-

Selling Cash-Secured Puts: Multiple Applications: Part I – July 10, 2023

Selling cash-secured puts is a low-risk option-selling strategy where the seller undertakes the contractual obligations to buy shares at the strike price, by the expiration date. In return for...

Read More -

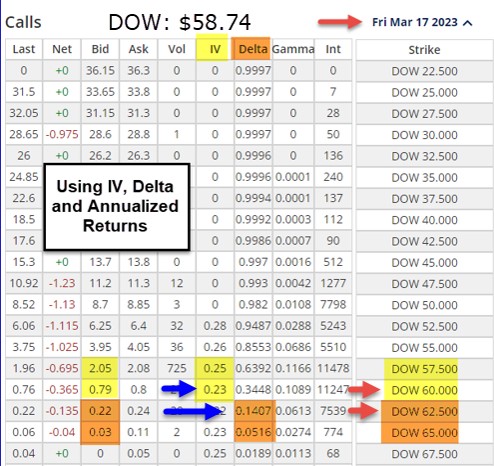

3 Approaches to Strike Selection When Portfolio Overwriting Existing Stocks: A Real-Life Example with Dow, Inc. (NYSE: DOW) – July 3rd, 2023

Portfolio overwriting is a covered call writing-like strategy where deep out-of-the-money (OTM) calls are sold against our long-term buy-and-hold securities. Typically, these stocks and exchange-traded funds (ETFs) are of a...

Read More -

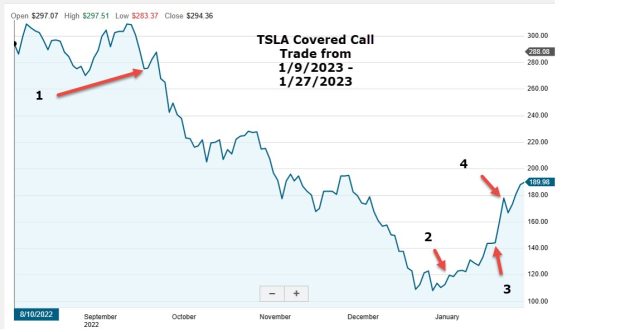

Should I Allow Exercise & Repurchase the Stock or Roll the Option?: A Real-Life Example with Tesla, Inc. (Nasdaq: TSLA) – June 26, 2023

The crafting and managing of our covered call writing trades are directly dependent on our pre-defined goals. In this article, we will analyze a TSLA covered call trade where...

Read More -

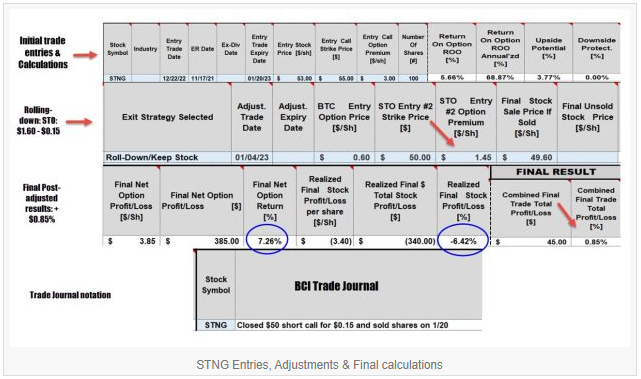

How to Enter and Archive a Covered Call Trade with 1 Exit Strategy that is Closed at Expiration – June 19, 2023

After entering our covered call trades, we immediately go into position management mode. Frequently, we can take advantage of a covered call exit strategy opportunity, sometimes more than one....

