-

Analyzing a 3-Income Covered Call Writing Trade: A Real-Life Example with Ready Capital Corp. (NYSE: RC) – February 27, 2023

Covered call writing with out-of-the-money (OTM) strikes provides the opportunity for 2 incomes streams, 1 from option premium and the other from share appreciation from current market value up to...

Read More -

Review of Dividend Dates & Their Impact on Our Covered Call Trades – February 21, 2023

The main reason for early exercise of our covered call writing options relates to corporate dividends. The key date to be aware of is the ex-dividend date. This article will clarify and...

Read More -

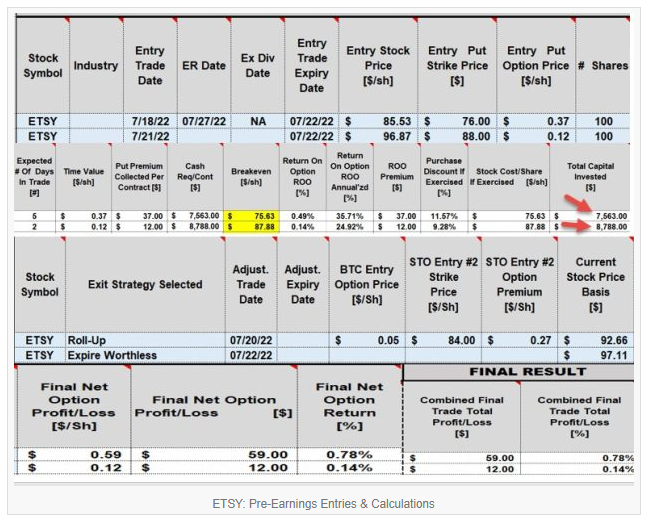

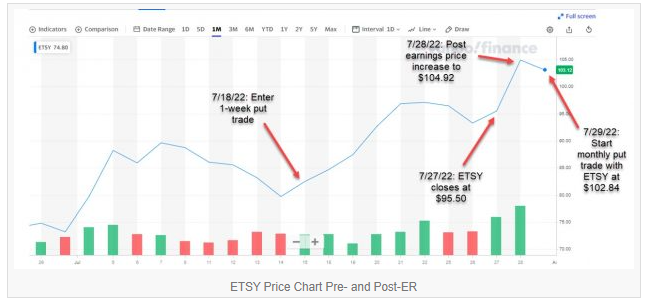

How to Enter and Archive Cash-Secured Put Trades Around an Earnings Report – February 13, 2023

In last week’s segment, I posted a series of cash-secured put trades with Etsy, Inc. (Nasdaq: ETSY). Some trades were executed before an earnings report and a few post-earnings....

Read More -

How to Manage Cash-Secured Put Trades Around an Earnings Report: A Real-Life Example with Etsy, Inc. (Nasdaq: ETSY) – February 06, 2023

When selling covered calls or cash-secured put options, we must avoid the risk of earnings reports. This is an important rule of the BCI methodology. This article will detail how a series of put...

Read More -

Calculating Realized Option & Unrealized Stock Covered Call Returns at the End of a Contract Cycle – January 30, 2023

Accurately calculating our covered call writing returns at the end of each contract cycle can be uncomplicated in some situations and more challenging in others. If we buy a...

