-

The 5 Most Common Mistakes Made by Covered Call Writers – February 10, 2025

Selling options (covered calls or cash-secured puts) is as much an art as it is a science. There are several principles that must be adhered to in order to...

Read More -

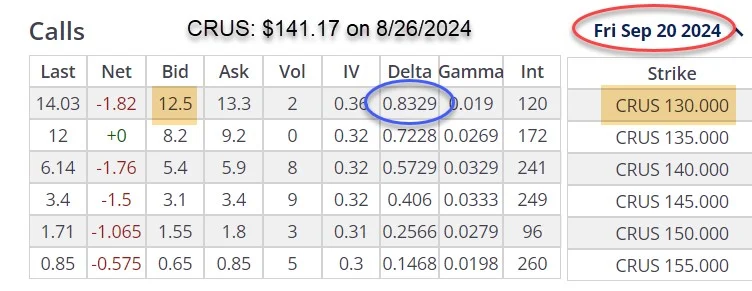

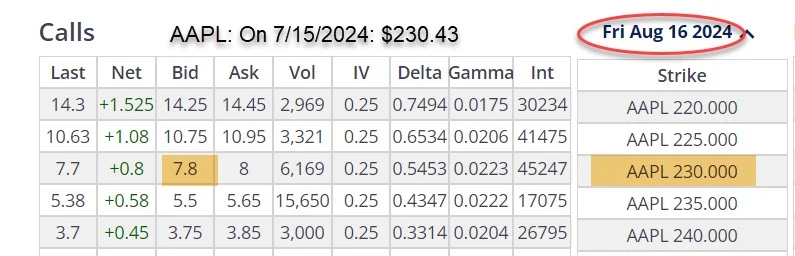

Can We Use Delta to Establish a Low End of a Trading Range for ITM Covered Calls? – February 3, 2025

Implied volatility (IV) can be used to establish approximate upper and lower ends of trading ranges for our covered call and put-selling trades. The BCI Expected Price Movement Calculator was designed for...

