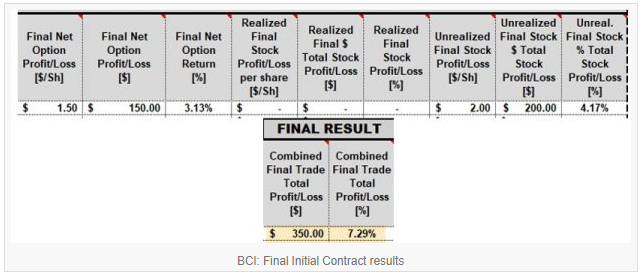

-

Calculating Mid-Contract Put-Selling Trade Status + A New Covered Call Writing Strategy Coming Soon – December 19, 2022

After entering our put-selling trades, we can calculate the current status of our trades mid-contract with a few simple entries into our Trade Management Calculator. In this article, a real-life...

Read More -

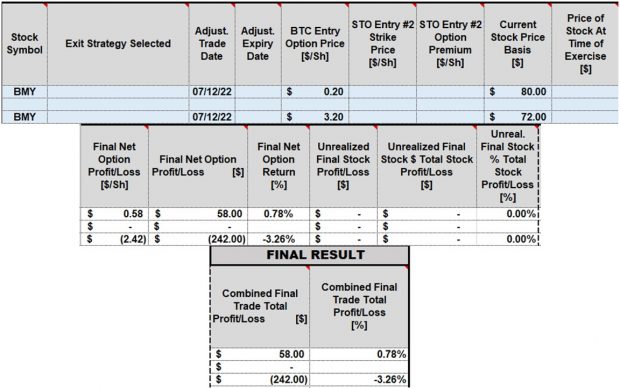

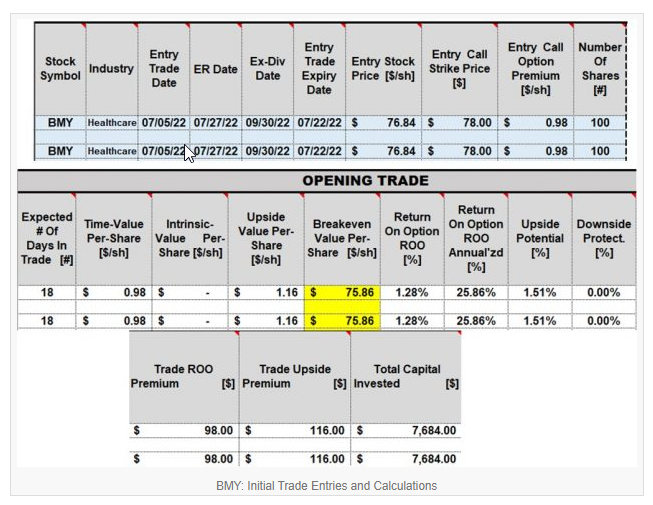

Calculating Mid-Contract Covered Call Writing Trade Status: A Real-Life Example with Bristol-Myers Squibb Comp. (NYSE: BMY) – December 12, 2022

After entering our covered call writing and put-selling trades, we can calculate the current status of our trades mid-contract with a few simple entries into our Trade Management Calculator. In this article,...

Read More -

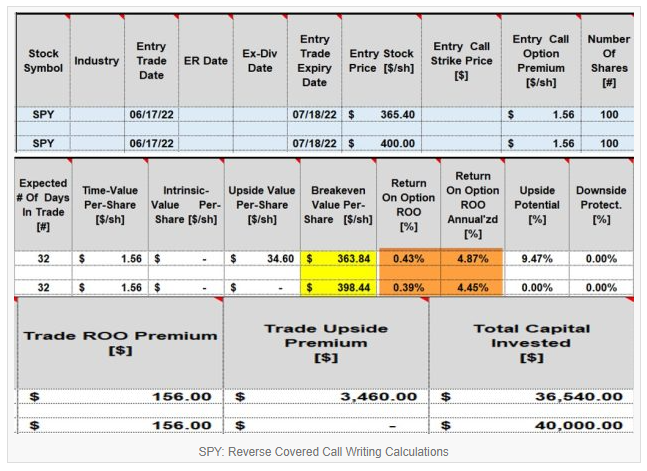

Reverse Covered Call Writing: A Reasonable Bear Market Strategy? A Real-Life Example with SPDR S&P ETF Trust (NYSE: SPY) – December 05, 2022

Covered call writing is defined as first purchasing or already owning the underlying security and then selling the corresponding call option. By doing so, we are protected; we know...

