-

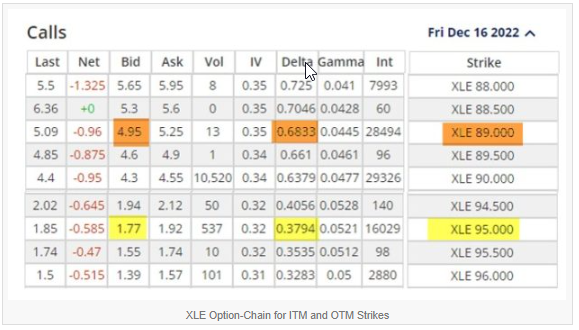

Application of the 20%/10% Guidelines for ITM & OTM Strikes + Registration Form for Thursday’s Webinar – May 08, 2023

One of the key methods to partially automate our covered call writing exit strategy arsenal is to place buy-to-close (BTC), good until cancelled (GTC) limit orders to close our short calls...

Read More -

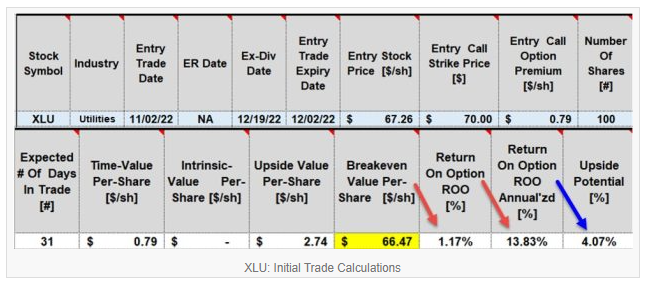

Analyzing a Defensive Turned Aggressive Covered Call Trade: A Real-Life Example with Select Sector SPDR Utilities (NYSE: XLU) – May 01, 2023

When we craft our covered call trades, we must decide if a defensive (in-the-money or ITM calls) or aggressive (out-of-the-money or OTM) position should be established. We base this on overall...

Read More -

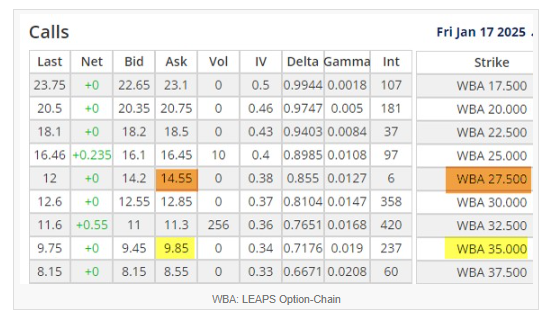

The Poor Man’s Covered Call: How to Re-Structure a Potentially Losing Trade into a Winning One – April 24, 2023

The Poor Man’s Covered Call is a covered call writing-like strategy where a LEAPS option is used as a surrogate for the actual stock or exchange-traded fund (ETF). When structuring our PMCC trades, we...

Read More -

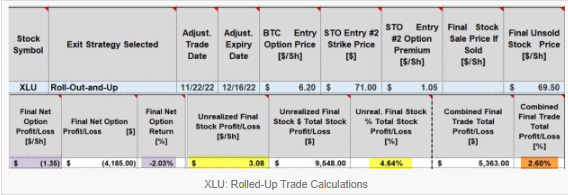

Understanding the Math When Rolling ITM Covered Calls Out-And-Up: A Real-Life Example with Utilities Select Sector SPDR Fund (NYSE: XLU) + Save the Date May 11th – April 17, 2023

All strategies, including covered call writing and selling cash-secured puts, have their pros and cons. The same holds true for the exit strategies associated with them. Several of our...

Read More -

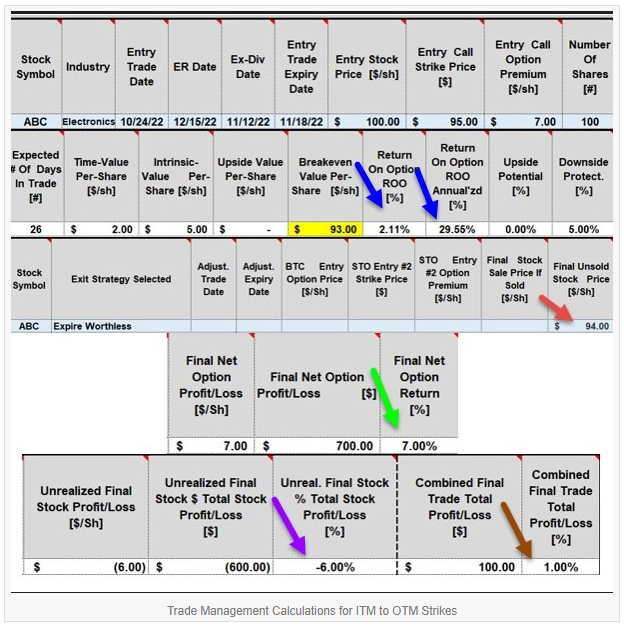

How to Record & Calculate ITM Covered Call Trades that Become OTM Trades – April 10, 2023

To properly analyze our covered call writing and put-selling trades, we must accurately record each step of the trades such that initial and final results are accurate. In this article, a...

