-

Should Good News Discourage Us From Entering a Covered Call Trade? – October 25, 2021

We examine the BCI Premium Stock Report on the Sunday May 23, 2021, after expiration Friday, for our Monday trade selections. One of the securities we choose is Applied Materials, Inc. (Nasdaq:...

Read More -

Explaining “Bought-Up” Value When Rolling a Covered Call Out-And-Up – October 18, 2021

One of our key covered call writing exit strategies is rolling an option when the strike is in-the-money at expiration and we want to retain our shares. We can roll-out to...

Read More -

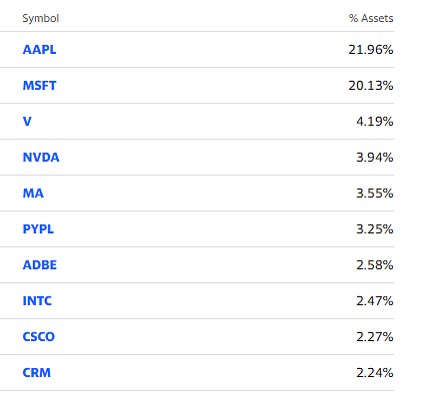

Best Technology ETFs for Our Option-Selling Portfolios: QQQ and XLK – October 11, 2021

When seeking to add a technology presence to our covered call writing and put-selling portfolios, we can do so by using exchange-traded funds (ETFs) based on technology benchmarks. Two such reliable...

Read More -

Exit Strategies for Covered Call Writing: “Hitting a Triple” with XLU – October 4, 2021

Benefitting from exit strategies, in our covered call writing and put-selling portfolios, is the result of preparation and opportunity. Our 20%/10% guidelines for covered call writing protects us when share price...

Read More -

“Hitting a Put Triple” with Lowe’s Companies, Inc. (NYSE: LOW) – September 27, 2021

Exit strategies for covered call writing and selling cash-secured puts are an integral part of the BCI success model. In April of 2021, Tom was excited to share with...

Read More -

Stock Repair Strategy: A Real-Life Example with Lyft, Inc. (Nasdaq: LYFT) – September 20, 2021

Stock options have a myriad of applications. With our covered call writing and put-selling strategies, we seek to generate cash-flow in a low-risk manner. Another utilization of stock options...

Read More -

The Poor Man’s Covered Call (PMCC): Explaining Upside Potential + Premium Membership News – September 13, 2021

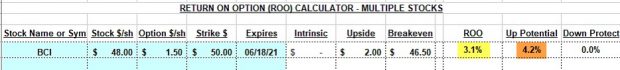

When using the PMCC strategy, a covered call writing-like strategy, our goal is to generate cash flow with a lower cash investment than traditional covered call writing. The BCI...

Read More -

Selling Cash-Secured Puts to Simultaneously Generate Cash Flow and Buy a Stock at a Discount – September 7, 2021

Selling cash-secured puts is a low-risk option-selling strategy geared to generating cash flow and beating the market on a consistent basis. In certain scenarios an additional goal of buying the...

Read More -

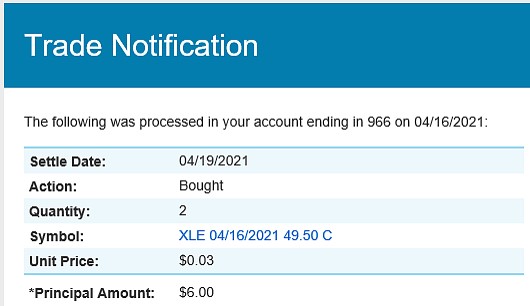

Rolling-Down with a Few Hours to Expiration: A Real-Life Example with Energy Select Sector SPDR (NYSE: XLE) – August 30, 2021

The 20%/10% guidelines are essential to our covered call writing exit strategies. They represent parameters as when to buy back our short calls. A frequent inquiry I receive related...

Read More -

Can Price Movement Be Explained by Profit-Taking?: A Real-Life Example with Global X Funds Infrastructure Dev. (PAVE)

On April 8,2021, Nathan shared with me his covered call writing trade with PAVE which was initiated 3 days earlier. This exchange-traded fund had a strong technical chart but the price...

Read More