Read More -

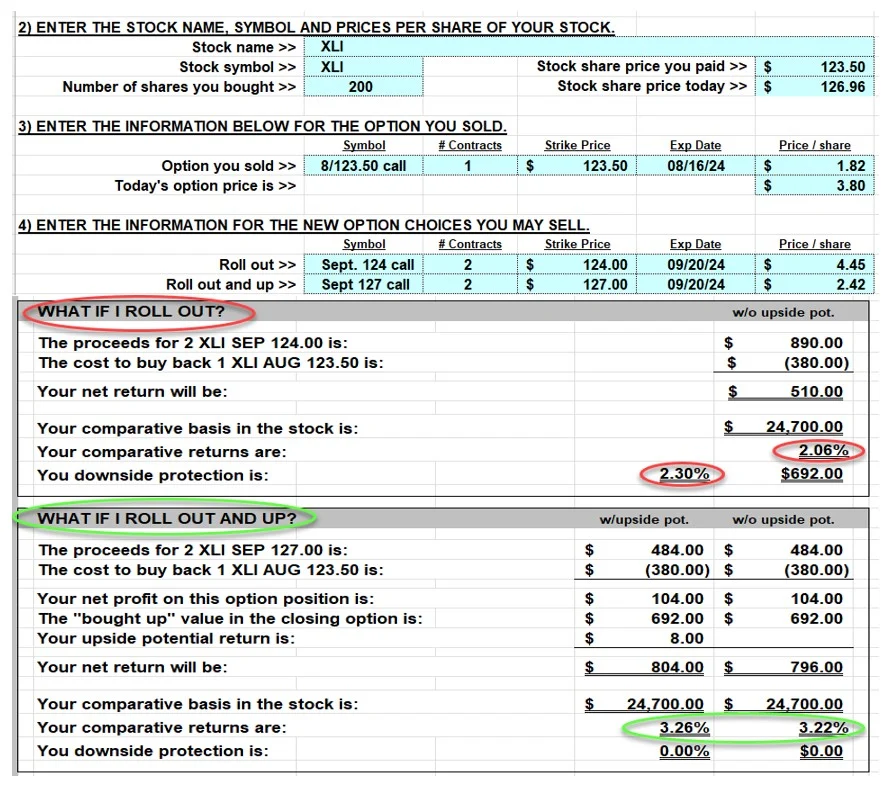

Rolling-Out Our Covered Call Trades After Rolling-Down – January 27, 2025

Market volatility can cause our covered call trades to whipsaw up and down, much like a roller-coaster. In this article, a real-life trade with The Industrial Select Sector SPDR Fund...

Read More -

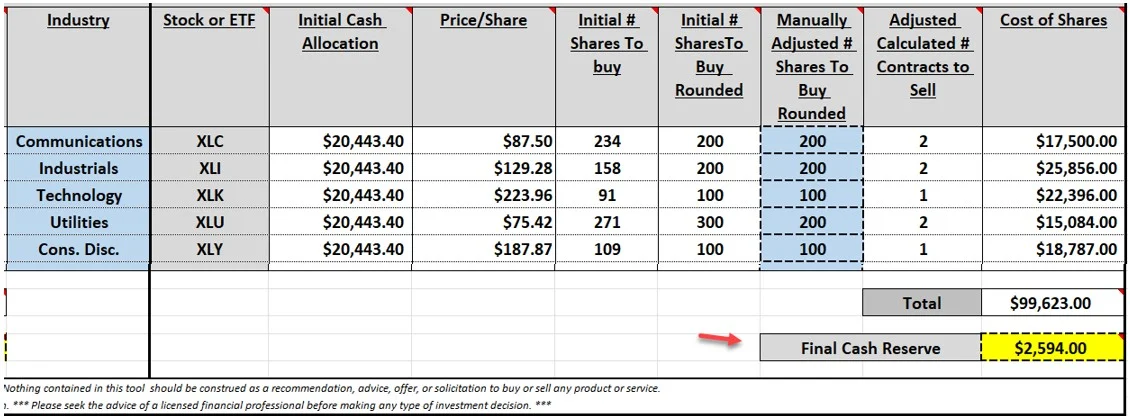

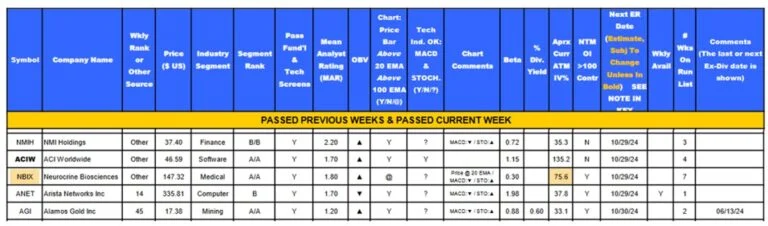

Converting a High Risk to a Low Risk Covered Call Trade – January 20, 2025

High implied volatility securities can be used in covered call trades in a defensive manner using the appropriate call strikes. In this article, Neurocrine Biosciences, Inc. (Nasdaq: NBIX) will...

Read More -

Rolling-Up Twice and Closing a Mixed Cash-Secured Put Trade – January 13, 2025

Exit strategies for covered call writing and selling cash-secured puts are critical in achieving the highest level of our trading returns. In this article, a real-life example with SPDR S&P...

Read More -

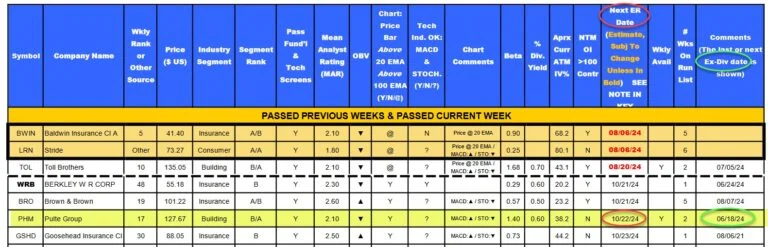

2 Important Dates When Trading Stock Options – January 6, 2025

When we sell covered call or cash-secured put options, there are 2 dates we should factor into our trade decisions. Earnings reports (ER) dates must be considered 100% of the time and ex-dividend dates are...