Read More -

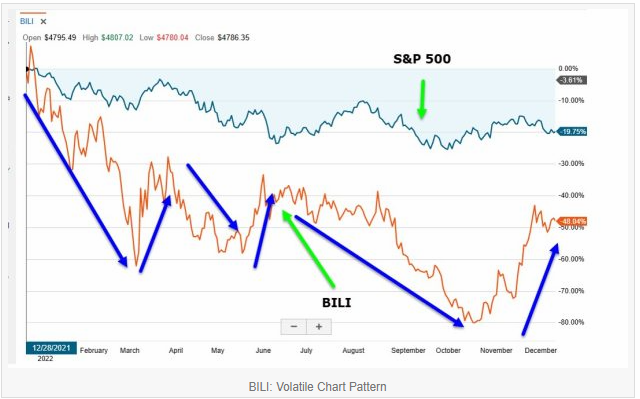

Should We Get the Kleenex or the Champagne? A Real-Life Trade with Bilibili Inc. (Nasdaq: BILI) – June 12, 2023

On 12/9/2022, Patrik sent me an email he titled “Covered Call Panic” He shared with me information on his trades and was distraught at the current outcome. This article...

Read More -

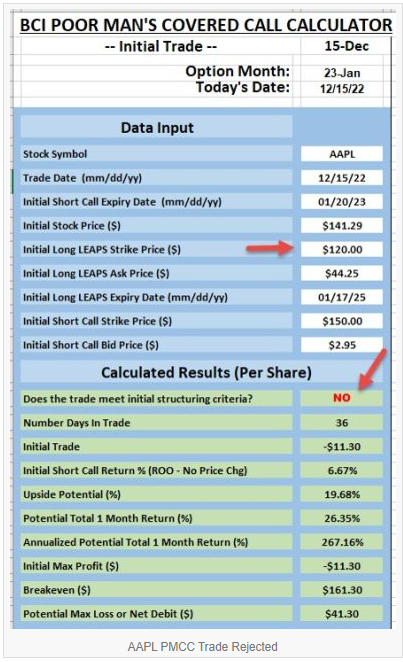

How to Adjust a Poor Man’s Covered Call (PMCC) Trade to Align with the BCI Trade Initialization Formula – June 05, 2023

The PMCC is a covered call writing-like strategy where LEAPS options act as surrogates for the underlying stock or ETF. It is technically called a long call diagonal debit spread and has the...

Read More -

Evaluating a Series of Multi-Rolling Covered Call Trades: A Real-Life Example with Elevance Health Inc. (NYSE: ELV) – May 30, 2023

In this article, we will analyze a series of covered call trades shared with me by a BCI premium member. These trade executions involve establishing a bullish covered call...

Read More -

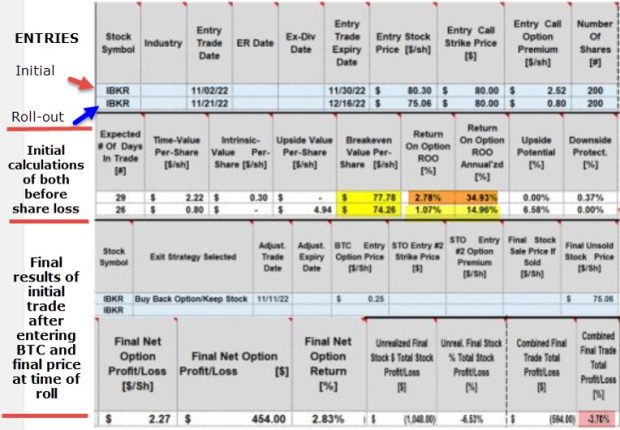

Analyzing a Covered Call Trade Over 2 Expiration Cycles: A Rea-Life Example with Interactive Brokers Group (Nasdaq: IBKR) – May 22, 2023

Covered call writing exit strategies can involve trade adjustments over 1 or more expiration cycles. This article will analyze a series of trades shared with me by Ken, where...

