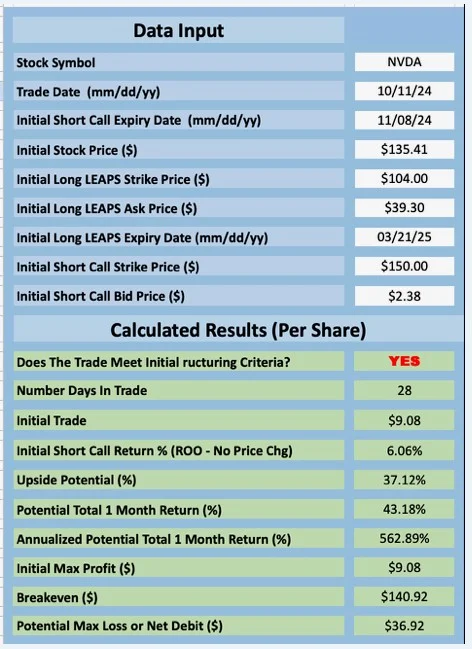

The Poor Man’s Covered Call: Can We Use ITM Covered Call Strikes? – March 17, 2025

What is the Poor Man’s Covered Call (PMCC)? This is a covered call writing-like strategy where LEAPS options are purchased instead of the actual stocks or ETFs and short calls are...

Read More -

Setting Up a Weekly CEO Portfolio – March 10, 2025

The CEO Strategy is a streamlined approach to covered call writing. It is an acronym for Combining Exchange-traded funds with stock Options. The methodology uses only the Select Sector SPDRs as underlying securities. These are exchange-traded...

Read More -

The Inverse Relationship Between Stock Price and Put Premium – March 3, 2025

When selling our cash-secured puts, understanding the correlation between stock price and our put premiums is critical to maximizing the success of our trades. For covered call writing, the relationship...

Read More -

Free Insurance for Our Covered Call Trades: Making the Case for ITM Strikes – February 24, 2025

There are 2 major ways to protect the investment inherent in our covered call trades. On way is buy protective puts and convert the covered call trade to a collar trade....

Read More -

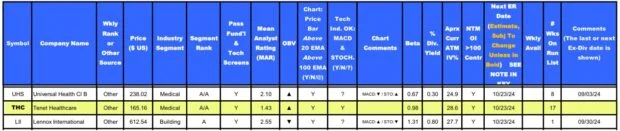

Setting Up a Covered Call Trade: Step-by-Step Process + New Trade Video – February 17, 2025

Establishing our covered call trades require a sequential process including stock selection, option selection and position management. This article will analyze the procedures using a real-life example with Tenet...

Read More