Read More -

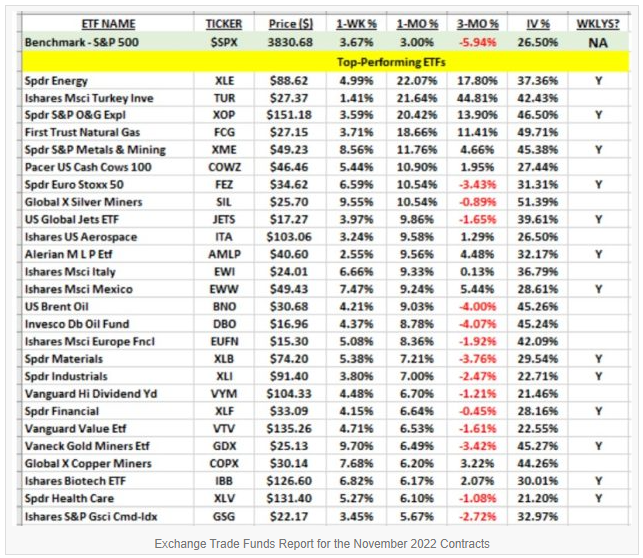

Establishing Our Option Portfolios in the Heart of Earnings Season – April 04, 2023

Populating our covered call writing and put-selling portfolios during earnings season can be challenging but nothing we can’t overcome. This article will provide ideas as to how to craft...

Read More -

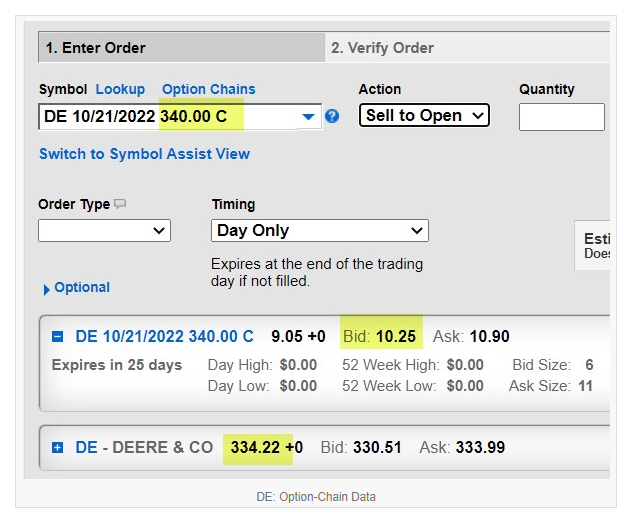

Technical Analysis for Options: A Real-Life Example with Deckers Outdoor Corp. (NYSE: DECK) – March 27, 2023

In our BCI methodology, we use a 3-pronged approach to screening for our covered call writing and put-selling portfolios: This article will focus in on the technical analysis of...

Read More -

Establishing 84% Probability of Success Put Trades in Bear Markets – March 20, 2023

Selling deep out-of-the-money cash-secured puts in bear markets will provide us with additional protection to the downside in return for lower, but still significant, option returns. This article will...

Read More -

How to Calculate Dividends into Our Covered Call Writing Calculations – March 13, 2023

Covered call writing is a low-risk, cash generating option-selling strategy. Premium is generated by undertaking the contractual obligation to sell our shares at a price (strike price) and date...

Read More -

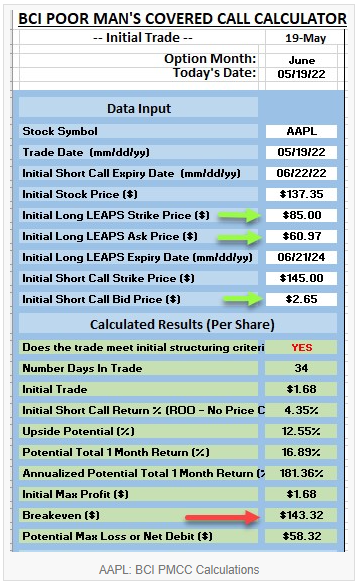

Estimating Our Breakeven Price Points When Establishing Our Poor Man’s Covered Call Trades: A Real-Life Example with Apple, Inc. (Nasdaq: AAPL) – March 06, 2023

When initiating our Poor Man’s Covered Call (PMCC) trades, we can estimate our breakeven (BE) price points. It gets more complicated as more layers are added to the trades over the months and,...

Read More