Read More -

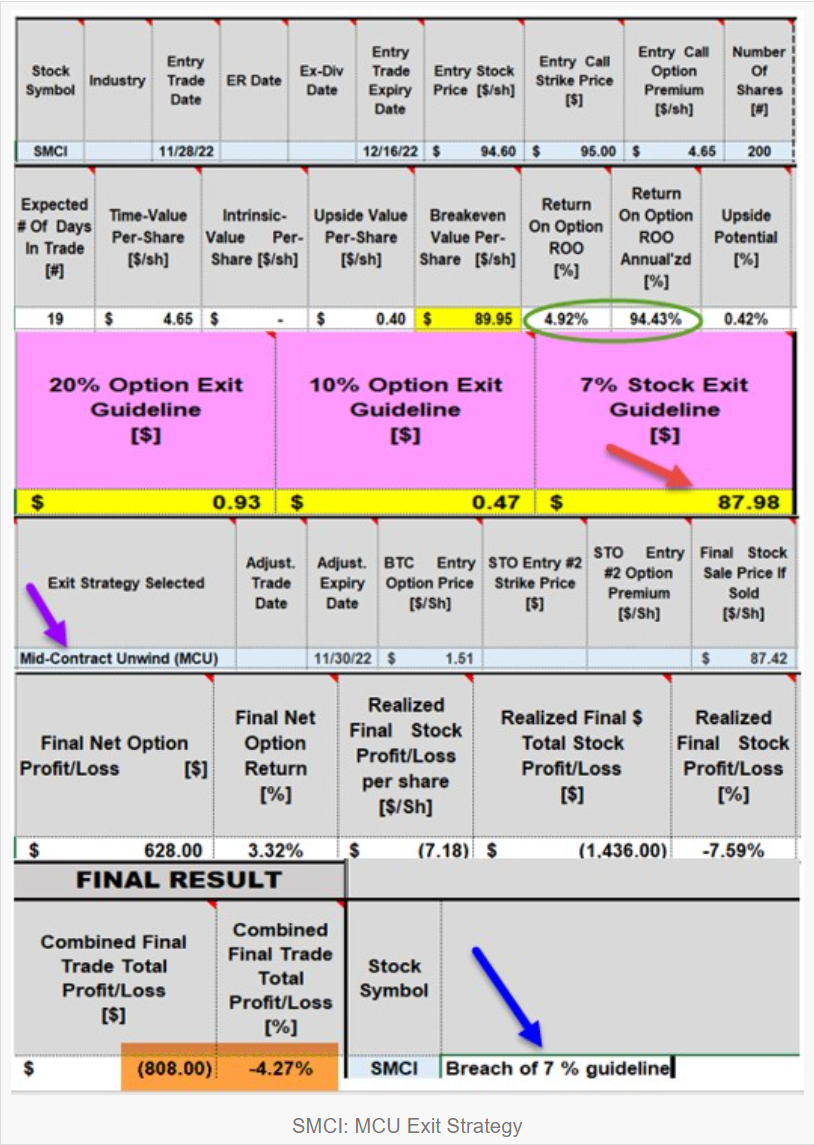

Multiple Applications of the Mid-Contract Unwind (MCU) Exit Strategy: A Real-Life Example with Super Micro Computer, Inc. (Nasdaq: SMCI) – May 15, 2023

covered call writing exit strategies allow us to mitigate trade losses and enhance trade profits. On 11/30/2022, Paul shares with me a series of trades he executed with SMCI where a...

Read More -

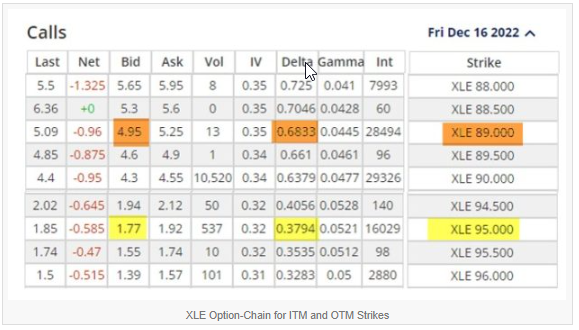

Application of the 20%/10% Guidelines for ITM & OTM Strikes + Registration Form for Thursday’s Webinar – May 08, 2023

One of the key methods to partially automate our covered call writing exit strategy arsenal is to place buy-to-close (BTC), good until cancelled (GTC) limit orders to close our short calls...

Read More