Read More -

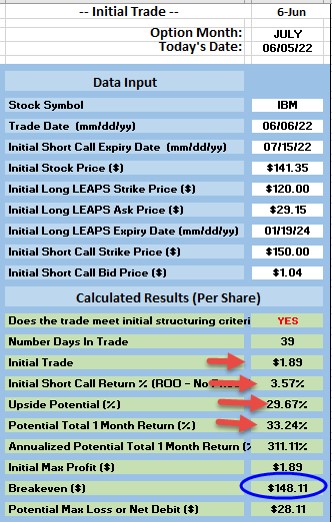

The Significance of Breakeven When Constructing Our Poor Man’s Covered Call (PMCC) Trades: A Real-Life Example with International Business Machines Corp. (NYSE: IBM) – November 28, 2022

The PMCC Strategy involves buying LEAPS call options (expirations 1 – 2 years out) and selling short-term call options against the long position. The technical term is a long call diagonal debit...

Read More -

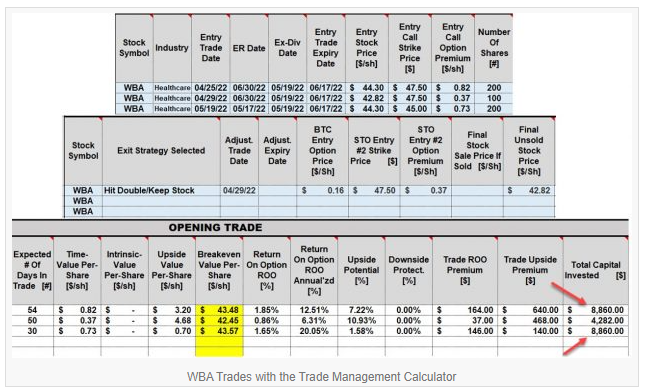

Entering and Adjusting Our Covered Call Trades Using the BCI Trade Management Calculator: A Real-Life Example with WBA – November 21, 2022

Entering, managing and archiving our covered call writing and put-selling trades are critical to our overall success as well as allowing us to learn and benefit from our investment...

Read More -

Why Did Option Value Decline After Stock Price Accelerated? A Real-Life Example with United Health Group Inc. (NYSE: UNH) – November 07, 2022

We, as covered call writers and sellers of cash-secured puts, are on the sell-side of options. Every so often, I receive interesting emails with educational value from members who...

Read More -

Evaluating Pre- and Post-Market Opening Calculations; A Real-Life Example with The Simply Good Foods Company: (Nasdaq: SMPL) – October 31, 2022

Preparing for our initial covered call writing and cash-secured put trades starts pre-market. After developing a watchlist of eligible securities, we turn to the option-chains to determine if initial time-value returns align with...

Read More -

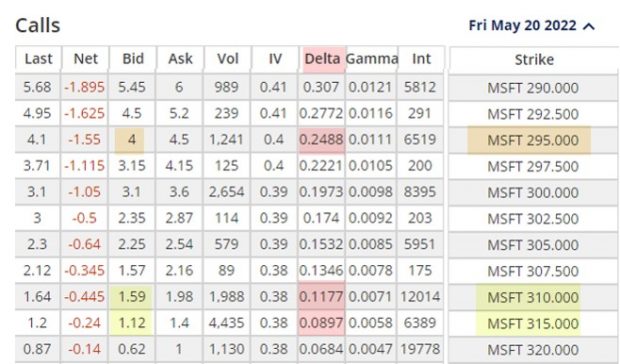

How to Select the Best Covered Call Writing Strikes in Bear & Volatile Markets – October 24, 2022

Option selection is the 2nd of the 3 required skills for achieving the highest possible returns when writing covered calls or selling cash-secured puts. Option decisions include strike and...

Read More -

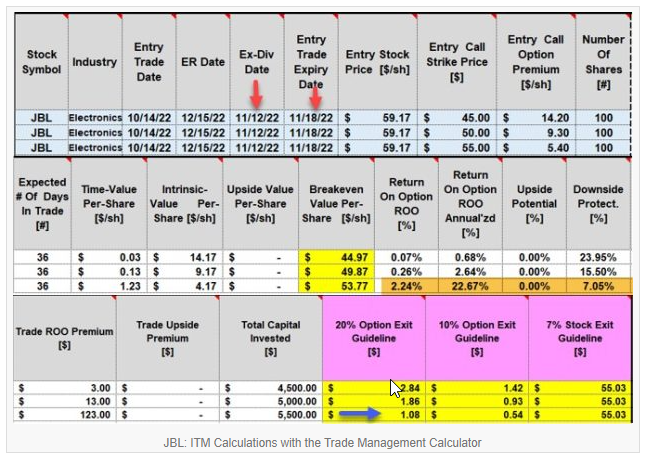

Setting Our 20%/10% Guidelines After Rolling an Option Out or Out-And-Up – October 17, 2022

Rolling-out is a covered call writing exit strategy we frequently use when a strike is expiring in-the-money (ITM) and we want to retain the underlying shares for the next contract cycle. After...

Read More -

Portfolio Overwriting in High Implied Volatility (IV) Markets – October 10, 2022

One of our covered call writing-like strategies is portfolio overwriting. The strategy involves selecting deep out-of-the-money (OTM) strikes that will generate lower returns than traditional covered call writing but also...

Read More