Read More -

The Mystery of Our Brokerage Accounts: Where Did My Option Premium Money Go? – December 30, 2024

We sell a covered call or cash-secured put and the cash is immediately placed into our broker cash account. Next, we check our account value, and it did not...

Read More -

Shorter Dated Options Deliver Higher Annualized Returns: The Square Root Rule – December 23, 2024

When selling covered calls or cash-secured puts, using contract expirations several months out (or longer) have the appeal of large option premiums. However, when we annualize these returns, they pale in comparison...

Read More -

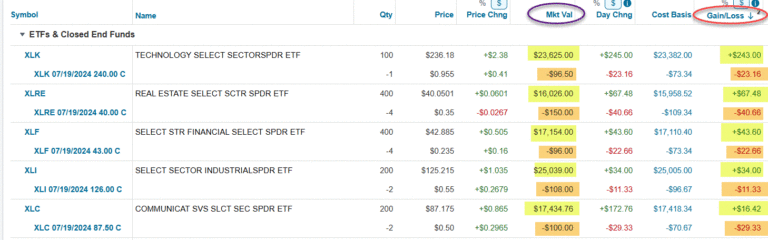

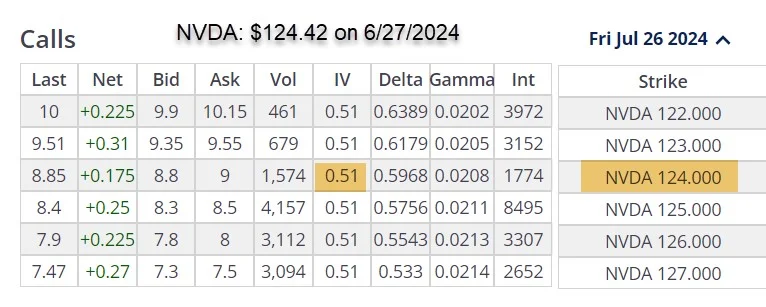

Portfolio Overwriting NVDA Using Implied Volatility – December 16, 2024

When NVIDIA Corp. (Nasdaq: NVDA) split 10-for-1 in June 2024, more retail investors had the opportunity to leverage this stock to sell options. Many already owned NVDA, but now...

Read More -

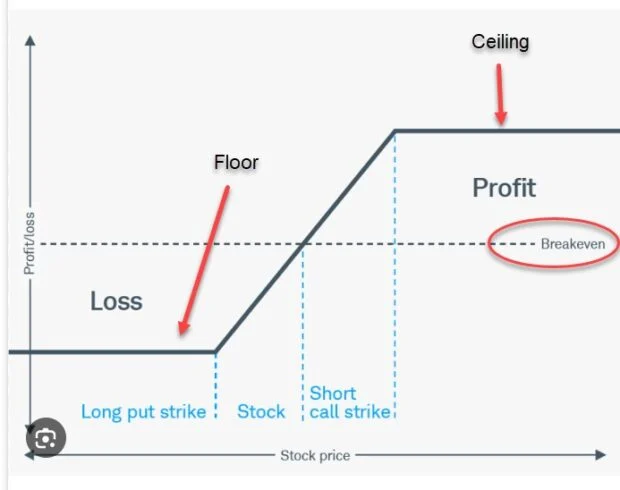

Calculating Covered Call Trades that are Converted to Collar Trades – December 9, 2024

What is a Collar Trade? The collar strategy consists of 3 legs: Real-life example with Alphabet, Inc. (Nasdaq: GOOGL): 6/24/2024 – 7/19/2024Buy GOOGL at $179.30 GOOGL call & put...

Read More