-

Generating a 3-Income Stream Put Trade: A Real-Life Example with ZIM Integrated Shipping Services Ltd. (NYSE: ZIM) – February 28, 2022

We have all read that when we sell a cash-secured put, the maximum return is the put premium. Is that true 100% of the time? Enter our exit strategy arsenal....

Read More -

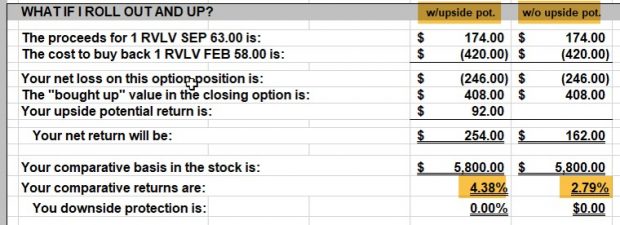

Making a Great Covered Call Trade Even Better: A Real-Life Example with Revolve Group, Inc. (NYSE: RVLV) – February 21, 2022

Covered call writing trades, when structured and managed properly, can result in impressive short-term and annualized returns. Such was the case with Art who shared with me a series...

Read More -

The Poor Man’s Covered Call LEAPS Selection: A Real-Life Example with SPDR S&P 500 ETF Trust (NYSE: SPY) – February 14, 2022

Before initiating a poor man’s covered call trade (PMCC), we must first master all aspects of the strategy including understanding the pros and cons inherent in this system. Once...

Read More -

Using Implied Volatility to Establish Reliable Trading Ranges for Our Option Contracts – February 07, 2022

PLEASE SEE A REVISION TO THIS ARTICLE AT THE END OF THE POST. I MADE AN ERROR AND REVERSED THE NUMERATOR AND DENOMINATOR IN ONE OF MY CALCULATIONS. THE...

Read More -

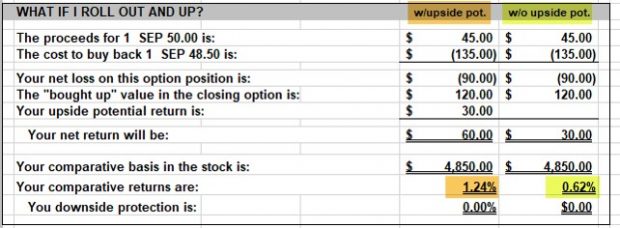

When to Roll Options on Successful Trades: A Real-Life Example with iShares MSCI India ETF (BATS: INDA) – February 1, 2022

Exit strategies for covered call writing are an inherent part of our BCI methodology. They allow us to mitigate losses, enhance gains and even turn losses into gains. There...

Read More -

Rolling Weekly 10-Delta Put Options Prior to a Holiday Weekend: A Real-Life Example with Etsy, Inc. (Nasdaq: ETSY) – January 24, 2022

One of the ultra-low-risk strategies developed by BCI in 2o20 involved selling weekly 10-Delta cash-secured puts. This created a greater than 90% probability that the puts would not be exercised...

Read More -

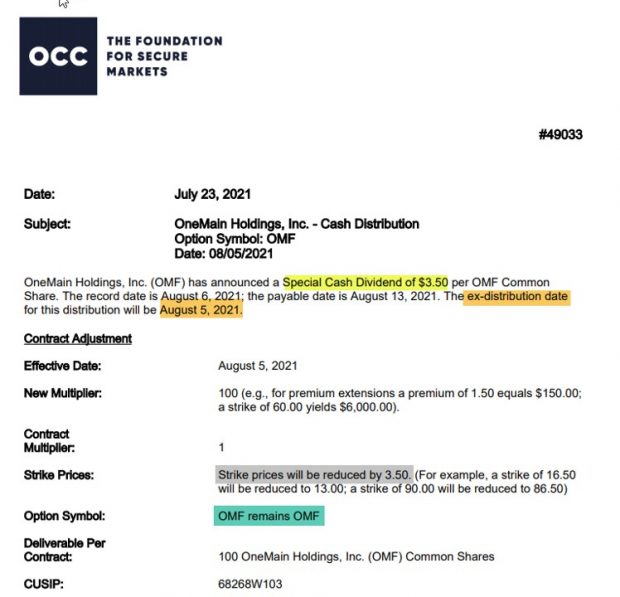

Understanding 1-Time Special Cash Dividends and Our Current Trade Status: A Real-Life Example with OMF – January 17, 2022

Contract adjustments will change the parameters of our covered call writing and put-selling trades but will not result in any trade loss or gain. The Options Clearing Corporation (OCC) will make alterations to our option contracts such...