Read More -

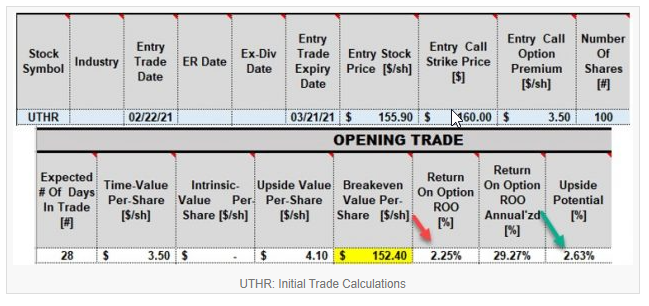

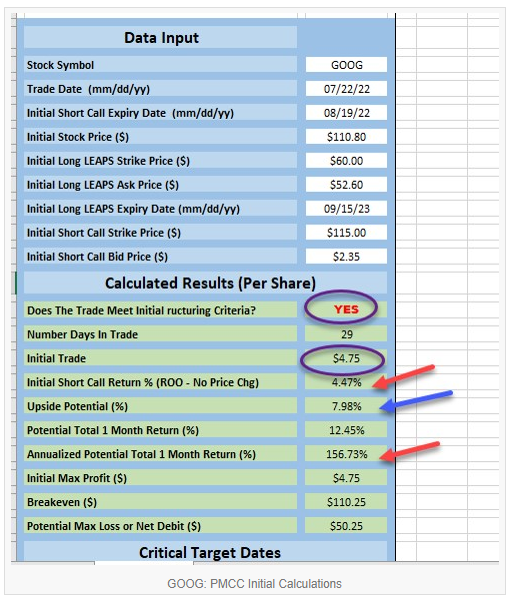

Rolling-Out Poor Man’s Covered Call Trades: A Real-Life Example with Alphabet Inc. (Nasdaq: GOOG) – January 23, 2023

When the Poor Man’s Covered Call (PMCC) strategy is employed, the short call is the active leg of the trade. If a strike is expiring in-the-money (ITM), we can roll...

Read More -

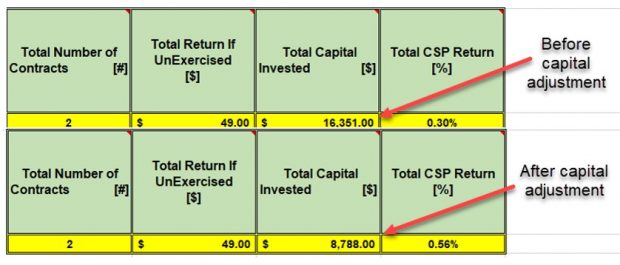

How to Use the Capital Adjustment Section of the Trade Management Calculator When Executing Multiple Exit Strategies in the Same Contract Cycle – January 16, 2023

Exit strategies for covered call writing and selling cash-secured parts are integral aspects of our trading system. It is critical to learn how to enter, calculate and archive these position...

Read More -

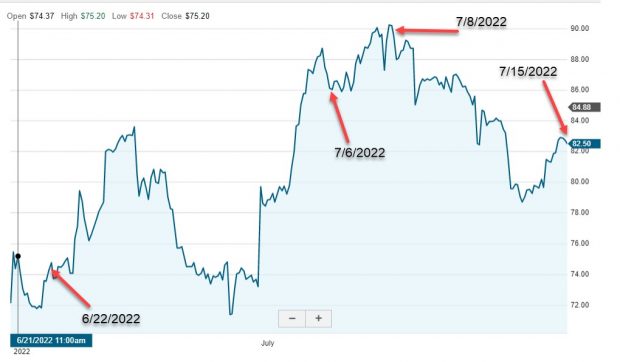

How to Enter & Calculate Rolling-Out-And-Down Cash-Secured Put Trades: A Real-Life Example with Invesco QQQ Trust (Nasdaq: QQQ) – January 09, 2023

When selling out-of-the-money (OTM) cash-secured puts, we calculate our initial time-value returns with this formula: % return = Put premium/ (put strike – put premium) When incorporating exit strategies...

Read More -

Rolling-Up Our Cash-Secured Put Trades: A Real-Life Example with Etsy, Inc. (Nasdaq: ETSY) – January 3, 2023

When we sell cash-secured puts, we are seeking to generate cash flow or buy securities at a discount. It is generally written that the maximum return for these trades is the...

Read More -

Exercising Call Options to Capture Dividends: A Reasonable Action or Investor Error? – December 27, 2022

Dividend capture is the main reason for early exercise of our covered call writing trades. More specifically, ex-dividend dates are the times most susceptible to early exercise and having our shares sold at the strike price....

Read More