-

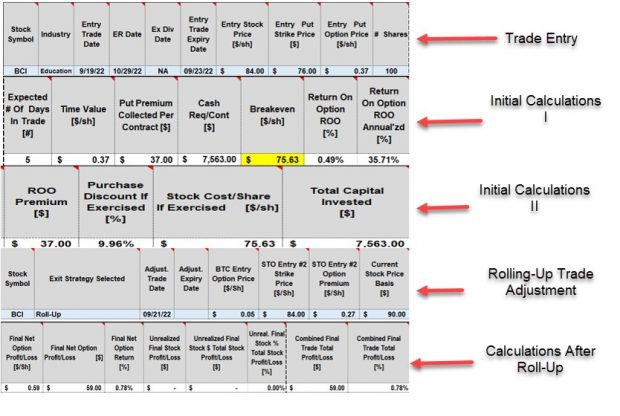

How to Enter & Calculate Closing a Weekly Put Trade After Rolling the Option in the Same Contract Cycle – October 3, 2022

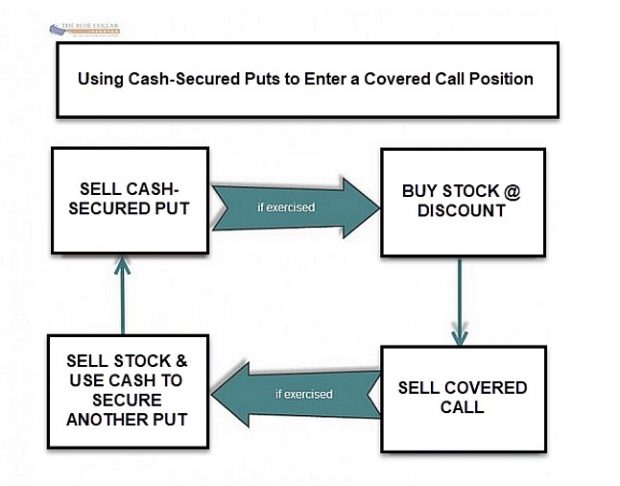

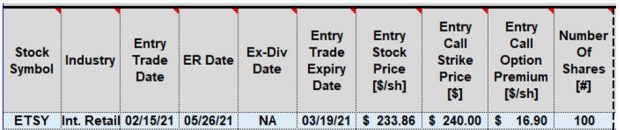

When we sell cash-secured puts, we are undertaking the contractual obligation to buy shares at the strike price by the expiration date. The option seller (that’s us) sets those...

Read More -

Dividend Stripping & Selling Cash-Secured Puts: A Real-Life Example with Walmart, Inc. (NYSE: WMT) – September 27, 2022

Whether we are selling stock options or buying stocks to accumulate dividend income, Blue collar Investors seek to generate cash-flow in a low-risk manner with capital preservation in mind. This article...

Read More -

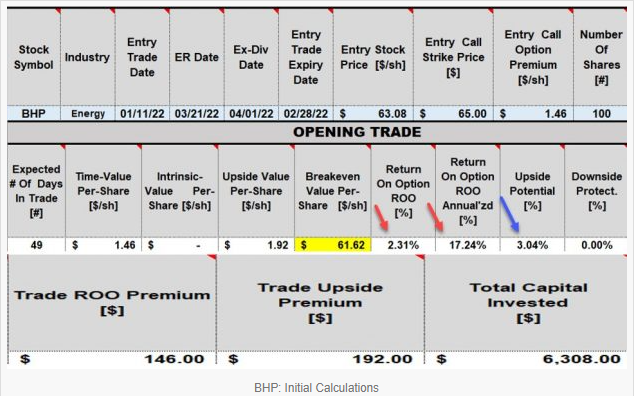

How to Manage a 5.3% Mid-Contract Unrealized Gain: A Real-Life Example with BHP Group Limited (NYSE: BHP) + Alan’s Wealth365 Webinar Registration Link – September 19, 2022

When we have a maximum mid-contract unrealized gain on a trade, there are opportunities when we can generate additional income streams and, thereby, enjoy higher than initial maximum returns....