Read More -

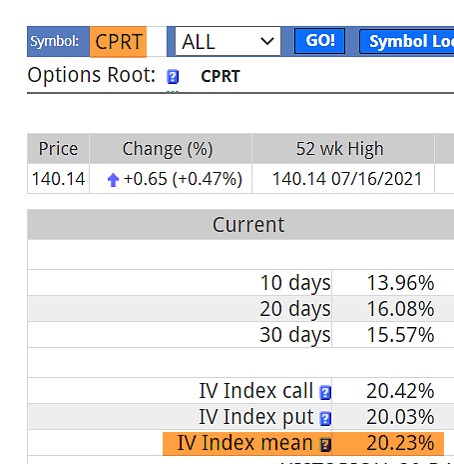

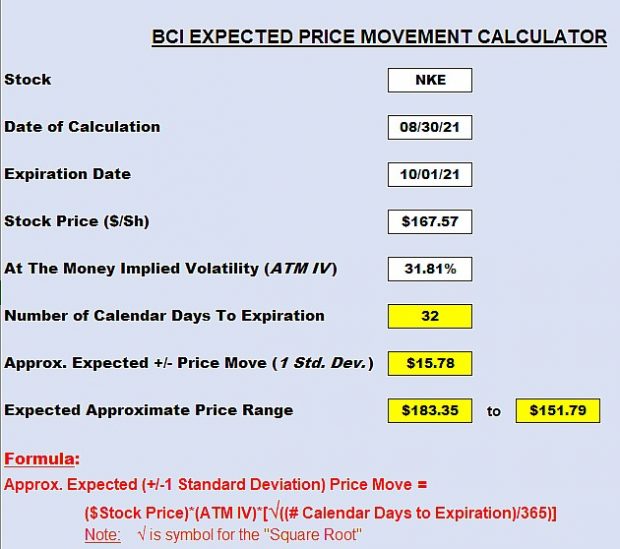

Comparing Implied Volatility and Delta When Establishing Projected Trading Ranges During Our Option Contracts – January 10, 2022

In 2020, BCI developed 2 ultra-low-risk option strategies, one using implied volatility and the other using Delta to establish low- and high-end trading ranges during our covered call writing and put-selling option contracts....

Read More -

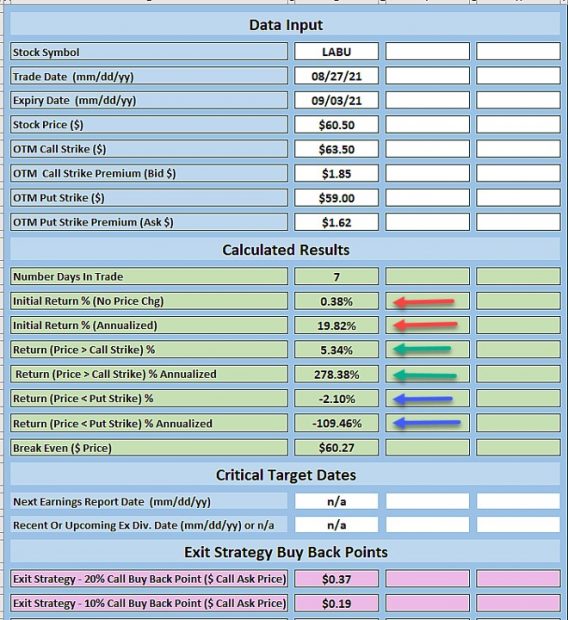

Collar Strategy Using Weekly Calls and Monthly Puts: A Real-Life Example with (LABU) – January 03, 2022

The collar strategy is a covered call writing-like strategy where protective puts are added to our covered call trades. This creates a ceiling (the short call) and a floor (the long put). Typically,...

Read More -

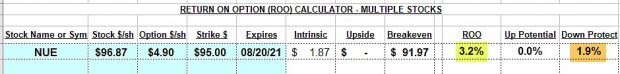

Closing a Covered Call Trade Mid-Contract: A Real-Life Example with Nucor Corp. (NYSE: NUE) – December 27, 2021

What happens when a covered call writing trade progresses much better than anticipated? This article will analyze a series of trades executed by William (thanks for sharing) with NUE...

Read More