-

Why are We Receiving a Higher Return When We’re Expecting a Lower Return? – July 18, 2022

On 2/21/2022, Frank emailed me about our 10-Delta ultra-low-risk cash-secured put strategy. With Moderna Inc. (MRNA) trading at $145.00 per-share, he asked about using the deep out-of-the-money $118.00 weekly strike...

Read More -

Hitting a Double: The BCI Trade Management Calculator in Action – July 11, 2022

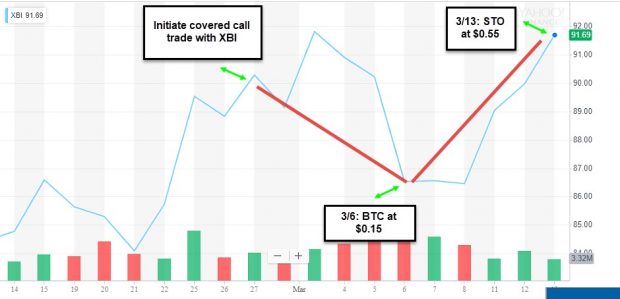

“Hitting a double” involves buying back the short call using our 20%/10% guidelines and then re-selling that same option when share price recovers. On 3/13/2019, Mario was kind enough...

Read More -

Enhancing Gains with the Mid-Contract Unwind Exit Strategy: The BCI Trade Management Calculator in Action – July 5, 2022

After entering our covered call trades and share price rises substantially, there are often opportunities to generate a 2nd income stream by closing both legs of the original trade...

Read More -

Mitigating Losses by Rolling-Down During a Severe Market Decline: The BCI Trade Management Calculator in Action – June 27, 2022

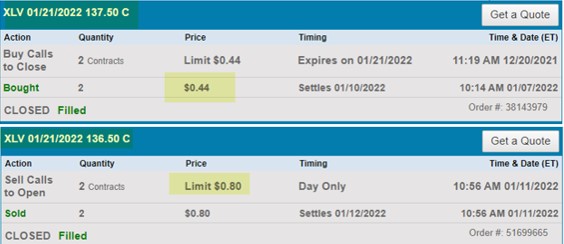

Rolling-down is one of our frequently used covered call writing exit strategies. During the January 2022 contracts, there was a 5% market decline due to COVD-19, inflation, and interest rate concerns....

Read More -

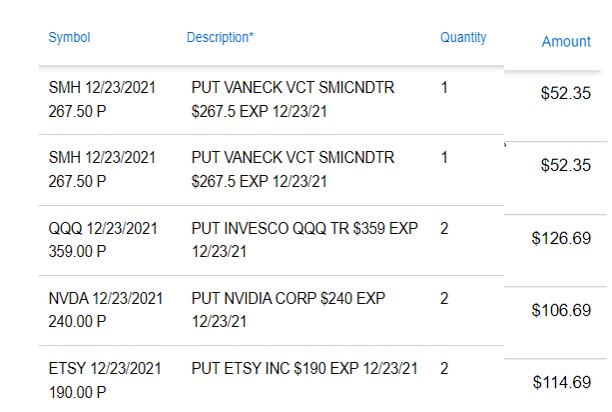

Exit Strategy Choices After Exercise of a Cash-Secured Put: A Real-Life Example with Etsy, Inc. (Nasdaq: ETSY) – June 21, 2022

How do we manage our trades after allowing exercise of a cash-secured put? This gameplan must be in place prior to entering the put trade. In this article, I...

Read More -

Selling 10-Delta Puts with 4-Day Expirations + 2 Free Webinar Registration Links – June 13, 2022

Can we sell 10-Delta weekly cash-secured puts and still generate significant annualized returns on a week where there is a market-recognized holiday reducing the number of days to expiration...

Read More -

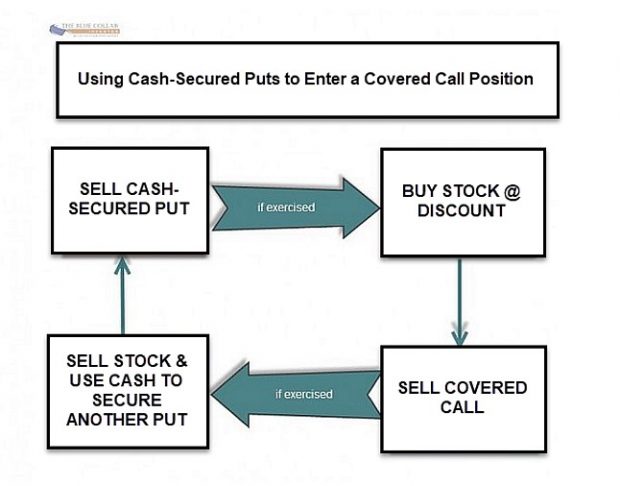

Using The Put-Call-Put (PCP) Strategy to Create Downside Protection on Steroids – June 6, 2022

Covered call writing and selling cash-secured puts are low-risk option-selling strategies that lower our cost-basis and generate cash-flow as we seek to beat the market on a consistent basis. By integrating...

Read More -

Rolling-Up in the Same Contract Month: A Real-Life Example with Ford Motor Company (NYSE: F)

Rolling-up in the same contract month is generally not a covered call writing exit strategy implemented in our BCI methodology. One of our members shared with me a series...

Read More -

Using Implied Volatility to Determine Safe Strikes for Portfolio Overwriting: A Real-Life Example with PayPal Holdings, Inc. (Nasdaq: PYPL) – May 23, 2022

Portfolio overwriting is a covered call writing-like strategy. We use it with our long-term buy-and-hold portfolios in non-sheltered accounts with the objectives to generate additional cash-flow while still retaining the...

Read More -

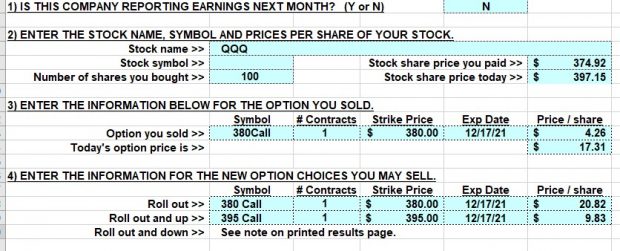

Rolling Out and Up to ITM and OTM strikes: A Real-Life Example with Invesco QQQ Trust (Nasdaq: QQQ) – May 16, 2022

When our covered call writing strikes are expiring in-the-money (ITM), and we want to retain the underlying shares for the next contract period, we can roll the option forward....

Read More