Read More -

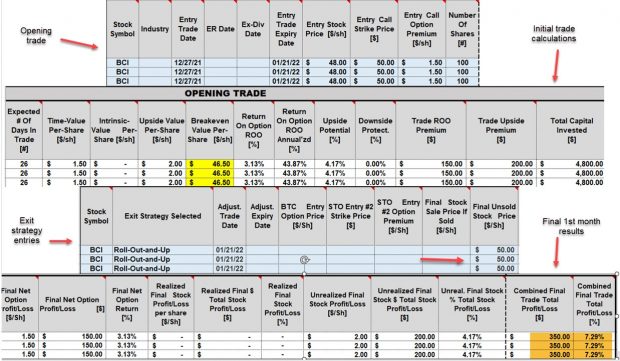

How to Enter Our Rolling-Out-And-Up Trades into Our Monthly Trading Logs – September 12, 2022

In our last blog article, we discussed how to enter our rolling-out trades into our covered call writing trading logs. This article will highlight the additional considerations when rolling our...

Read More -

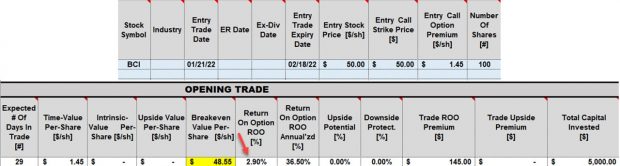

How to Enter Our Rolling-Out Trades into Our Monthly Trading Logs – September 6, 2022

When we roll-out our covered call trades, we are actually combining 2 months of option premiums, the current month and the next contract cycle. This may create some confusion...

Read More -

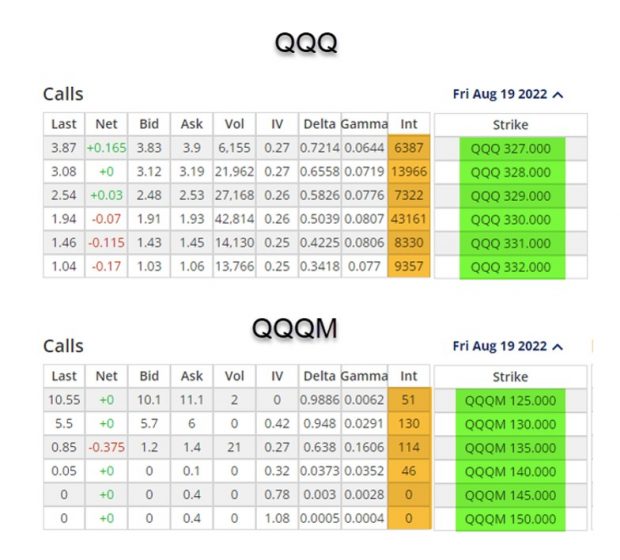

Comparing Nasdaq 100 ETFs: Real-Life Examples with QQQ & QQQM – August 29, 2022

Over the years, the most frequently used ETF in my portfolios has been Invesco QQQ Trust (Nasdaq: QQQ). Premium members have noticed that, lately, a relatively new eligible security...

Read More -

Technical Analysis and Our Option-Selling Portfolios: A Real-Life Example with Matador Resources Company (NYSE: MTDR) – August 22, 2022

BCI has a 3-pronged approach to screening for our covered call writing and put-selling watchlists. These include fundamental analysis, common-sense principles (like minimum average trading volume) and technical analysis....

Read More -

Will My Stock Be Sold Because of the $2.00 Dividend? A Real-Life Example with Star Bulk Carriers Corp. (Nasdaq: SBLK) – August 15, 2022

On 2/21/2022, Bob wrote a 3/17/2022 $29.00 call on SBLK. On 2/26/2022, SBLK was trading at $31.76 and the cost-to-close the short call was $2.78. On 3/1/2022, SBLK was...

Read More -

Covered Call Writing & Selling Cash-Secured Puts: Strategies or Exit Strategies? A Real-Life Example with T-Mobile US Inc. (Nasdaq: TMUS) – August 08, 2022

Covered call writing and selling cash-secured puts are low-risk option-selling strategies seeking to generate weekly or monthly cash-flow. Can these basic strategies be considered exit strategies as well? In this article,...

Read More -

Rolling-In Covered Call Trades – August 1, 2022

Exit strategy implementation is a critical aspect of successful covered call writing and put-selling strategies. Over the years, we have discussed rolling options as an integral part of our position management...

Read More